GST Registration means allotment of a GST Number or GSTIN to the taxpayer who is liable to collect and pay tax to the government after claiming the credit of input tax paid on purchases. When the GST Officer approves the application for registration, the GST Department issues a unique GSTIN to the taxpayer. The Department does not issue a physical certificate of registration. The taxpayer can download his certificate of registration from his account on the GST Portal.

Steps to Download Certificate of Registration on GST Portal

- Login to GST Portal

Go to GST Portal. Enter the username and password to login to your account.

- Navigate to View/Download Certificates

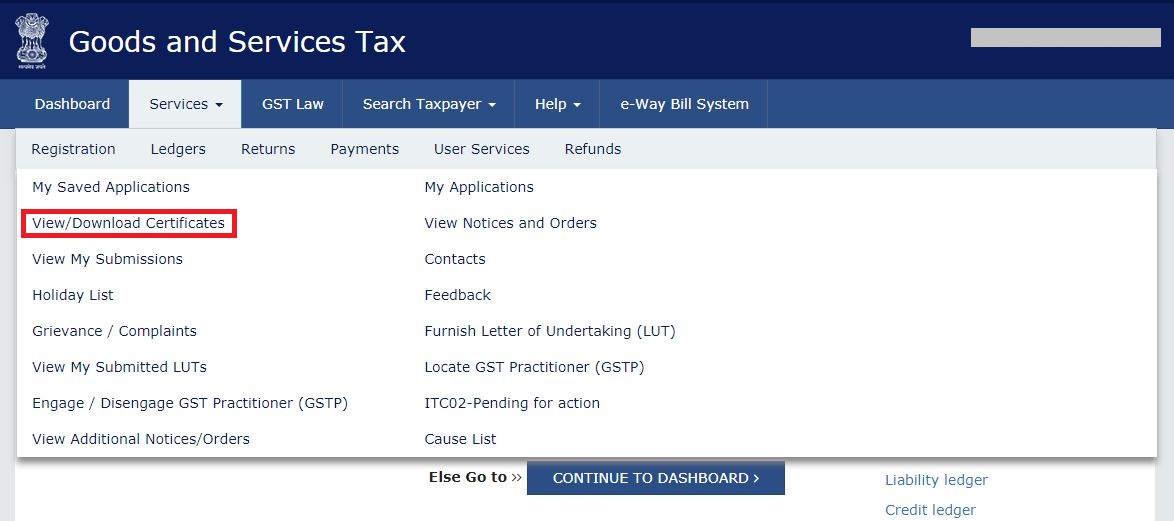

Go to Services > User Services > View/Download Certificates.

- Certificate Details

Hence, you can view the certificate description along with the date of issue of the certificate on the next page. Then, click on Download.

- Registration Certificate – First Page

The registration certificate is downloaded in a pdf format with the following details. The first page displays the following business details – legal name, address, constitution, certificate issue date, and other details.

- Registration Certificate – Annexure A

Annexure A displays the following business details – Details of GSTIN, legal name, and additional places of business.

- Registration Certificate – Annexure B

Details of GSTIN i.e. GST Identification Number, legal name, and details of the Managing Director.

FAQs

No. Taxpayer cannot download the certificate of registration without logging into the GST Portal. Once the GST officer processes the registration, the taxpayer will receive an email with GSTIN and first-time login credentials. Using these credentials, the taxpayer can log in to the GST Portal and download registration certificate.

Once the taxpayer submits an application for registration, the tax officer responds to it within 7 working days. However, if the application is successfully processed, the GST Department sends GSTIN and first-time login credentials to the registered email. If the tax officer needs additional information, details of the same are communicated on registered email. The application is processed only once the taxpayer provides additional details and documents.

In order to cancel the GST registration of a business, you need to visit the GST official portal. Go to services > Application for cancellation. Provide details and valid reasons. You can then submit the cancellation request.

Hey @HarshitShah

GST Registration is the application for GST Number or GSTIN(GST Identification Number). Under the GST(Goods and Service Tax) Regime, it is mandatory for to have GSTIN to collect, pay GST and claim the Input Tax credit.

For GST registration, the dealer has the following options:

Voluntary Registration: The business does not have the liability to register under GST, however, can apply for GST Registration. This usually is when the businesses are willing to take advantage of the Input Tax Credit facility

Registration under Composition Scheme: Composition scheme is a voluntary and optional scheme for registering under GST. Under the composition scheme, the compliance is simpler and lesser returns are to be filed. The tax is to be filed at a fixed rate. If the business turnover is in between INR 40 Lakhs and 1.5 Crores, they can opt for GST Registration under Composition Scheme

No Registration: In the case, when your business does not fall under the conditions for compulsory registration you do not require GST Registration

Hope this helps!

What documents do I need for a new GST number?

Hey @SonalYadav

To get a GST Number or GSTIN in India, you will be required to Register under GST(Goods and Service Tax)

Usually, you receive the GST Number within 4–7 days of GST Registration application is submitted.

Follow these steps to register under GST on GST Portal:[1]

PART A of the GST Registration Application

Now let’s start with the PART B of the GST Application

The PART B of GST Application has various tabs. You will be required to enter the relevant details and upload relevant documents.

Usually, GST Number or GSTIN is allocated within 4–7 days from submitting the GST registration application.

Hope this helps!

Footnotes

[1] GST Registration Process online on GST Portal: Guide | Help Center | Quicko

Hey @Shweta_Saini

You can opt out of Composition Scheme from your account on GST Portal. Once the taxpayer type is updated to Regular in your profile, you can start filing GST Returns under the regular scheme. If you are facing any issues while making the withdrawal application, you can create a grievance on the GST Portal.

Do let us know if you have any further queries.

I want to be able to claim input tax credit for GST paid. Should I opt for the GST composition scheme or regular scheme?

Hey @Joe_Fernandes

If you wish you claim Input tax credit, you should opt for GST Regular Scheme.

Read more about the difference here.

1.composite scheme dealer inward supplies detailes(purchases invoices ) uploaded manadatory show in gstr4 annual return.

2.composite dealer late fees and interest calculate procedure.

Hi @Sundaraiah_Kollipara,

As per Rule 62(3)(a) of CSGT Rules, 2017 (Part A_Rules) A composition taxpayer has to furnish

As per the instructions given below FORM GSTR-4 of CGST Rules, 2017 (Part B_Forms), the following information relating to inward supplies (rate-wise) needs to be provided

But as per clarification by GST department, when the auto-population feature for inward supplies which was available on the GST portal was not working. Reporting in table 4A of GSTR-4 is not mandatory.

Further, late fee of Rs. 200 per day is levied if the GSTR-4 is not filed within the due date. The maximum late fee that can be charged cannot exceed Rs. 5,000. Interest is also calculated at rate of 18% p.a on tax liability.

You can read our below articles for more insights:

A retail pharmacy store dealer composite scheme registered in gst act recently.dealer purchase of medicines different tax rates(1 ,12,18 percent)and sale to counter sales through on Google pay and phone pay online mode and cash mode sales two types amounts received.my doubt: dealer how to accounting entry passed procedure in books

@AkashJhaveri @Kaushal_Soni @Divya_Singhvi @Laxmi_Navlani can you?