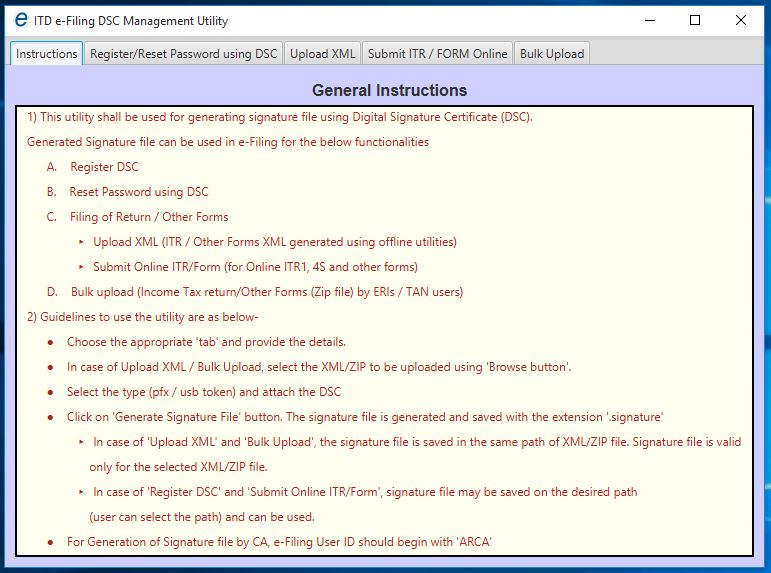

DSC i.e. Digital Signature Certificate is an electronic signature that is used to sign electronic documents or to access information or services on the internet. The certificate contains the following details of the user – name, pin code, country, date of issue, date of expiry, and name of the certifying authority. To use DSC services on Income Tax E-filing Portal, the taxpayer should use the DSC Management Utility to generate a signature file. To upload an XML on the Income Tax website, the taxpayer should generate a signature file from DSC Management Utility.

The signature file from DSC Utility can be used to avail the following services on the Income Tax E-filing Portal:

- Register DSC – To register DSC in the profile on the Income Tax E-filing Portal

- Reset Password using DSC – If the taxpayer has forgot password, he can reset it using DSC

- Upload XML – The taxpayer can upload XML to file ITR

- Upload Tax Audit Report – A Chartered Accountant can upload XML to file Tax Audit Report of the taxpayer

- Submit ITR Online – Taxpayer can approve Tax Audit Report filed by Chartered Accountant

- Submit Form Online – Taxpayer can upload any form on Income Tax E-filing Portal

- Upload Zip File (Bulk Upload) – TAN users or ERIs can bulk upload ITRs or other forms

DSC Management Utility – Steps to Generate a Signature File to Upload XML

- Download DSC Management Utility

Firstly, Download DSC Management Utility from the income tax e-filing portal. A zip folder is downloaded

- Open the Java Utility

Extract the zip folder. Click on DSC_MGMT_UTILITY.jar to open the utility

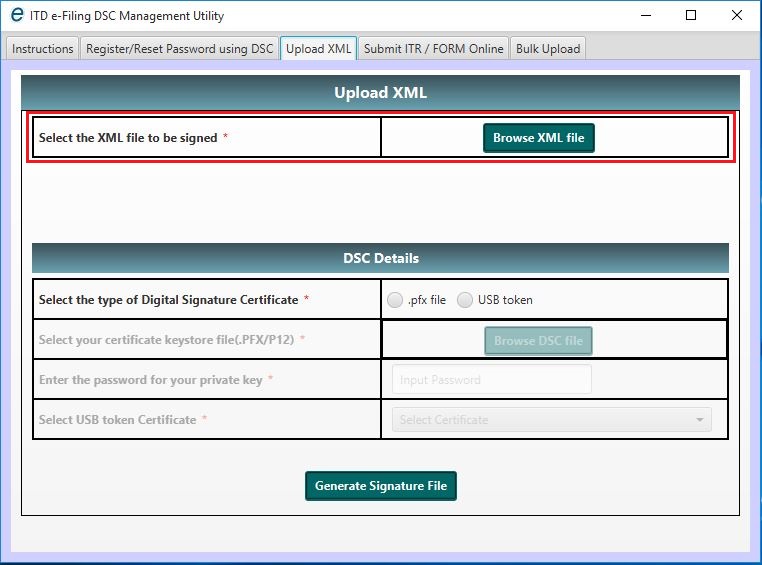

- Tab – Upload XML

Select tab ‘Upload XML’. Click on ‘Browse XML file’ to select XML file for which you want to generate the digital signature file

- Type of DSC – Using .pfx file

If you select the type of DSC as .pfx file, follow these steps:

a. Select the option .pfx file

b. Select the certificate file

c. Enter the password

d. Click on ‘Generate Signature File’

- Type of DSC – Using USB Token

If you select the type of DSC as .pfx file, follow these steps:

a. Select the option USB Token

b. Select USB Token Certificate from the drop-down

c. Click on ‘Generate Signature File’

d. Enter the USB Token PIN. Click on ‘Ok’

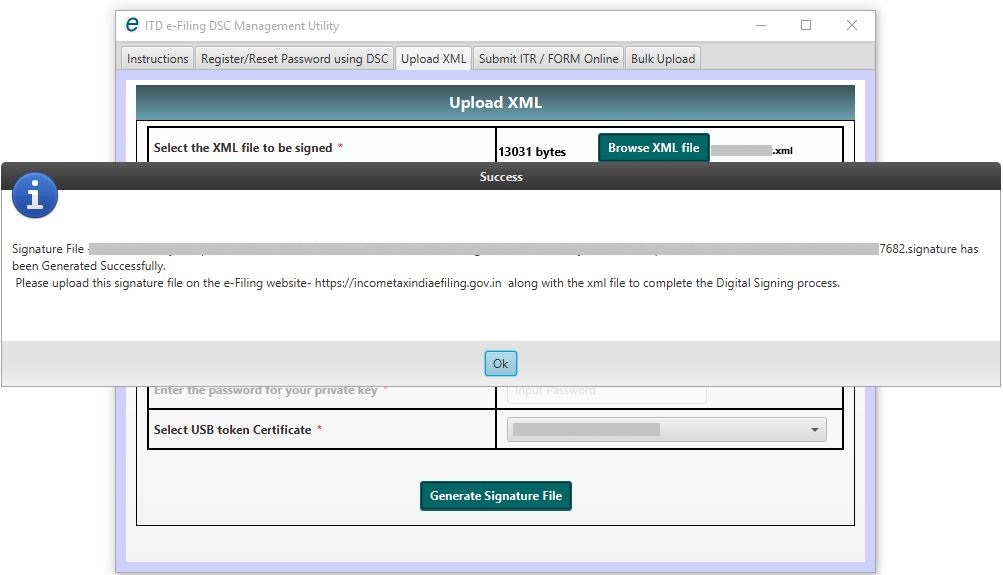

- Success Message

A success message will appear on the screen and a signature file is generated. Save it in the appropriate folder

- Use DSC Signature File

You can use the signature file for the following services:

a. Upload ITR by Taxpayer – Login to incometaxindiaefiling.gov.in > e-file > Upload Return > Attach XML > Attach Signature File

b. File Rectification by Taxpayer – Login to incometaxindiaefiling.gov.in > e-file > Rectification > Attach XML > Attach Signature File

c. Upload Tax Audit Report or Upload Other Forms by CA – Login to incometaxindiaefiling.gov.in > e-file > Upload Form > Attach XML > Attach Signature File

FAQs

If the validity period of the Digital Signature Certificate has expired, the taxpayer should apply for a new Digital Signature Certificate from the Certified Service Provider. Once the new DSC is issued, the taxpayer should register the DSC on Income Tax Portal and upload XML.

If the PAN in the Digital Signature Certificate does not match with the registered PAN of the taxpayer, PAN mismatch error will appear on the screen. The taxpayer should contact the Certificate Provider and check the PAN in DSC.

If the taxpayer is a Firm / Company / AOP / BOI / Legal Authority / Co-operative Society / Artificial Juridical Person / Trust, ensure that the PAN mentioned in the Digital Signature is of principal contact (Authorized Signatory). If the principal contact has changed, ensure that you have updated PAN details of the new principal contact (under ‘Profile Settings’ > ‘Update Principal Contact’s details). The PAN encrypted in DSC should match with PAN of principal contact.

Hey @TeamQuicko

Can you tell me about ITD’s new ITR filing utility for AY 2021-22?

Hey @HarshitShah

To improve the tax filing process, the Income Tax Department has decided to do away with the excel and java-based utility and has launched a new offline JSON-based utility for the AY 2021-22. The new utility will help taxpayers import prefilled data and edit it before filing the income tax return (ITR).

The taxpayers can download the pre-filled data from the income tax e-filing portal and fill in the rest of the data. This imported prefilled data can be edited to change basic information such as address and all. Currently, the utility can be used to file ITR1 to ITR 4. ITD has also released a step-by-step guide to using the utility.

Hope this helps!

Is it possible to file ITR online without an account on the Income Tax e-filing portal?

What should be done in case of discrepancies in actual TDS and TDS credit under Form 26AS?

Hey @Amitabh_Verma

It is mandatory to create an account on the Income Tax e-filing portal to file your ITR online. It is a hassle-free quicko process. One can register on the portal by providing relevant details such as user type, PAN, first name, surname, date of birth, and fill in the registration form.

Hey @Niraj

Many times mismatches and discrepancies in actual TDS and TDS credit under Form 26AS happen because of wrong information provided in the TDS return. One can approach the employer/deductor to file a revised TDS return after making the necessary corrections.

The income-tax department allows an assessee to mention the reason for mismatch in the online portal in answer to a notice sent by them.

Hope this helps!

Hi, actually I filed ITR 1(A.Y. 2013-14) due to notice served in Jan month.

The ITR is pending for verification. Ask the options aren’t available for me client i.e Aadhar verification,evc etc. Only thing is I got my clients DSC. but option of DSC for e-verification is not showing. I can’t send CPC to Bengaluru since it will take time. How can I use DSC to e-verify my already filed return

Hi @Arsheen

The option to e-verify ITR using DSC is to be selected while filing. Once you have filed your ITR only option available for e-verification is EVC/Aadhar OTP or sending ITR V to CPC Bangalore. You have 120

days from the date of e-Filing to e-verify your ITR.

So if 120 days are not over you can send the signed ITR V to CPC Bangalore to get it e-verified and processed.

Hope this helps

Hi @Sharath

It is suggested to file ITR as NRI in India if you have trading transactions even if there are losses.

If you do not file ITR then there are high chances of your PAN getting flagged by the IT department for non-filing of ITR.

Also, If you file the ITR on time you can take benefit of carry forwarding the losses and setting off those losses against the profits in future years.

I have started an HUF by infusing funds by collecting gifts from HUF members. If I invest in Shares, Equity MF, from that Capital (Collected as gifts from members), and earn income in the name of HUF, will that income be clubbed with the income of the members?

In a way that will be the outcome of the business (trading and investing of shares) done by HUF. And there will be a degree of efforts and luck involved, not a fixed income instrument as FD, etc.