GSTR 3B is a summary GST Return with details of Outward supplies i.e. sales, input tax credit claimed on inward supplies i.e. purchases and expenses, and Payment of Tax. Every business registered as a Normal Taxpayer shall file GSTR-3B by 20th, 22nd or 24th of the subsequent month. In case, there are no business transactions, you must file a NIL GST Return.

Following are four steps to file GSTR-3B:

- Prepare GSTR-3B

- Save GSTR-3B

- Payment of Tax

- File GSTR-3B

You can prepare GSTR-3B in the following two ways:

- Prepare GSTR-3B Online on GST Portal

- Prepare GSTR 3B Offline through Offline Tool

How to file GSTR-3B? Online on GST Portal

You can enter the data of sales and input tax credit, pay the tax and file the GST Return on GST Portal.

- Prepare GSTR-3B

Login to your account on the GST Portal with valid username and password.

- Navigate to Services

Click on Returns > Returns Dashboard.

- Select the Financial Year and Period of filing

Click on ‘PREPARE ONLINE’ under Monthly Return GSTR-3B.

- Instructions Page

Once you read the instructions, click OK to proceed.

- Questionnaire

A list of questions to show the relevant sections of the GST Return is displayed. Fill in the answers with either ‘Yes’ or ‘No’ and click on ‘NEXT’.

- Enter details of Sales, Input Tax Credit, Interest etc

Only the sections for which ‘YES’ was selected will be shown. Enter details of the relevant tax period in each of the sections displayed

- Payment of Tax

Click on SAVE GSTR-3B. And click on PREVIEW DRAFT GSTR-3B to review the data entered.

- There are three tables displayed:

(i) Electronic Cash Ledger with an outstanding balance that the taxpayer can utilise for paying tax, interest, penalty, or late fee.

(ii) Electronic Credit Ledger with an outstanding balance that the taxpayer can utilise for paying tax.

(iii) The Electronic Liability Ledger reflecting liability, tax paid by using Input Tax Credit and tax, penalty, late fee, and interest paid by using the cash balance. - Set Off Tax Liability

Once you click ‘MAKE PAYMENT / POST CREDIT TO LEDGER’ to pay off the tax liability, no changes can be made. Click ‘PROCEED TO FILE’ and you can file the return using two options:

1. File GSTR–3B with DSC – Use Digital Signature of the Authorised Signatory. It is mandatory in case of a Company and an LLP

2. File GSTR–3B with EVC – Use OTP sent on registered email and mobile number of the Authorised Signatory. - Success message with ARN (Acknowledgment Reference Number)

A confirmation message with ARN is sent to the registered email and mobile number and the status of the return on the dashboard is changed to FILED.

How to file GSTR-3B? – using Offline Tool

You can enter the data of sales and input tax credit in the excel utility, generate and upload the JSON file, pay the tax and file the GST Return on the GST Portal.

Steps to use GST Offline Tool

- Download the latest GSTR-3B excel utility from the GST Portal.

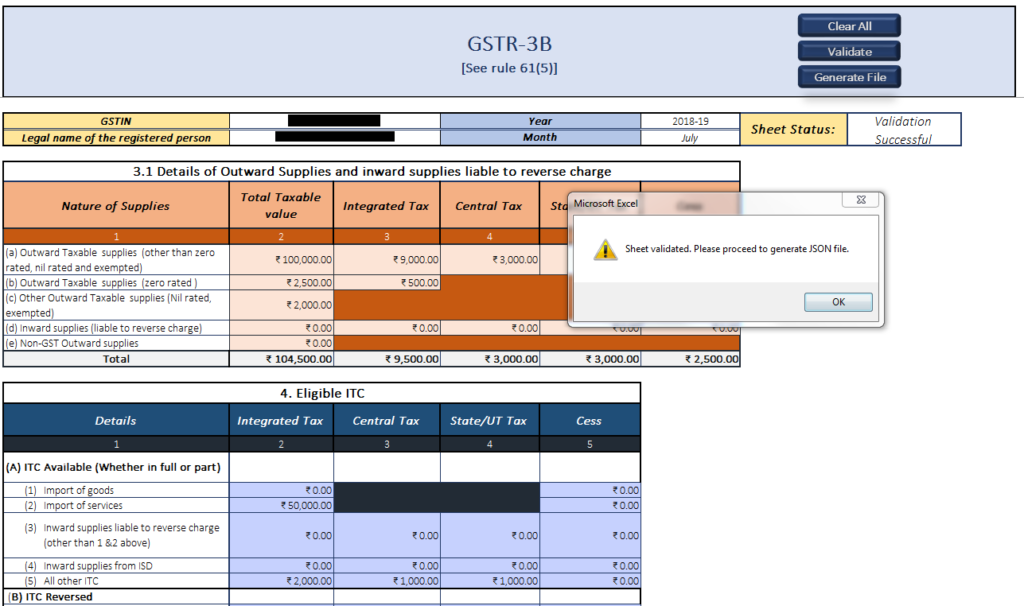

- To clear the data in the excel worksheet, click on ‘Clear All’.

- Enter the basic details – GSTIN, Legal Name, Financial Year, and Month.

- Enter details of the relevant tax period in each of the sections displayed as per the table below.

|

Details of Sales |

|

|

Table Name |

Details to be entered |

|

3.1 Details of Outward Supplies and inward supplies liable to Reverse Charge |

|

|

3.2 Of the supplies shown in 3.1 (a), details of inter-state supplies made to unregistered persons, composition taxable person and UIN holders |

|

|

Details of Purchases |

|

|

Table Name |

Details to be entered |

|

4. Eligible ITC |

|

|

5. Values of exempt, Nil-rated and non-GST inward supplies |

|

|

Interest & Late Fee |

|

|

Table Name |

Details to be entered |

|

5.1 Interest & late fee payable |

|

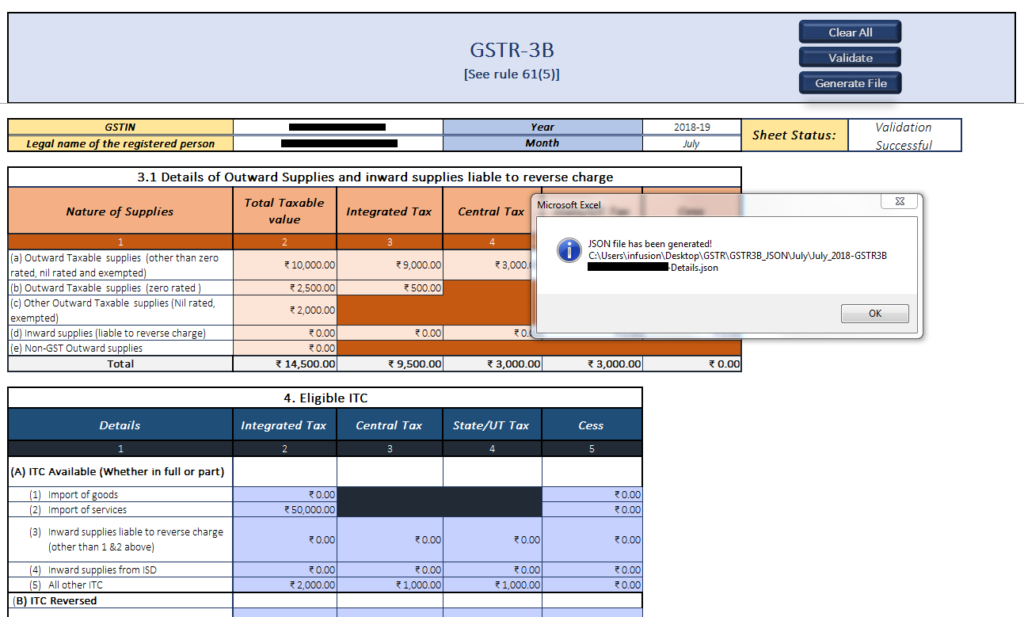

- Click on ‘Validate’. In case, there is a failure in validation, correct the errors as per error message displayed.

- Once the validation is successful, click on ‘Generate file’ to generate the JSON file.

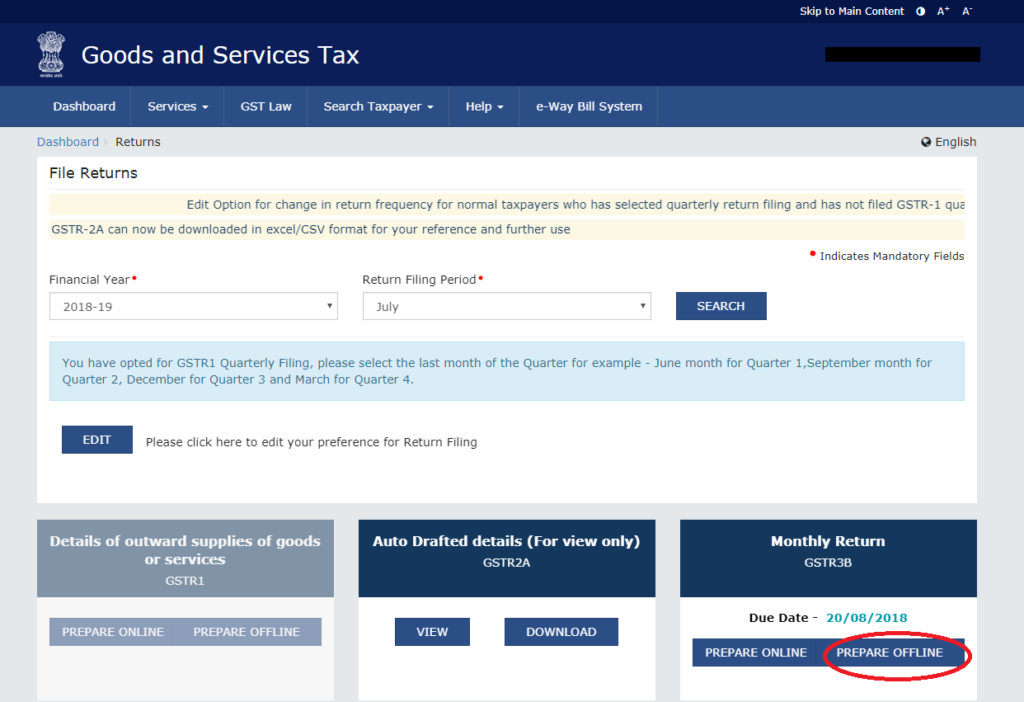

Steps to file on GST Portal

- Log in to your account on the GST Portal using valid username and password.

- Click on Services > Returns > Returns Dashboard.

- Select the Financial Year and Period of filing.

- Click on ‘PREPARE OFFLINE’ under Monthly Return GSTR-3B.

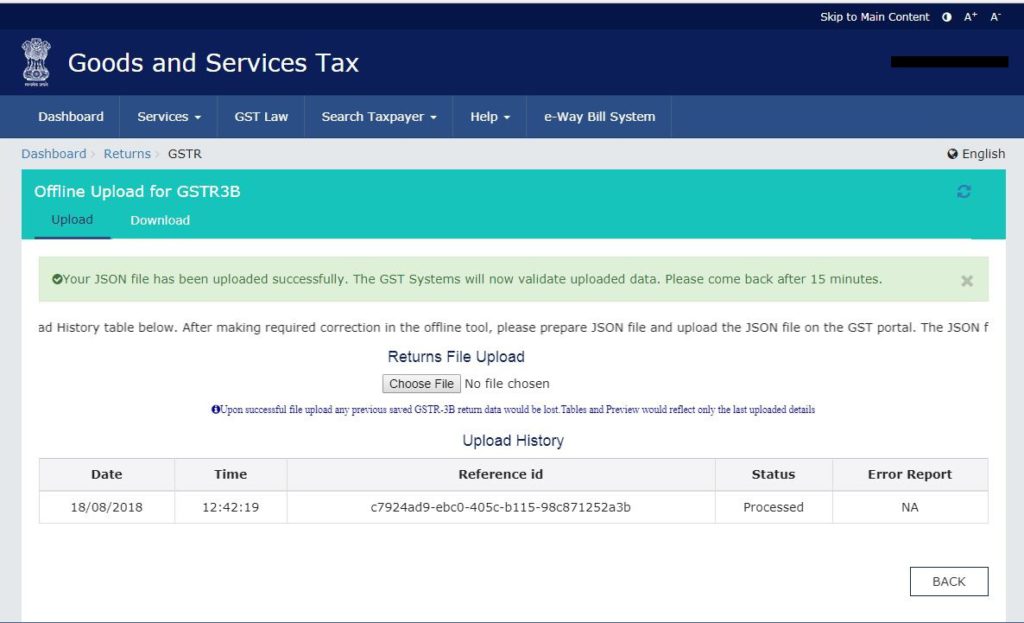

- Upload the JSON file.

- Click on SAVE GSTR-3B and click on PREVIEW DRAFT GSTR-3B to review the data entered.

- There are three tables will appear on the screen:

- Electronic Cash Ledger with an outstanding balance that the taxpayer can utilise for paying tax, interest, penalty, or late fee.

- Electronic Credit Ledger with an outstanding balance that the taxpayer can utilise for paying tax.

- The Electronic Liability Ledger reflecting liability, tax paid by using Input Tax Credit and tax, penalty, late fee, and interest paid by using the cash balance.

- Once you click ‘MAKE PAYMENT / POST CREDIT TO LEDGER’ to pay off the tax liability, no changes can be made.

- Click ‘PROCEED TO FILE’ and then you can file the return using two options:

- File GSTR-3B with DSC – Use Digital Signature of the Authorised Signatory. It is mandatory in case of a Company and an LLP,

- File GSTR-3B with EVC – Use OTP sent on registered email and mobile number of the Authorised Signatory.

- A success message will appear on the screen with the ARN (Acknowledgment Reference Number). The system sends a confirmation message to the registered email and mobile number. The status of the return on the dashboard changes to ‘FILED’.

FAQs

It is not possible to revise GSTR 3B once filed. But Government has now allowed to ‘Reset GSTR 3B’ through which the status of ‘Submitted’ will be changed to ‘Yet to be Filed’, and all the details filled in the return will be available for editing.

To file GSTR-3B NIL Return, follow these steps:

1. Login to your account on GST Portal

2. Go to Services > Returns > Returns Dashboard

3. Select the Financial Year and Filing Period

4. Click on Prepare Online

5. In the questionnaire displayed, select ‘Yes’ for the question Do you want to file NIL Return?

6. You can file GSTR-3B using DSC or EVC

In GSTR-3B, the taxpayer should report the Net Amount:

Value of Taxable Supplies = Value of Invoices + Value of Debit Notes – Value of Credit Notes + Value of Advances Received for which invoices have not been issued in the same month – Value of Advances adjusted against invoices.

So, suppose if any invoice is issued and further in respect of that invoice other documents like Credit Note, Debit Note, etc. are issued then the impact of those further issued documents has to be adjusted against the amount of invoice and the net amount has to be uploaded.

I found this blog post very helpful. I was able to complete my GST return using the online tool on the GST portal. Thank you for providing this information.