Definition of NRI

Income Tax for NRI will depend upon his Residential Status for the year. It is important to determine the residential status of an individual before determining their taxability. The criteria to determine your residential status is as follows:

You are an Indian resident for a particular financial year:

- If you are in India for at least 182 days (6 months) during the financial year or

- You lived in India for at least 60 days (2 months) during the previous year and have lived for at least 365 days (a year) during the last four years.

However, only the first condition is applicable if you are an Indian Citizen working abroad or a member of a crew working on an Indian ship. So if you spend at least 182 days in India during the financial year, you are a resident India.

A person shall be deemed to be of Indian origin if he, or either of his parents or any of his grandparents, were born in undivided India.

However if you do not meet any of the above conditions, then you are an NRI.

The residential status will help us determine the taxability of the income.

If your status for the previous year is “Resident“, your global income will be taxable in India. If your status is “NRI“, only the income which is earned or accrued in India will be taxable in India. Some of the examples of Incomes earned or accrued in India are Salary received in India, professional fees received in India, rent Income from House Property in India, capital gains on transfer of assets situated in India, interest income on fixed deposits or savings bank account in India, etc.

All these incomes are taxable in India for an NRI. So any income which is earned by an NRI outside India will not be taxable in India, for an eg. his Salary Income abroad or interest earned on NRE account or deposits abroad, etc.

Please note that interest income on the NRE account is completely tax-free whereas interest earned on NRO account will be applicable to TDS at the rate of 30.9%.

Taxable Incomes for NRI Include

Salary: As discussed earlier, any income which is earned or accrued in India will be taxable in India. So if the salary is earned or received in India by an NRI or by someone else on behalf of the NRI then it will be taxable in India. This salary income will be taxable at the slab rates applicable to individuals.

For Eg. Ravish is an employee of an Indian company and he has been deputed to Dubai to look after the company’s work there. He has been working in Dubai for the past two years. During his deputation in Dubai, Ravish’s salary was deposited to his designated bank account in India. Since his salary is received in India, it will be taxable in India.

Salary received by the diplomats and ambassadors is completely exempt

House Property Income: If an NRI owns a property which is situated in India, then any income from such property will be taxable in India.

The income from such house property will be calculated as if it is calculated normally in case of a resident Indian. The NRI will be allowed all the deduction including the standard deduction of 30% and the deductions for the interest and principal repayment in case a home loan is taken. This income will be taxed at the slab rates.

It is important to note that the rental income received by an NRI is applicable to 30.9% TDS. So when a tenant pays rent to the owner of the property who is NRI, he has to deduct TDS @ 30.9% from such rent.

Income from Business and Profession: Any Income from a Business that is set up in India or controlled from India is taxable in the hands of the NRI.

Income from Other Sources: Any income earned by NRI by way of interest on any deposits or balance in the savings bank account will be taxable in India. It is to be noted that the interest income on the NRE account and the FCNR account are completely exempt in the hands of the NRI however the interest earned on the NRO account is applicable to TDS @ 30.9%.

Income from Capital Gains: Any Capital Gains from the transfer of a capital asset situated in India is taxable in India. Even if an NRI invests in shares and securities India then capital gains on the transfer of such shares and securities will also be taxable in India.

Any NRI can claim exemptions available under section 54 & 54EC, from the capital gains arising on sale of residential house property.

Deductions and Exemptions for NRI

Here is a summary of deductions and exemptions which are / not allowable for NRI:

| Deductions/ Exemptions | Allowable | Not allowable |

|---|---|---|

| Section 80C | Life Insurance Premium Payment | Investment in PPF |

| Children’s Tuition Fee Payment | Investment in NSCs | |

| Principal Repayment on Loan for purchase of House Property | Post Office 5 year Deposit Scheme | |

| Investment in ELSS | Senior Citizen Saving Scheme | |

| Investment in Unit Link Insurance Plan | ||

| Section 80CCG | – | Investment under RGESS |

| Section 80D | Premium Paid for Health Insurance | – |

| Section 80DD | – | Expenditure on Maintenance including medical treatment of a handicap dependent |

| Section 80DDB | – | Expenditure towards medical treatment of a differently abled dependent |

| 80E | Interest paid on education loan | – |

| 80G | Donations for charity (social) causes | – |

| 80TTA | Interest income from savings bank account | – |

| 80U | – | Deduction available to differently abled individuals |

| 80U | – | Deduction available to differently abled individuals |

| Deductions from House Property Income | Standard deduction | – |

| Property taxes paid | ||

| Interest paid on home loan | ||

| Exemption on sale of Long term property | Section 54: On sale of long term house property | – |

| Section 54F: On sale of any long term asset other than house property | ||

| Section 54EC: On sale of any property and reinvestment in bonds of National Highway Authority of India (NHAI) and Rural Electrification Corporation (REC) |

How to Avoid Double Taxation?

One of the most common questions amongst NRI is that “Do I have to pay taxes in both the countries i.e country of resident and India?”

The NRI can save themselves from double taxation by availing the relief from the Double Taxation Avoidance Agreement (DTAA) which is an agreement between India and foreign countries.

Different agreements with different countries may vary in terms of tax relief. But broadly, the benefit is provided in two ways:

- Exemption from double taxation: When the agreement provides for the exemption, the NRI will be taxed in only one country and they will not have to pay any taxes in the other country. Say Manali is a non-resident Indian and she is working in the US as a Certified Accountant. She earns some interest income from fixed deposits in India. Now if India and the USA have entered into an agreement and have provided the exemption, Manali’s interest income will be taxed only in India and the same income shall be exempt from tax in the USA.

- Tax Credit (Relief): When the agreement provides for relief, the incomes will be taxed in both the countries, however, tax relief will be allowed to the NRI in the country of their residence. Say Paritosh is a non-resident Indian and is working as a content writer for a newspaper company in Australia. He has rental income from his residential flat in India. If India and Australia have entered into an agreement and have provided relief from the double taxation by way of the tax credit, the rental income will be taxed both in India and Australia. However, Paritosh will be allowed to take the tax credit in Australia for the taxes which he has paid in India.

Changes for NRIs According to the Budget 2020

The budget 2020 announced by the Finance Minister Nirmala Sitharaman on the 1st of February had the following major changes for the Non-Resident Indians (NRIs):

- Criteria for determining Residential Status has been changed

- Change in RNOR

- New Clause added to Section 6 IA

- Change in the Dividend Distribution Tax (DDT)

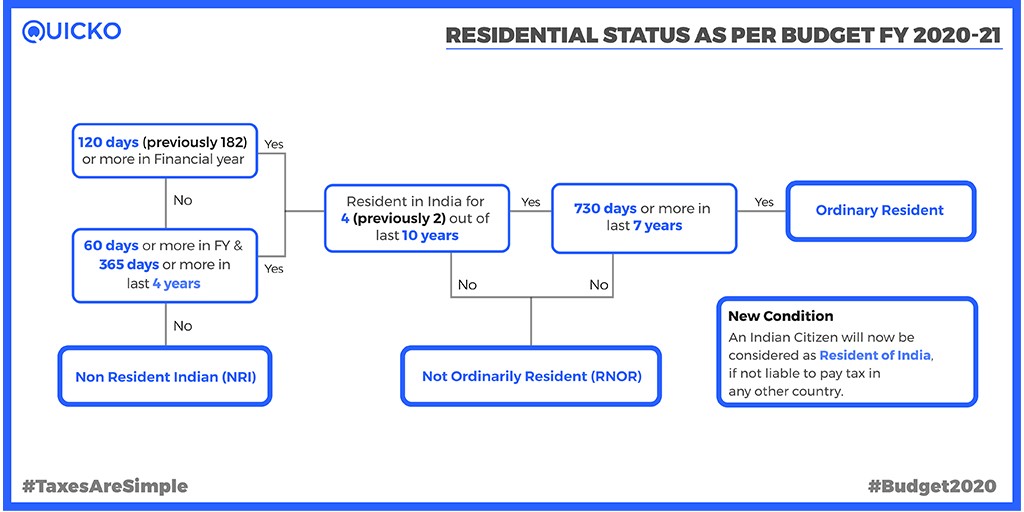

Criteria for Determining Residential Status

The Primary condition of 182 days for determining Residential Status has been changed to 120 days in the Union Budget 2020. Hence, an Indian National will be deemed a resident of India if they have stayed in India for at least 120 days in a Financial Year.

Resident – Not Ordinary Resident

Previously, an individual had to be a resident for 2 out of the 10 previous years and had to be staying in India for up to 729 days in order to be deemed as an R-NOR. After the announcement made in the Budget 2020, the requirement for being a resident was increased to 4 out of the previous 10 years.

Section VI (IA) – New Clause

The new clause announced by the Finance Minister states that, if an individual is not a resident of any other country, then he/she will be deemed a resident of India by default. Furthermore, once the person is deemed a citizen of India, he/she becomes liable to disclose all their assets and finances they possess. These finances and assets can be either from India or from any foreign country.

Dividend Distribution Tax – DDT

According to the current tax regime, the DDT is deducted by the companies on the dividend paid to its shareholders. However, under the new tax regime, the dividend is no longer taxable at the hands of the shareholders. Therefore, the companies will deduct the TDS on the dividend distributed. Furthermore, TDS will be deducted u/s 195 in the case of NRI shareholders and dividend income will be taxed at slab rates.

| Source of Income | Resident | Not Ordinary Resident | None-Residents |

| Income earned in India | Taxable in India | Taxable in India | Taxable in India |

| Any income received in India | Taxable in India | Taxable in India | Taxable in India |

| Income earned outside India but received in India | Taxable in India | Taxable in India | Taxable in India |

| Income earned and received outside India | Taxable in India | Taxable in India | Not Taxable in India |

| Any income earned outside India for a business or profession controlled in or from India | Taxable in India | Taxable in India | Not Taxable in India |

| Income earned outside India from any source other than business or profession controlled from India | Taxable in India | Not Taxable in India | Not Taxable in India |

FAQs

For NRIs, the incomes which are earned in India will be taxable in India. For Indian Residents, global incomes i.e incomes earned in India and also the foreign incomes will be taxable in India.

If you are an NRI then you are not required to pay taxes on your foreign income. You will have to pay taxes on the income which you have earned in India. On the other hand, if you are an Indian Resident than all your Global incomes will be taxed in India. However, if you have paid taxes on such foreign incomes in the same country, then you can claim the relief as per the Double Taxation Avoidance Agreements (DTAA)

For NRIs, one does not need to declare foreign assets and foreign incomes in Indian Income Tax Return except the incomes which are earned or received in India as they would be liable to Indian Income Tax.

For Indian Residents, one needs to declare all the foreign assets and foreign incomes. The foreign incomes will be subject to Indian Income Tax (subject to Double Taxation Avoidance Agreement) as for a Resident Indian, global incomes are subjected to Indian Income Tax.

If any of the Incomes earned by NRI is taxable in India and the same income suffers from another tax levy in the country of residence of NRI, individual will be allowed to take the benefit of DTAA (Double Taxation Avoidance Agreement) so as to save the income from suffering double taxation.

However, if no income of NRI is subject to the tax levy, the need to claim relief does not arise.

For filing Income Tax Return (ITR), you need to have an Active Bank Account with any of the Indian Banks. Hence, for payment of Income Tax or claiming Income Tax Refund, you are required to have a bank account in India. However, for payment of Income Tax, anybody (if not you) can pay the tax on your behalf from his/her bank account. So NRIs can pay tax through any of their friends or family members who have an active Bank account in India.

Whether you are an NRI or not, if your income exceeds Rs. 2,50,000 then you are required to file an Income Tax Return in India. On the other hand, even if your income is less than Rs. 2,50,000, you will have to file a return if:

1. You want to claim a refund &/or

2. You have a loss that you want to carry forward

31st July is the last date to file the Income Tax Returns in India for the NRI

Whether you are an NRI or not, if your total tax liability exceeds Rs. 10,000 in a financial year, you are required to pay the Advance Tax. Interest under section 234B and 234C will have to be paid in case of failure to pay the Advance Tax.