As part of the registration process of a LLP, it should apply for name reservation through RUN-LLP service on MCA Portal. An LLP can file RUN (Reserve Unique Name) on MCA for the following purposes:

- To Reserve the name of New LLP,

- To Change the name of any Existing LLP

Before applying for name reservation, the applicant must check the available names of the proposed LLP before filing RUN form to avoid rejection.

Steps to file RUN-LLP for Name Reservation for LLP Registration

- Login to MCA

Log in to your account on MCA Portal with valid username and password

- Navigate to RUN-LLP Service

Go to MCA Services > LLP Services > RUN-LLP (Reserve Unique Name-LLP)

- Select option for name reservation

Select an appropriate option for reserving a name i.e. for incorporating a new LLP or converting into LLP

- Enter LLPIN

Enter LLPIN i.e. Limited Liability Partnership Identification Number if you are applying for the change of name for an existing LLP

- Enter Names

Enter two proposed names and click on the Auto check

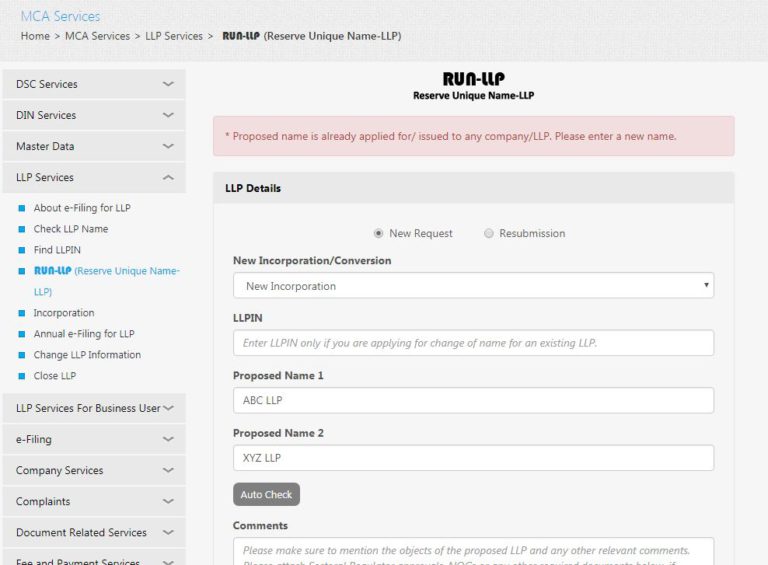

- Primary Check for Proposed Name – Invalid

The system does a primary check for the names entered and displays a message whether it is valid or invalid

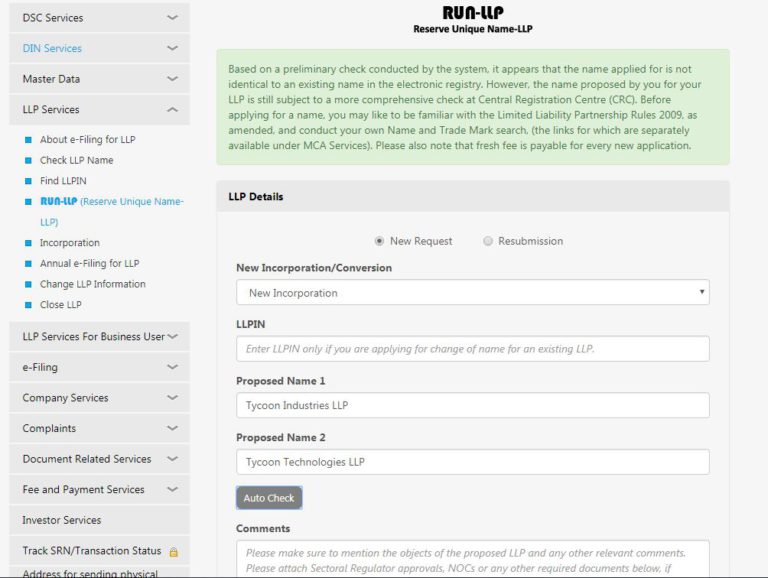

- Primary Check for Proposed Name

The system does a primary check for the names entered and displays a message whether it is valid or invalid

- Objects of Proposed LLP

In the comments section, describe the objects of the proposed LLP. The officer would accept or reject the name reservation request based on this description

- Attach Documents

If there are any sectoral regulator approvals, NOCs or any other required documents, the applicant should attach such documents too. Click on Submit

- Payment

The next screen is the payment screen on which a fee of Rs.200 is payable. Once the payment is made, the applicant can submit the request. There is no option to make payment with the PayLater option

- SRN generated

On successful submission, an SRN and a Challan would be generated. The applicant can use the SRN to track the status of name approval on MCA

- Acknowledgment Letter

MCA would send the acknowledgment letter for approval or rejection of the proposed name to the registered email ID of the MCA account from which the applicant had submitted the request

- File for Incorporation within 3 months

The applicant has a period of 3 months to file for incorporation of the LLP from the date of acknowledgment letter received on email

FAQs

No. The applicant does not need DPIN of the designated partner for making an application for name reservation in the RUN-LLP service. Earlier, it was compulsory to hold a DPIN for making an application for approval of the name of an LLP through Form 1.

No. The applicant does not need the digital signature of the designated partner for making an application for name reservation in the RUN-LLP service. Earlier, it was compulsory to have a DSC i.e. digital signature for making an application for approval of the name of an LLP through Form 1.

Hello @Shelly_Trivedi

In order to register an LLP on Ministry of Corporate Affairs, the first step is to reserve a name for the proposed LLP. In order to reserve name, RUN-LLP needs to be filled out on MCA along with 2 proposed names of the LLP and NoC, if any required by paying a fee of Rs. 200/-

Once the name has been approved by MCA, the name is valid for a period of 3 months within which e-Form FiLLiP needs to be filed along with documents as may be required, for incorporating the LLP. The fees of filing e-Form FiLLiP depends on the contribution of the LLP.

Hope this helps!

Hey @AM_POWER

As per the Limited Liability Partnership Act, 2008, Financial Year is defined as under:

" financial year, in relation to a limited liability partnerships, means the period from the 1st day of April of a year to the 31st day of March of the following year:

Provided that in the case of a limited liability partnership incorporated after the 30th day of September of a year, the financial year may end on the 31st day of March of the year next following that year;"

Hence, an LLP incorporated in February, 2019 can opt for closing its books of accounts in March, 2021. Thus you don’t need to make the compliances for FY 2019-20, as the first financial year will be from February 2019, to March, 2021.

Hope this helps!

Hey @AM_POWER

There was a typo in the previous post regarding the financial year.

However, you wont be able to take the benefit of Financial Year in your case so what you can do is raise a complaint on MCA and explain that Form-3 wasnt approved. Or you can contact your local ROC for this.

Hope this helps!

Hey @AM_POWER

For Form-8 (Section 34) and Form-11 (Section 35) of the LLP Act, 2008, specifies that if any LLP fails to file its annual return before the expiry of the periods specified, such LLP and the Designated Partners shall be liable to pay a penalty of Rs. 100/- per day, subject to maximum Rs. 100,000/-

The above provisions are subject to any extensions that may have been provided by MCA for that financial year.

You can check out the LLP Act, 2008 here.

Hope this helps!

Hi @Mohit_More

In order to add or remove Designated Partner of an LLP, e-Form - 4 needs to be filed within 30 days of such addition/ removal.

You can learn more about making changes in Designated Partners of LLP here

Hope this helps!

Hello @Rachit_Awasthi1

LLP Agreement shall be filed in e-Form-3 within 30 days of incorporation.

Here’s an article that explains LLP Agreement in details

Hey @Vicky_Singh

The major advantages of an LLP over a partnership firm is that an LLP has a separate legal existence than its owners and the liability of the partners of an LLP is limited which is not the case in a partnership firm.

You can read more about the process of converting an a partnership into an LLP here:

Hope this helps!

I had a query, how can I file Annual Return for LLP?

Hey @Nandana

Annual return of LLP is to be filed in e-Form 11. Fill in the details regarding LLP and Designated Partners like their contribution, etc. Details of LLP and or company in which Partner/Designated Partner are a Director/Partner is mandatory to attach with the form.

Hope this helps!

Hey @Ujvin_Nevatia

As per LLP Act, Financial Year means the period starting 1st of April and ending 31st March of the following year. However, since your LLP has been incorporated after 1st April, your financial year will start from the date of incorporation, i.e., 07/11/2020.

Details of Designated Partners is a mandatory attachment for Form-11 even if the Designated Partners are not Directors/ Designated Partners in any other entity. You can mention “NIL” in the field where you are supposed to mention the name of LLP/Company against the DPIN or each Designated Partner.

You can download the format of details of designated partners here

Hope this helps!