An Extraordinary General Meeting (EGM) is a meeting other than a Company’s Annual General Meeting (AGM). An EGM is also called a special general meeting or emergency general meeting. The only time shareholders and executives meet are during a Company’s annual general meeting, which usually occurs at a fixed date and time. The extraordinary general meeting is used as a way to meet and deal with urgent matters that arise in between the annual shareholders’ meetings. An EGM might be called to deal with any of the following:

- The removal of an executive

- A legal matter

- Any matter that can’t wait until the next shareholders meeting

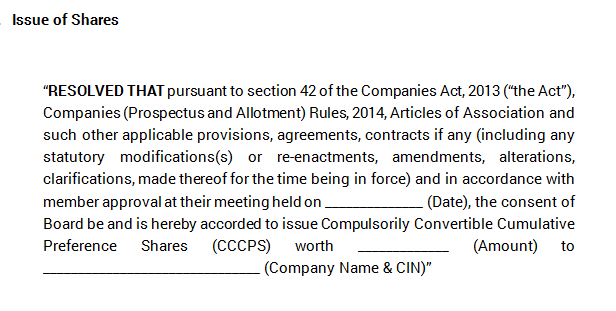

The Extraordinary General Meeting must be held 21 days from the date of issue of the notice. The meeting is called for deciding about allotment of shares. The Board of Directors assigns a committee of Directors known as the Allotment Committee. The allotment committee would then decide about the allotment of shares.

Once allotment committee provides its report with respect to allotment of shares, the Board then approves such a report and then passes the resolution for allotting shares to the respective applicants.

FAQs

Voting shares are shares that give the stockholder the right to vote on matters of corporate policymaking. Owning voting shares also allows a vote on who should be on the company’s Board of Directors.

An Annual General Meeting (AGM) is a mandatory yearly gathering of a company’s interested shareholders. At an AGM, the directors of the company present an annual report containing information for shareholders about the company’s performance and strategy.

An Extraordinary General Meeting (EGM) refers to any shareholder meeting called by a company other than it’s scheduled annual meeting.

A block holder is the owner of a large block of a company’s shares and/or bonds. In terms of shareholding, these owners are often able to influence the company with the voting rights awarded with their holdings.

Hi @Nandana

e-Form PAS-3 is to be filed with RoC. If the allotment is through Private Palcement, PAS-3 is required to be filed within 15 days of allotment and in case allotment is made to public at large, within 30 days of allotment.

Hope this helps!

What attachments are required with PAS-3

Hi @Nandana

PAS-3 is the return of allotment to be filed with RoC once the allotment of shares is made. Certified true copy of board resolution and a list of allottees must be attached with PAS-3.

Hope this helps!

Who shall sign a share certificate?

Hi @emmy

When shares are issued by a Company, the share certificate must be signed by at least two directors or one director and the company secretary, if appointed.

Hope this helps!

@Sakshi_Shah1 can you help?

Hi @Farzeen

Whenever any company makes any allotment of shares or securities, it is required to file a return of allotment in e-Form PAS-3 to Registrar on mca portal with the complete list of allottees to whom the securities have been issued.

As per the Instruction Kit of filing PAS-3, details of maximum five such allotments can be filed through this eForm. However, if the total number of allotments is more than five, then file another eForm

PAS-3 for remaining such allotments.

Read more about it here - Instruction Kit PAS-3

Hey @Bharti_Vasvani can you please help here

Hey @Gowtham_Raj,

In this case, 2 allottments will be considered, preference share allotment will be considered as one allotment and another as debenture.

Hope this helps!

Hi @harshjain

A share certificate should be signed by either 2 company directors or 1 director and a company secretary.