An extraordinary general meeting (EGM) is a meeting other than a company’s Annual General Meeting (AGM). An EGM is also called a special general meeting or emergency general meeting. An EGM is usually called to deal with any of the following situations:

- The removal of an executive

- A legal matter

- Any matter that can’t wait until the next shareholders meeting

An EGM can be carried out on any day including holidays, unlike the AGM. An EGM can be called by the board on the requisition of shareholders, requisitionists, or tribunal.

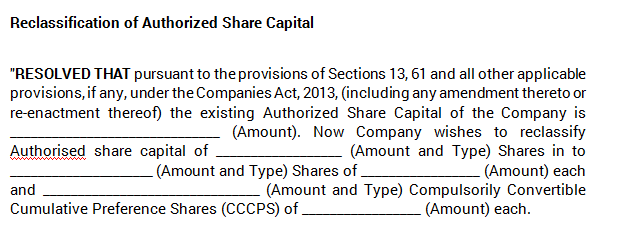

Hence, in accordance with the Companies Act, 2013, a limited company having a share capital may alter its memorandums in the general meeting with regard to its authorized share capital if it is authorized by its articles.

Share class or share classification are different types of shares in company stock that have different levels of voting rights The different categories of shares are as follows:

- Ordinary Shares

- Deferred Ordinary Shares

- Non-Voting Ordinary Shares

- Redeemable Shares

- Preference Shares

- Cumulative Preference Shares

- Redeemable Preference Shares

FAQs

The various reasons for which a Company would classify their shares are given as follows:

– Attract investment

– Push dividend income in a certain direction

– Remove (or enhance) voting powers of certain individuals

– Motivate staff (to remain as employees)

An extraordinary general meeting can be called by a:

– Committee member (if approved by the majority of voting committee members) or,

– A written request signed by at least 25% of lot owners or their representatives or,

– A person authorized by an adjudicator’s order

Directors of Private Companies with only one class of share do not need an express authority from the shareholders before they allot new shares. They can simply allot new shares, subject to the Companies Act and the Articles of Association (AOA).

Hello @Archan434

Yes, the Board Resolution for re-classification of shares shall be filed with RoC within 30 days of passing such resolution.

Hope this helps!

Hi @Paritosh_Trivedi

For MGT-14:

For SH-7

You can read more about re-classification of shares here:

Hope this helps!