Under the Startup India initiative, eligible companies can get recognised as Startups by DPIIT, in order to access tax benefits, easier compliance, IPR fast-tracking & more. To apply for ‘Recognition by DPIIT, you can process your application through the Startup India profile. In order to be DPIIT recognized Startup follow the given procedure.

- Click on ‘Get Recognized’ option provided on the pop-up box displayed after setting up a startup India profile

- Under user details, click ‘View Details’

OR

- Login to the Startup India profile

- Go the Dashboard, on the Right side navigation bar

- Click on the Recognition and Tax Exemption, Or

- Under Recommendations, go to Get DIPP Certified and click on- ‘Register Here’

DPIIT recognition by Startup India website

- Go to Startup India Website

Access the Startup India Website

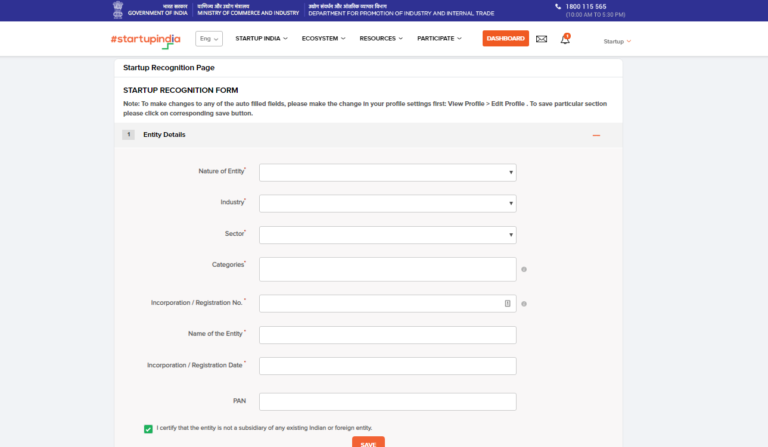

- Enter Entity Details

Enter details for Nature of Entity, Industry, Sector, Categories, etc.

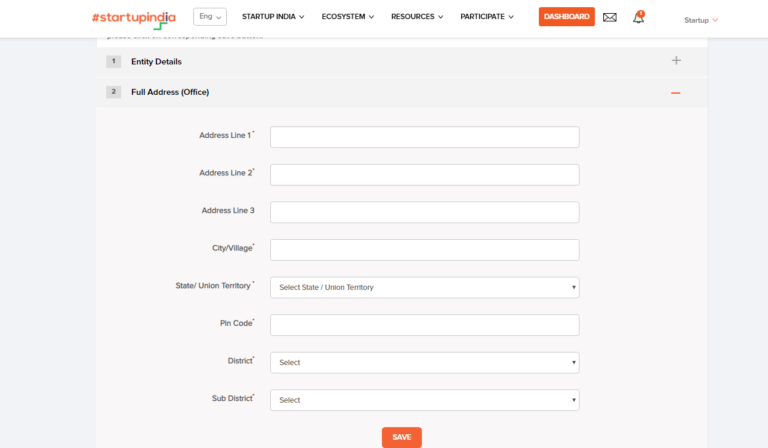

- Enter Full Office Address

Enter the details regarding Address City/Village, State/Union, Territory, Pin Code, District, Sub-District.

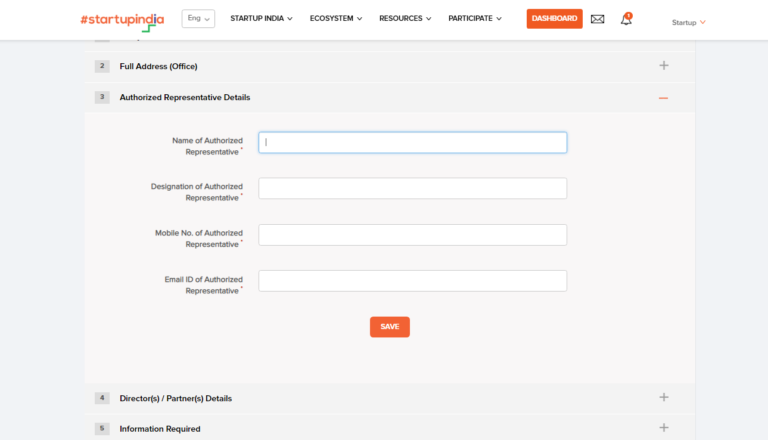

- Enter the Information of Authorized Representative

Enter the details in regards to Name, Designation, Mobile No, Email ID.

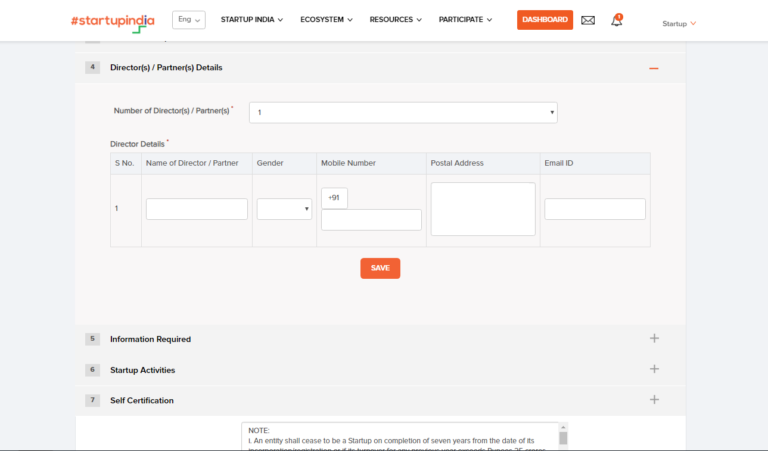

- Next, Enter the details for Directors and Partners.

Enter details for Number of Partners

Details- Name, Gender, Mobile Number, Postal Address and Email ID.

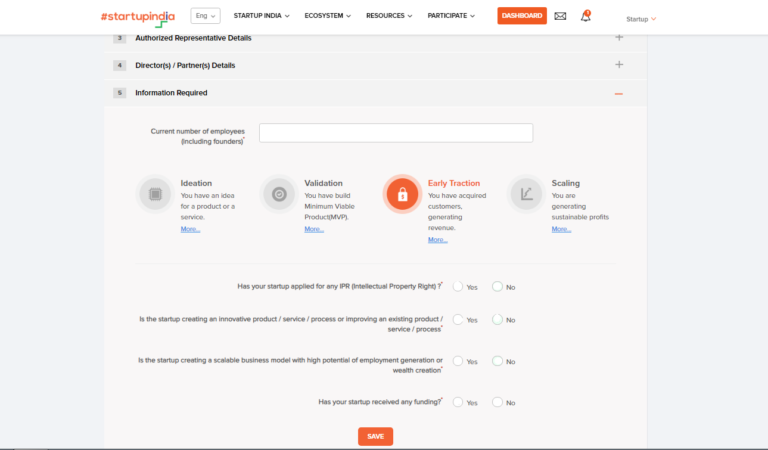

- Enter Other Information

Enter information in terms of the Incumbent number of employees, Intellectual Property Rights Status, etc.

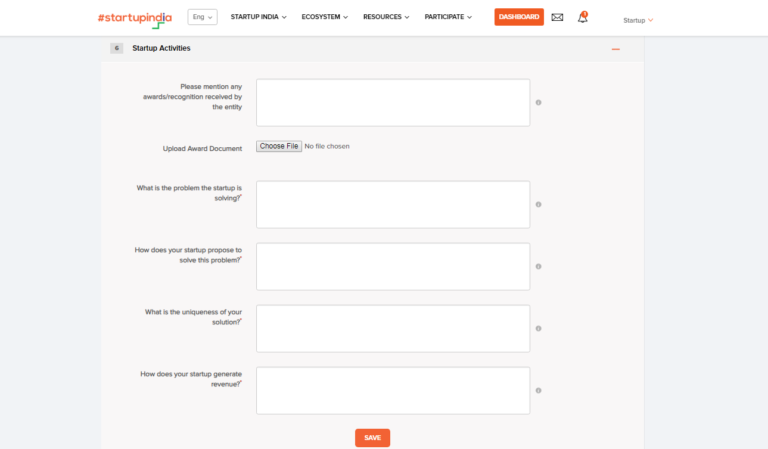

- Enter Details of Startup India

Mention any recognition or awards received by the startup and answer subsequent questions.

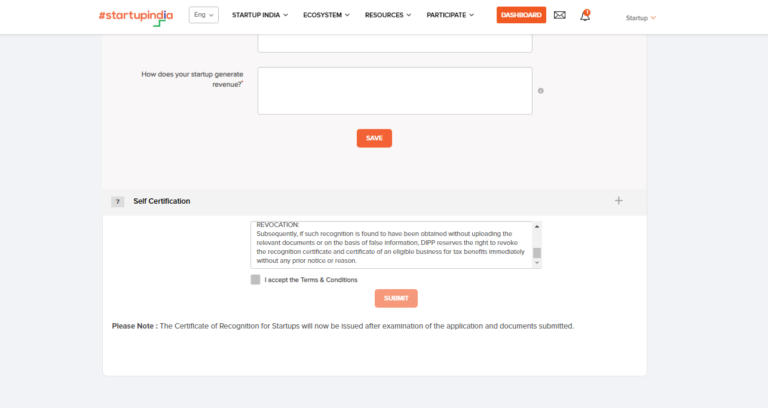

- Upload Self Certification

Upload Incorporation/Registration Certificate- It is the certificate issued by MCA(Ministry of Corporate Affairs). Importantly,the file should be less than 5MB in PDF, JPG or PNG format. Click Continue and Submit.

The application will be examined along with the documents submitted. If found satisfactory, the Certificate of Recognition will be issued to the startup.

FAQs

Eligibility Criteria for Startup Recognition:

1. The Startup should be incorporated as a private limited company or registered as a partnership firm or a limited liability partnership

2. Turnover should be less than INR 100 Crores in any of the previous financial years

3. An entity shall be considered as a startup up to 10 years from the date of its incorporation

4. The Startup should be working towards innovation/ improvement of existing products, services and processes and should have the potential to generate employment and create wealth.

An entity formed by splitting up or reconsutrction of an existing business shall not be considered a “Startup”

Startup India Registration under DIPP: This scheme supports Startups by providing various benefits to the registered entity. The benefits include financial as well as non-financial benefits. To register under this scheme the entity must fulfill the criteria specified.

The certificate of recognition is issued typically within 2 working days upon successful submission of the application.

Hey @Sofiyah_Valiante ,

Co-operative societies can obtain Udyog Aadhaar registration. PAN of Co-operative society is to be used.

The following listed are the benefits of Udyam Aadhar Registration:

Hope this helps

@Aishwarya_Shah @Kaushal_Soni can you help?

Hi @Rohit_Kumar_Bishnoi, you will have to register the start up as company and then you can register and sign up for different start up schemes to get the benefits.

Hello @Rohit_Kumar_Bishnoi

For the registration of private limited company with MCA, there are 2 forms to be filed:

Name Reservation Form - can be filed twice on payment of applicable fee. Thus, if the form is rejected more than 2 times, fresh form needs to be filed again after paying the fee again.

Incorporation Form - The applicant can submit the form on payment of applicable fee. If there is any query from MCA department, you can re-submit the form after making relevant changes.