Companies are incorporated with the Ministry Of Corporate Affairs (MCA) in India. And the activities of incorporated companies are monitored by the Registrar of Company (ROC). The companies need to file certain documents with the ROC in the normal course of business. Form GNL-2 can be filed when there is no prescribed eform available for filing that document. It is commonly used by the companies for the following:

- Submitting Prospectus of Company before the fresh issue of shares,

- Submitting Offer Letter (PAS-4) in case of Private Placement,

- Furnishing Circular for inviting deposits in the company,

Who can file GNL-2?

Form GNL-2 can be filed by any company incorporated under the Companies Act 2013/Companies Act 1956 for the following transactions:

- Prospectus

- Information Memorandum

- Private placement offer letter

- Record of a private placement offer to be kept by the company

- Circular for inviting deposits

- Circular in the form of advertisement for inviting deposits

- Form 149 of the Companies (Court) Rules, 1959

- Form 152 of the Companies (Court) Rules, 1959

- Form 153 of the Companies (Court) Rules, 1959

- Form 154 of the Companies (Court) Rules, 1959

- Form 156 of the Companies (Court) Rules, 1959

- Form 157 of the Companies (Court) Rules, 1959

- Form 158 of the Companies (Court) Rules, 1959

- Form 159 of the Companies (Court) Rules, 1959

- Others

Information Required to file GNL-2

The following information is required for filing GNL-2:

- CIN of the company,

- Type of Document to be filed with GNL-2,

- Details of the documents being filed,

- Date of event,

- Date of passing resolution relating to the document,

- Supporting Attachments i.e, copy of prospectus or copy of private placement offer letter.

Steps to file GNL-2

- Access MCA Portal.

Go to the MCA Portal and Login with your credentials.

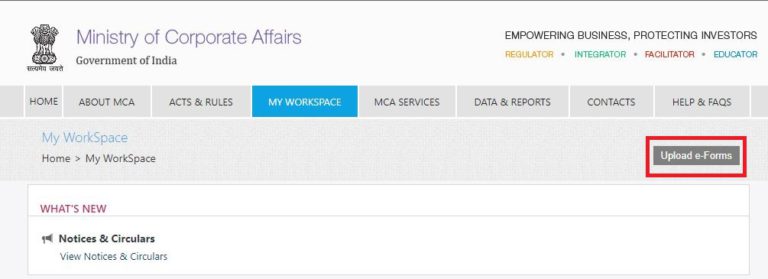

- Click on Upload e-Forms

On the MCA Portal, click on My Workspace and then click on Upload e-Forms.

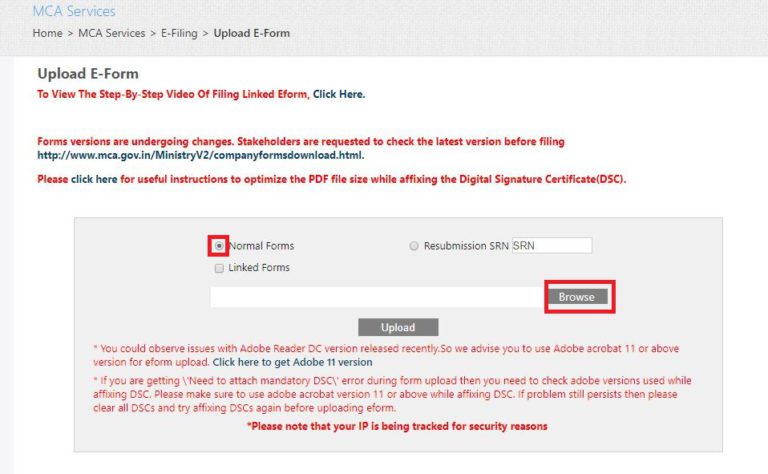

- Upload the saved GNL-2.

Click on Normal Forms and click on Browse to upload the saved GNL-2 File.

- Save the SRN to make payment of form fees.

Once the form is uploaded successfully, SRN (Service Request Number) will be generated. Save the SRN to make payment of form fees. The form will be processed once the payment of form fees is done.

Fee of GNL-2

Form GNL-2 needs to be filed within 30 days from the event date. The fees are applicable based on the capital structure of the company:

- In the case of a company having a share capital,

- In the case of a company not having a share capital.

In the case of a company having a share capital

| Nominal Share Capital | Fee Applicable |

| Less than 1,00,000 | INR. 200 |

| 1,00,000 to 4,99,999 | INR. 300 |

| 5,00,000 to 24,99,999 | INR. 400 |

| 25,00,000 to 99,99,999 | INR. 500 |

| 1,00,00,000 or more | INR. 600 |

In the case of a company not having a share capital

| Fee Applicable |

| Rupees INR. 200 per document |

Additional Fees

| Period of Delays | All Forms |

| Up to 30 days | 2 times of normal fees |

| More than 30 days and up to 60 days | 4 times of normal fees |

| More than 60 days and up to 90 days | 6 times of normal fees |

| More than 90 days and up to 180 days | 10 times of normal fees |

| More than 180 days | 12 times of normal fees |

Additional fees are applicable when a form is filed after 30 days from the event date.

FAQs

No need to file GNL -2. Instead only PAS-6 need to be filed

ADT – 1 i.e notice to the ROC by company for the appointment of Auditors is required to be filed as an annexure to GNL-2

Annex the ADT 1 (Digitally Signed)+ Resolution Copy + Letter from Auditor in the optional attachment tab of the GNL-2 and submit it to ROC

Hello @Paritosh_Trivedi

Form GNL-2 can be filed when there is no prescribed e-Form available for filing that document. It is commonly used by the companies for the following:

Submitting Prospectus of Company before the fresh issue of shares,

Submitting Offer Letter (PAS-4) in case of Private Placement,

Furnishing Circular for inviting deposits in the company.

You can learn more about e-Form GNL-2 here:

Hope this helps!