If a taxpayer is liable to audit as per Section 44AB of the Income Tax Act, he/she must appoint a Chartered Accountant in practice to conduct a tax audit. The CA would prepare and upload the Tax Audit Report on the Income Tax e-Filing portal. Once the audit report is filed, the taxpayer should accept / reject tax audit report. Once the audit report is filed, the taxpayer can file the Income-Tax Return. In this article, we discuss the 4 important functions when it comes to audit report filing on the income tax portal:

- Taxpayer appoints practicing CA for Tax Audit

- CA accepts/rejects the appointment

- CA file the Tax Audit Report

- Taxpayer accepts/rejects Tax Audit Report

Steps to Accept and File Tax Audit Report on Income Tax E-Filing Portal

- Login to Income Tax E-Filing Portal

Log in to income tax e-filing portal with valid username and password

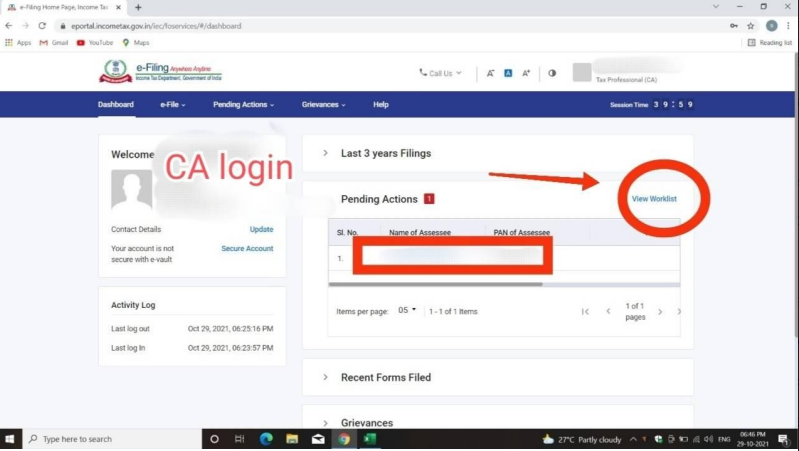

- View Worklist

Navigate to the profile and click on the worklist option.

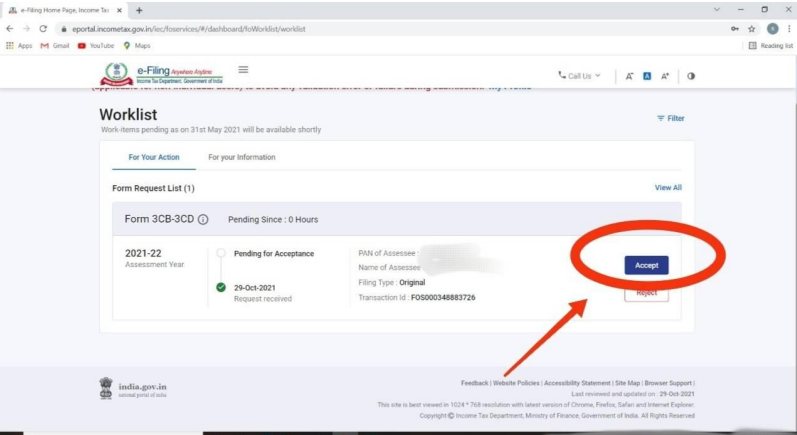

- Accept Option

Under the “For your action” section, click on the accept option for the form request.

- File Form

Clicking on accept form would take you to the pending for filing section. Click on the option to file form.

- Verify details

Verify the details presented on the screen and click on continue.

- Upload filled forms

In the next window, upload the supporting documents such as balance sheet, profit & loss, cost audit, etc.

- File Audit Report

Finally, attach the DSC and submit the form.

FAQs

Approving your Audit Repost is easy and can be done in 5 steps:

1. Log in to Income Tax Department Website with your Client ID.

2. Go to “Worklist” and click on “For Your Action”

3. Under the “For Your Action” tab click on “Click Here”

4. Search your Form by filtering the Assessment Year and Form Name. 5. Click on ‘View Form’

6. Click on “Approve” and Choose your Signature File.

A Tax Audit Report should be filed anytime before the due date of filing the Report. The last date to file the Report this year is September 30. Please note that the Tax Auditor should submit the Tax Audit Report online by using his login details in the capacity of ‘Chartered Accountant’. Taxpayers must also add the details of their Chartered Accountant in their login portal.

Yes, it can be revised. If you wish to revise your Tax Audit Report, please keep in mind that the Report should be submitted in a manner as prescribed by the Institute in SA-560 (Revised) “Subsequent Events”.

Hey @TeamQuicko

Can you tell me about ITD’s new ITR filing utility for AY 2021-22?

Hey @HarshitShah

To improve the tax filing process, the Income Tax Department has decided to do away with the excel and java-based utility and has launched a new offline JSON-based utility for the AY 2021-22. The new utility will help taxpayers import prefilled data and edit it before filing the income tax return (ITR).

The taxpayers can download the pre-filled data from the income tax e-filing portal and fill in the rest of the data. This imported prefilled data can be edited to change basic information such as address and all. Currently, the utility can be used to file ITR1 to ITR 4. ITD has also released a step-by-step guide to using the utility.

Hope this helps!

Is it possible to file ITR online without an account on the Income Tax e-filing portal?

What should be done in case of discrepancies in actual TDS and TDS credit under Form 26AS?

Hey @Amitabh_Verma

It is mandatory to create an account on the Income Tax e-filing portal to file your ITR online. It is a hassle-free quicko process. One can register on the portal by providing relevant details such as user type, PAN, first name, surname, date of birth, and fill in the registration form.

Hey @Niraj

Many times mismatches and discrepancies in actual TDS and TDS credit under Form 26AS happen because of wrong information provided in the TDS return. One can approach the employer/deductor to file a revised TDS return after making the necessary corrections.

The income-tax department allows an assessee to mention the reason for mismatch in the online portal in answer to a notice sent by them.

Hope this helps!

Hi, actually I filed ITR 1(A.Y. 2013-14) due to notice served in Jan month.

The ITR is pending for verification. Ask the options aren’t available for me client i.e Aadhar verification,evc etc. Only thing is I got my clients DSC. but option of DSC for e-verification is not showing. I can’t send CPC to Bengaluru since it will take time. How can I use DSC to e-verify my already filed return

Hi @Arsheen

The option to e-verify ITR using DSC is to be selected while filing. Once you have filed your ITR only option available for e-verification is EVC/Aadhar OTP or sending ITR V to CPC Bangalore. You have 120

days from the date of e-Filing to e-verify your ITR.

So if 120 days are not over you can send the signed ITR V to CPC Bangalore to get it e-verified and processed.

Hope this helps

Hi @Sharath

It is suggested to file ITR as NRI in India if you have trading transactions even if there are losses.

If you do not file ITR then there are high chances of your PAN getting flagged by the IT department for non-filing of ITR.

Also, If you file the ITR on time you can take benefit of carry forwarding the losses and setting off those losses against the profits in future years.

I have started an HUF by infusing funds by collecting gifts from HUF members. If I invest in Shares, Equity MF, from that Capital (Collected as gifts from members), and earn income in the name of HUF, will that income be clubbed with the income of the members?

In a way that will be the outcome of the business (trading and investing of shares) done by HUF. And there will be a degree of efforts and luck involved, not a fixed income instrument as FD, etc.