Goods under GST are classified by the Harmonized System of Nomenclature (HSN) code. There are various types of goods and services. A common rate of tax is not applicable to all of them. Thus, they are classified into smaller groups and a specific GST rate is applied to the groups. Services are classified on the basis of the Service Accounting Code (SAC).

An individual can search the tax rate associated with a specific HSN/SAC code on the GST Portal. It isn’t necessary for the individual to be a registered user at the GST Portal.

GST Portal – Steps to Search HSN/SAC Tax Rates

Follow steps 2 through 8 to find HSN codes and follow steps 9 through – to find the SAC tax rates

- Go to the GST portal homepage

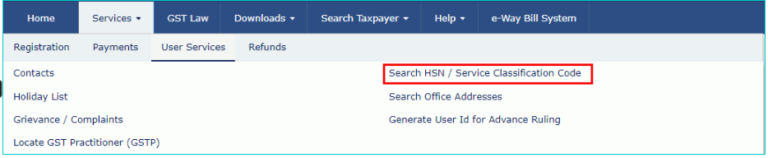

Visit the GST Portal Homepage and login with valid credentials. Click on Services > User Services > Search HSN/SAC Code

- In the case of HSN Codes

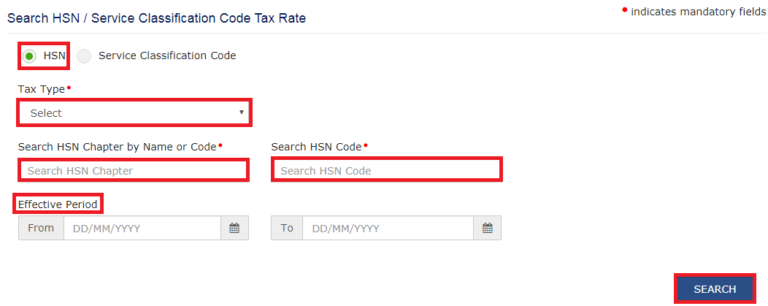

Firstly, click on the HSN checkbox.

- Select the tax-type

Secondly, select the tax-type you are searching for in the Tax-Type drop-down list.

- Search HSN Chapter by Name or Code

Furthermore, enter the HSN code or name of the chapter whose rates you are looking for under the “Search HSN Chapter by Name or Code.”

- Search HSN Code

Additionally, enter the HSN code of the goods whose tax rates you are looking for under the “Search HSN Code” category.

- Select the appropriate dates

Select the appropriate dates in the “Effective Period” category from the calendar.

- Click on the “Search” option.

Finally, once the details are filled in, click on the “Search” option.

- Select the State

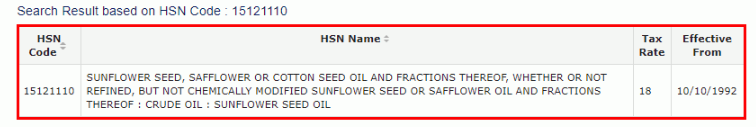

In case you select SGST from the Tax Type list, you also need to select the State for which you want to check the tax rate. We receive the result in the following manner:

- In the case of SAC Codes

Firstly, click on the SAC checkbox.

- Select the tax-type

Secondly, select the tax-type you are searching for in the Tax-Type drop-down list.

- Enter the Service Classification Code (SAC)

Furthermore, enter the Service Classification Code (SAC) whose rates you are looking for under the “Service by Name or Code.”

- Select the appropriate dates

Additionally, select the appropriate dates in the “Effective Period” category from the calendar.

- Click on the “Search“

Finally, click on the “Search” option.

After the completion of the above process, the details will be displayed to the user.

FAQs

HSN codes shall not be used mandatorily in the following cases:

1. Dealers who have an annual turnover of less than INR 1.5 Crores

2. Dealers registered under the Composition Scheme of GST are exempted from the usage of HSN Codes

Since GST returns are completely automated, it will be hard for the dealers to upload the description of the products being supplied. Hence, HSN Codes shall be automatically picked up from the registration details of the dealer and will reduce the efforts thereby. Dealers have to be careful in choosing the correct HSN/SAC code while migrating to GST or making a fresh registration.

Hey @HarishMehta

From 1st April 2021, Taxpayers with an aggregate Annual Turnover of more than INR 5 Crore during the financial Year 2020-2021 have to mandatorily mention 6 digits of the HSN Code in all tax invoices.

Businesses with a turnover of up to INR 5 crore in the preceding financial year will be required to mandatorily furnish 4 digit HSN code on B2B invoices.

Hope this helps!

Hey @Dia_malhotra

Let’s take an example of Cocoa powder to calculate the GST using the HSN code.

Cocoa Powder per Kg = INR1,000.

HSN Code = 18 05 00 00

GST Rate = 18% (For Cocoa powder, not containing added sugar or sweetening matter)

Therefore, GST = INR180

Hope this helps!

Hey,

What are the consequences of not mentioning or incorrectly mentioning the HSN Code?

Hey @SonalYadav

It is very crucial to mention the correct HSN/ SAC Code on the tax invoices and Form GSTR-1, barring to do so may attract a penalty of INR 50,000 (INR 25,000 each for CGST and SGST) for non-mentioning or incorrect mention of wrong HSN/ SAC Code under Section 125 of the CGST Act.

Hope this helps!

Hey @Prasana_Srinivasan, this tool can help