Taxpayers can view or download the demand orders issued by the Tax Authority. This information is available on the GST Portal. This information is available in chronological order. Furthermore, users can view the Notices and Demand Orders for the last one year. If required, users can also download the notices or orders issued in the PDF Format.

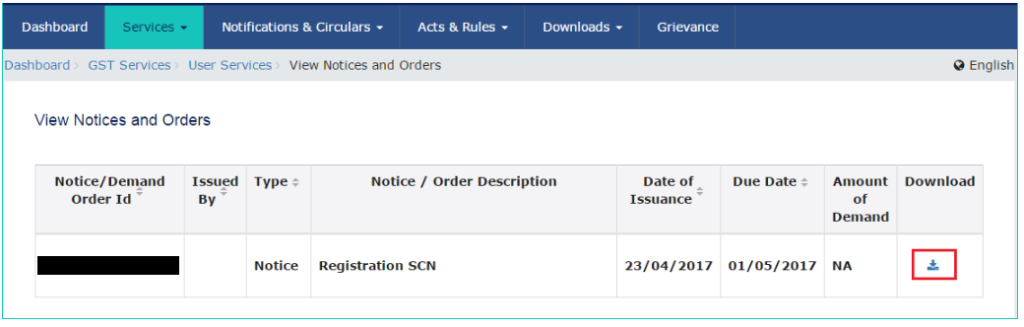

The data that is available under this category is as follows:

- Notice/Demand Order ID

- Issued by (Authority)

- Type

- Notice / Order Description

- Date of issuance (Descending Order)

- Due Date

- Amount of Demand (if applicable)

- View / Download

Steps to View/Download Notices or Demand Orders issued

- Go to the GST Portal.

Access the GST Portal and Login with your Credentials.

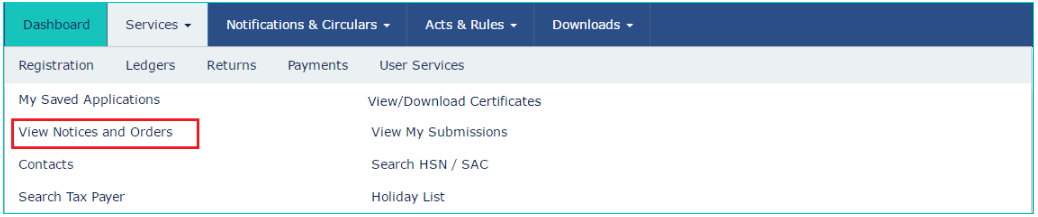

- Next, click on Services > User Services > View Notices & Orders Command

To view Notices and Orders Command, click on Service and then User Service.

All the notices and demands issued to the taxpayer for the last one year is displayed on the screen in chronological order (Descending).

The user can also download or view any of the documents. The option to download the document is highlighted in the above image.

FAQs

An Individual can reply to any notice on the GST Portal itself. It is advisable to reply to the notices on the portal itself at the earliest moment. Failing to do so will attract penalties.

The proper officer will be required to isses the notice 6 months prior to the limit. The time limit for filing of annual return is 5 years from the due date.

An Individual wishing to make corrections can do so by filling the FORM GST REG-14 along with documents. Note: It might take up to 2 weeks for the GST officer to verify and approve your application.

Hey @Joe_Fernandes

To understand the steps for logging in to the GST portal, please refer to this article.

The password the user has created while logging in for the first time is valid for 120 days.

GST Portal Login Link

Visit: https://ssoid.net.in/gst.html

Steps to Login on GST Portal:

Open the GST Portal

Go to www.gst.gov.in

Click on “Login”

This button is on the top right corner of the homepage.

Enter Your Credentials

Username: Provided during registration.

Password: Enter your password.

Captcha Code: Type the characters shown in the image.

Click on “LOGIN”

Forgot Password?

If you’ve forgotten your password:

Click on“Forgot Password” on the login page.

Enter your username and captcha.

OTP will be sent to your registered mobile/email.

Set a new password.

Common Uses After Login:

File GST Returns (GSTR-1, GSTR-3B, etc.)

Check Payment Ledgers

Download GSTR Reports

Apply for refunds, etc.

Access the official GST portal at www.gst.gov.in to file returns, pay taxes, and manage your GST compliance online. Use your credentials to log in and navigate seamlessly through returns, invoices, and dashboard services.