GSTR-2A is an auto-populated return that contains details of inward supplies (purchases), TDS credits and TCS credits. It is auto-populated based on the return filed by seller. The buyer can view and download GSTR-2A from his account on the GST Portal.

How to Download GSTR 2A?

- Visit GST Portal

Log in to your account on GST Portal.

- Navigate to Services

Click on Returns > Returns Dashboard.

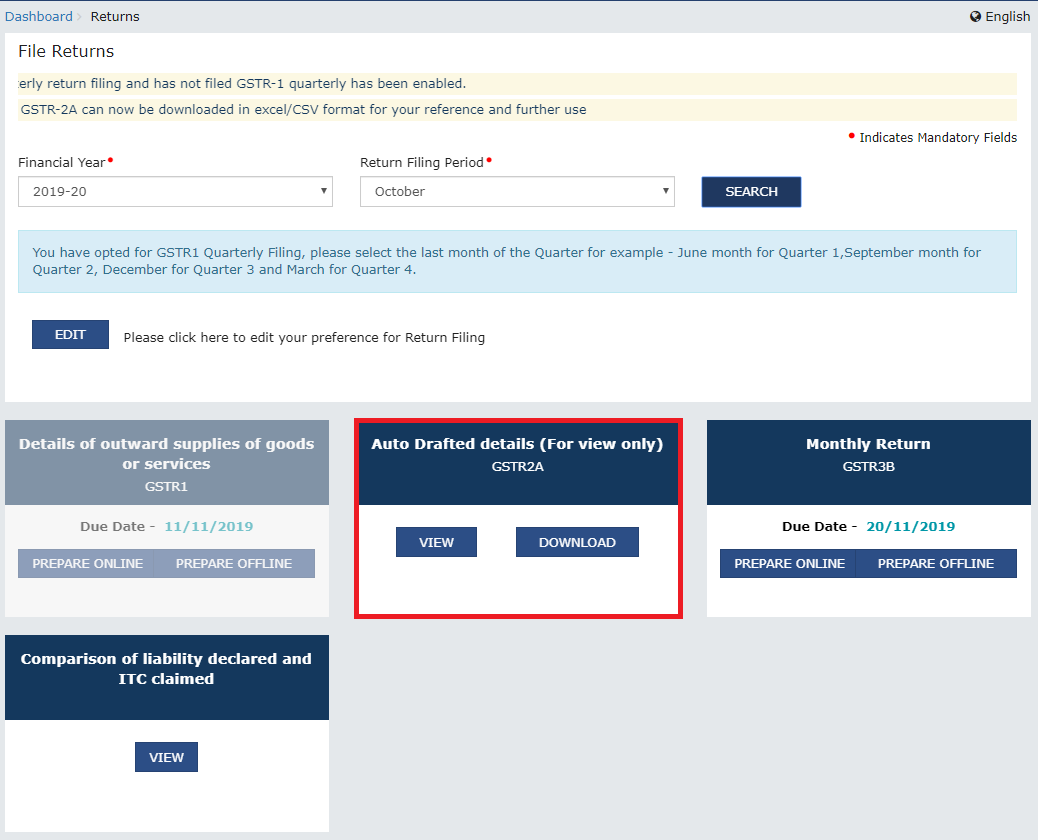

- Select the Financial Year and Return Filing Period i.e. the month for which you want to view or download GSTR-2A

Click on Search. The File Returns page is displayed.

- Download GSTR-2A – Click on the Download button

Click on Generate JSON file to download – to generate data in JSON format

Click on Generate Excel file to download – to generate data in Excel format

Note: If the number of invoices is more than 500, then you need to download the invoices in Form GSTR-2A

- View GSTR-2A

Click on the View button. Part-A, Part-B and Part-C are displayed with auto drafted details.

- Part A – B2B Invoices, Amendments to B2B invoices, credit/debit notes, amendments to credit/debit notes

This tab contains details of invoices and credit/debit notes uploaded by the seller on filing GSTR-1 or GSTR-5. To view the details, click on the relevant tab, GSTIN hyperlink and invoice/note hyperlink

- Part-B – ISD Credits, Amendments to ISD Credits

This tab contains details of invoices and credit/debit notes uploaded by an ISD i.e. Input Service Distributor on filing GSTR-6. To view the details, click on the relevant tab and GSTIN hyperlink

- Part C – TDS Credits, Amendments to TDS Credits, TCS Credits

This tab contains details of invoices and credit/debit notes uploaded by a TDS Deductor on filing GSTR-7 and TCS Collector on filing GSTR-8. To view the details, click on the relevant tab.

FAQs

No, you don’t have to file Form GSTR-2A. It is a read-only document provided with the record of all the sales from various suppliers in a given tax period. You can view or download GSTR-2A from your account on the GST Portal.

No, the taxpayer cannot edit GSTR-2A. It is an auto-populated return based on the returns filed by the sellers. The buyer can view and download GSTR-2A. If there is any mismatch in the data reflected in GSTR-2A and the taxpayer’s purchases, the taxpayer can inform the respective seller to make corrections in the Sales Return.