GSTIN

GSTIN is a unique identification number issued to a business registered under GST. It is a 15-digit number. The GSTIN comprises of the PAN number of the business. It is important to verify the GSTIN of a taxpayer to ensure that the GSTIN quoted by a business on the documents actually belongs to them. Thus, the GST Portal has an option to search the taxpayers using the GST number. Individuals can search the taxpayers without logging in to the GST Portal.

The details of registered dealers/suppliers are also available on the GST Portal. The tool to search the taxpayer’s details allows you to view the profile of any registered taxpayer on the portal. The details provided during pre/post-login are different. Additional details are provided once you search for the details of the taxpayer post-login. Furthermore, details of UN Bodies, Embassies, Government Offices or Other Notified persons are also available on the portal. In such a case, you need to provide the Unique Identification Number (UIN).

GST Portal – Steps to Search Taxpayers

In the Case of Pre-Login:

1. Visit the GST Portal. Then click on Search Taxpayer > Search by GSTIN/UIN

2. Finally, enter the required details and click on “Search.”

In the Case of Post-Login:

The process as compared to the case of pre-login is almost the same. In this case, we log in to the GST Portal. Additional information is provided once the details of the taxpayer are searched post-login.

- Access the GST Portal.

Visit the GST Login Page and Login with Credentials.

- Click on Search Taxpayer > Search by GSTIN/UIN

To search the details of the Taxpayer, click on search taxpayer and then click on ‘Search by GSTIN’

- Click on the “Search” option.

Finally, enter the required details and Click on ‘Search’ Option.

There are other methods to search for the details of the taxpayer. You can search for the details using the PAN number of the business or you could specifically search for the details of the composition taxpayer.

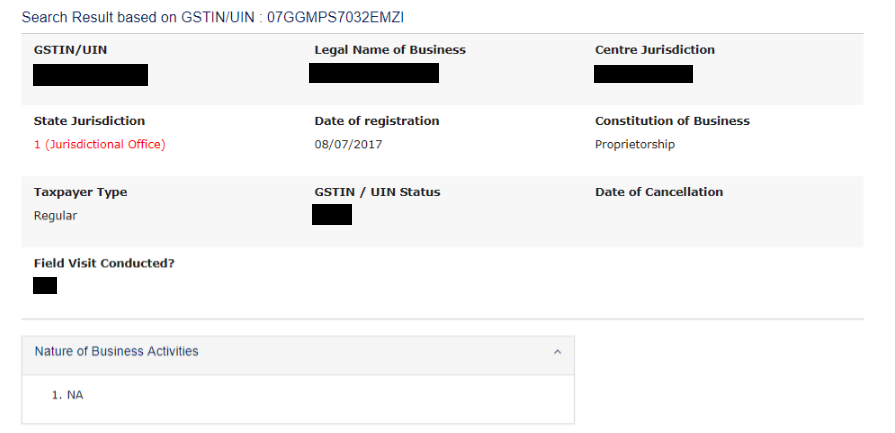

The search result consists of various details such as the legal name of the business, state jurisdiction, GSTIN status, etc.

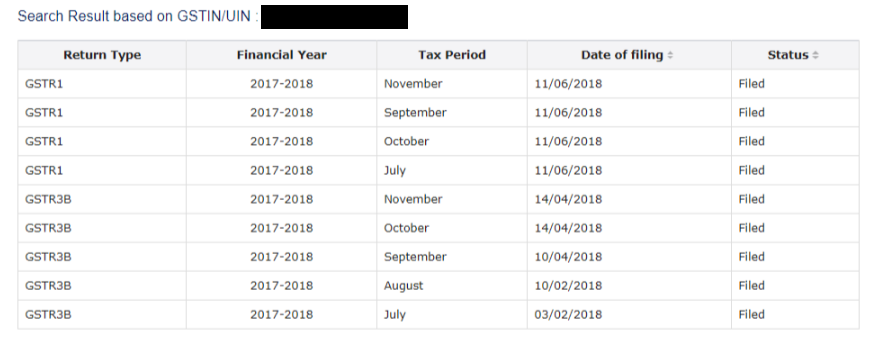

Along with other details of the taxpayer, you can also view Return Status for the last 10 Returns transactions.

FAQs

1. Visit the GST Portal.

2. Click on Search Taxpayer > Search by GSTIN/UIN

3. Enter the required details and click on “Search.”

Follow these steps to recover GST ID:

– Login to GST Portal and log in

– Click on Forgot Username at the bottom of the page

– Submit your GST Registration Number (GSTIN) or any Provisional ID or UIN. Click on Generate OTP

– Enter the OTP received

– You shall receive your User ID in your e-mail

Hey @Joe_Fernandes

To understand the steps for logging in to the GST portal, please refer to this article.

The password the user has created while logging in for the first time is valid for 120 days.

GST Portal Login Link

Visit: https://ssoid.net.in/gst.html

Steps to Login on GST Portal:

Open the GST Portal

Go to www.gst.gov.in

Click on “Login”

This button is on the top right corner of the homepage.

Enter Your Credentials

Username: Provided during registration.

Password: Enter your password.

Captcha Code: Type the characters shown in the image.

Click on “LOGIN”

Forgot Password?

If you’ve forgotten your password:

Click on“Forgot Password” on the login page.

Enter your username and captcha.

OTP will be sent to your registered mobile/email.

Set a new password.

Common Uses After Login:

File GST Returns (GSTR-1, GSTR-3B, etc.)

Check Payment Ledgers

Download GSTR Reports

Apply for refunds, etc.

Access the official GST portal at www.gst.gov.in to file returns, pay taxes, and manage your GST compliance online. Use your credentials to log in and navigate seamlessly through returns, invoices, and dashboard services.