GSTR-1 is the monthly or quarterly return to be filed by taxpayers registered under the regular scheme of GST registration. It comprises of details of goods or/and services supplied during the return period. The taxpayer should file GSTR-1 on or before the due date i.e. 10th of next month for monthly GSTR-1 and last date of the month from the end of the quarter for quarterly GSTR-1.

There are five steps to file GSTR-1:

- Prepare GSTR-1

- Generate GSTR-1 Summary

- Preview GSTR-1

- Submit GSTR-1

- File GSTR-1

You can prepare GSTR-1 in the following two ways:

- Prepare GSTR-1 Online on the GST Portal

- Prepare GSTR-1 Offline through the Offline Tool

How to file GSTR 1? – Online on GST Portal

To file GSTR-1 on the GST Portal, follow these steps:

- Visit GST Portal

Log in to the GST Portal with valid username and password.

- Navigate to Returns Dashboard

Go to Services > Returns > Returns Dashboard.

- Financial Year and Period of filing

Select the Financial Year and Filing Period for the GST Return. For filing GSTR-1, the taxpayer can select the filing frequency as monthly or quarterly based on the aggregate turnover.

- GSTR-1 – Prepare Online

Click on ‘PREPARE ONLINE’ under GSTR-1. Enter details of the relevant tax period in the sections that appear on the screen.

- Generate GSTR 1 Summary

Click on ‘Generate GSTR 1 Summary’ to generate the latest summary of the entered details. Click on ‘PREVIEW’ to download the draft GSTR-1. Review the data and click on ‘SUBMIT’.

- File Return

Click ‘FILE RETURN’ and you can file the return using two options:

1. File with DSC – Use Digital Signature of the Authorised Signatory. It is mandatory in the case of a Company and an LLP.

2. File with EVC – Use OTP sent on registered email and mobile number of the Authorised Signatory. - Success Message and ARN

A success message with the ARN (Acknowledgment Reference Number) appears on the screen. The system sends a confirmation message to the registered email and mobile number. The status of the return on the dashboard changes to FILED.

How to file GSTR 1 using Offline Utility?

You can enter the data of sales, HSN summary and document summary in the GSTR offline tool, generate and upload the JSON file and file the GST Return on the GST Portal.

Steps to use GST Offline Utility:

- Step-1: Download the latest version of GST Offline Tool

Go to GST Portal > Downloads > Returns Offline Tool. It contains excel utility for GSTR-1 and the java utility to generate JSON file - Step-2: Clear the sample data in the excel worksheet

Enter details of the relevant tax period in each of the sections displayed by using help instructions in the first tab - Step-3: Open the GST Offline Tool and follow these steps:

- Click on New

- Enter GSTIN, Financial Year, Tax Period and click on Proceed

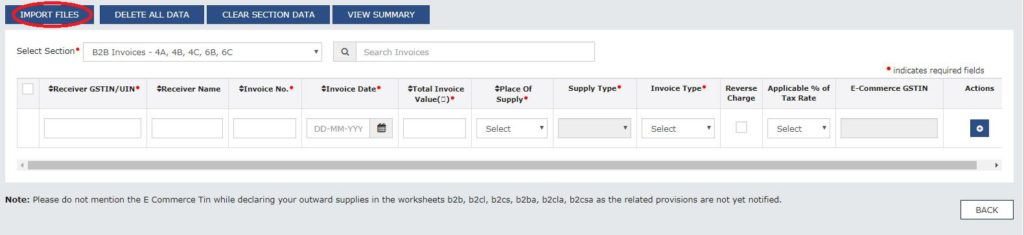

- Step-4: Enter Data or Import Data

You can either enter data manually or import data from excel utility. Click on Import Files.

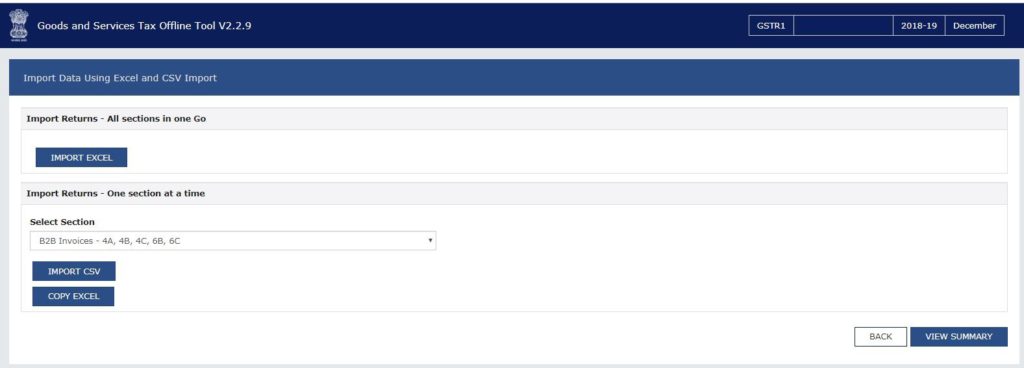

- Step-5: Import Excel

You can either Import the entire excel sheet or selected sections. Select Import CSV to import the .csv file.

- Step-6: Generate File

Select Copy Excel to copy-paste the data of the section you wish to import. Click on View Summary. Review the data and click on Generate File to create a JSON file.

Steps to file GSTR-1 on GST Portal:

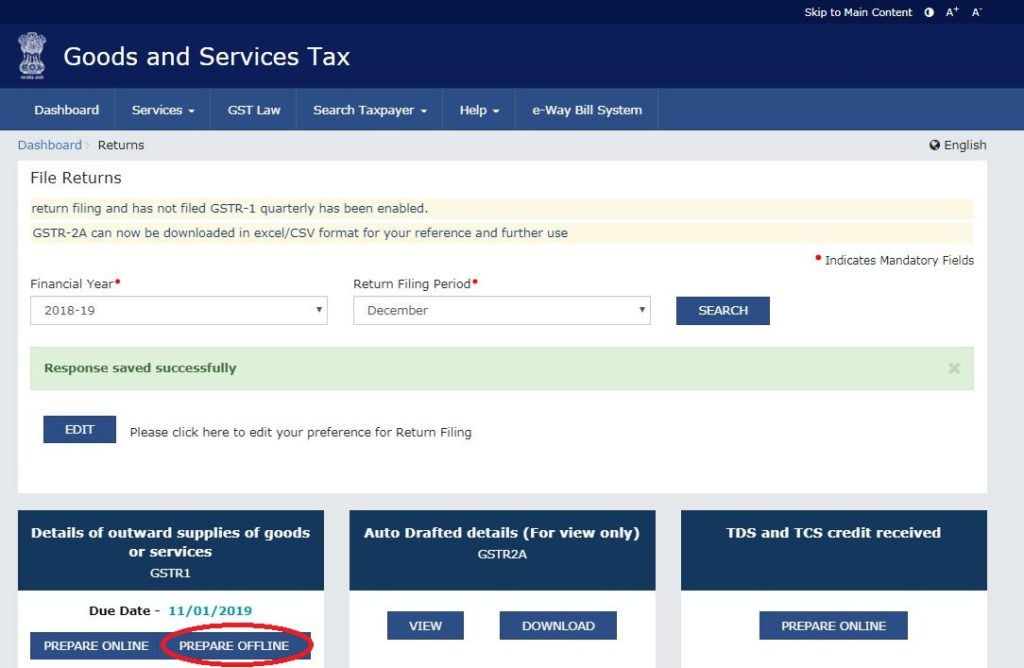

- Step-7: Navigate to Returns Dashboard on GST Portal

Log in to GST Portal with a valid username and password. Select the Financial Year and Period of filing. Click on ‘PREPARE OFFLINE’ under GSTR-1.

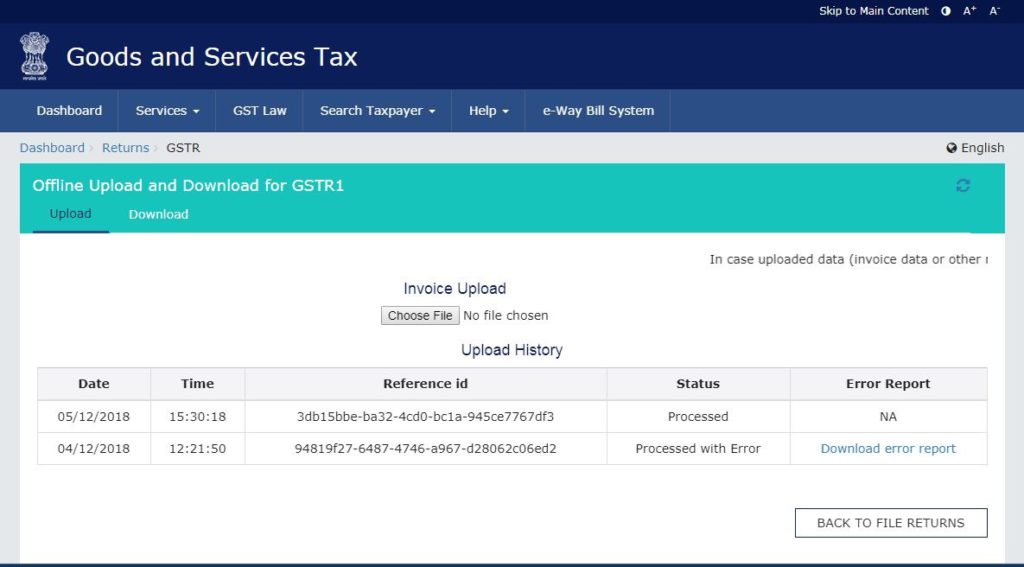

- Step-8: Upload JSON file

Upload the JSON File that you have saved. Once the status changes to ‘processed’, go back to the returns dashboard and click on prepare online.

- Step-9: Generate GSTR-1 Summary

Click on ‘Generate GSTR 1 Summary’ to generate the latest summary of GSTR-1. - Step-10: Preview and Submit

- Click on ‘PREVIEW’ to download the draft GSTR-1

- Review the data and click on ‘SUBMIT’

- Step-11: File Return

Click ‘FILE RETURN’ and you can file the return using two options:- File with DSC – Use Digital Signature of the Authorised Signatory. It is mandatory in case of a Company and an LLP

- File with EVC – Use OTP sent on registered email and mobile number of the Authorised Signatory.

- Step-12: Success Message and ARN

A success message with the ARN (Acknowledgment Reference Number) appears on the screen. The system sends a confirmation message to the registered email and mobile number. The status of the return on the dashboard changes to FILED.

FAQs

Every registered taxable person, other than an input service distributor/compounding taxpayer/TDS Deductor/TCS Collector is required to file GSTR-1, the details of outward supplies of goods and/or services during a tax period, electronically on the GST Portal.

The following taxpayers are not required to file GSTR-1:

• Taxpayers under the Composition Scheme. They should file CMP-08 and GSTR-4.

• Non-resident foreign taxpayers. They should file GSTR-5.

• Online information database and access retrieval service provider, They should file GSTR-5A.

• Input Service Distributors (ISD). They should file GSTR-6.

• Tax Deducted at Source (TDS) Deductors. They should file GSTR-7.

• E-Commerce Operators deducting TCS. They should file GSTR-8.

PLS LIVE SESSION SEND ME.HOW CAN I FILE GSTR-1

Hello Manisha, Please drop an email at help@quicko.com, we shall get in touch and help you.