The Permanent Account Number (PAN) holds extreme importance in India, not only for Income Tax purposes but also as a proof of identity. Any incorrect information on your PAN can lead to problems in the future. So it is better to keep PAN Details updated. A taxpayer can update PAN Address details on TIN-NSDL using Form 49A. Moreover, both citizens, as well as non-citizens of India, can apply for Change/Correction in PAN through TIN-NSDL.

Steps to Update Address of PAN on TIN-NSDL

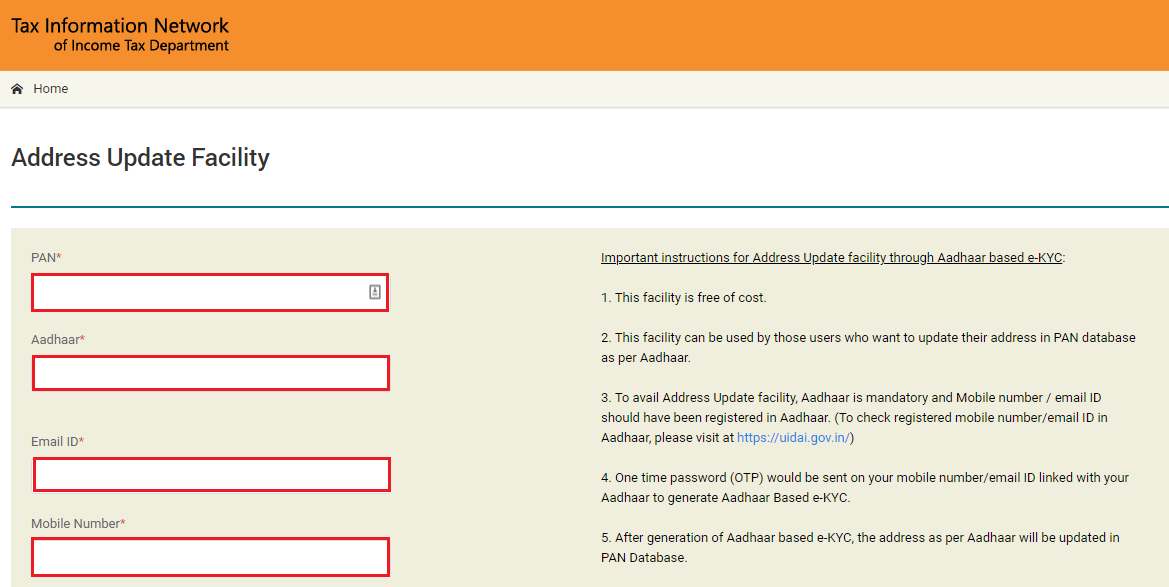

- Visit the TIN-NSDL portal to update the Address on the PAN.

Click on “Paperless Address Update in PAN”.

- Enter the following details in the respective fields

PAN Number, Aadhaar Number, Email ID, Mobile Number

- Click on the check-box.

Enter the captcha code from the given image. Click on the “Submit” option.

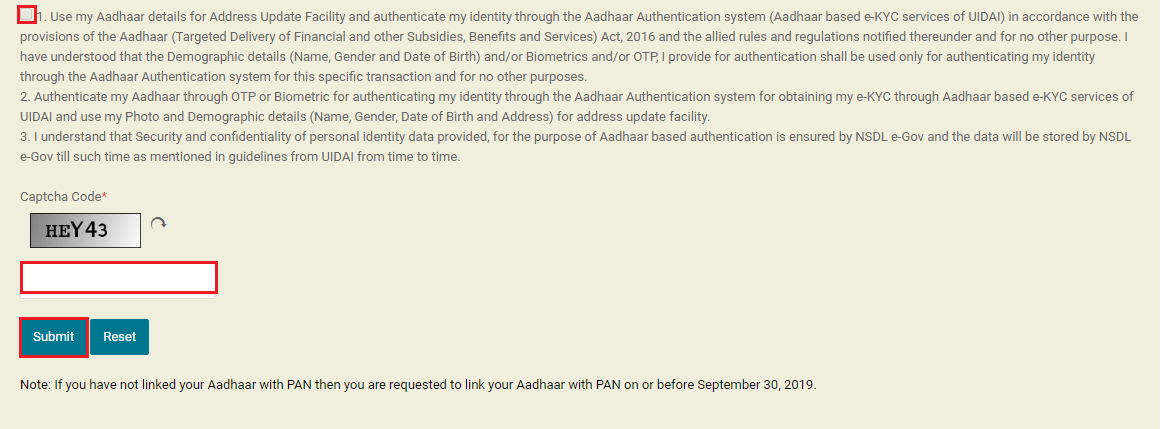

- Hence, the e-KYC page. The mobile number linked to your Aadhaar will receive an OTP.

Click on “Continue with e-KYC”.

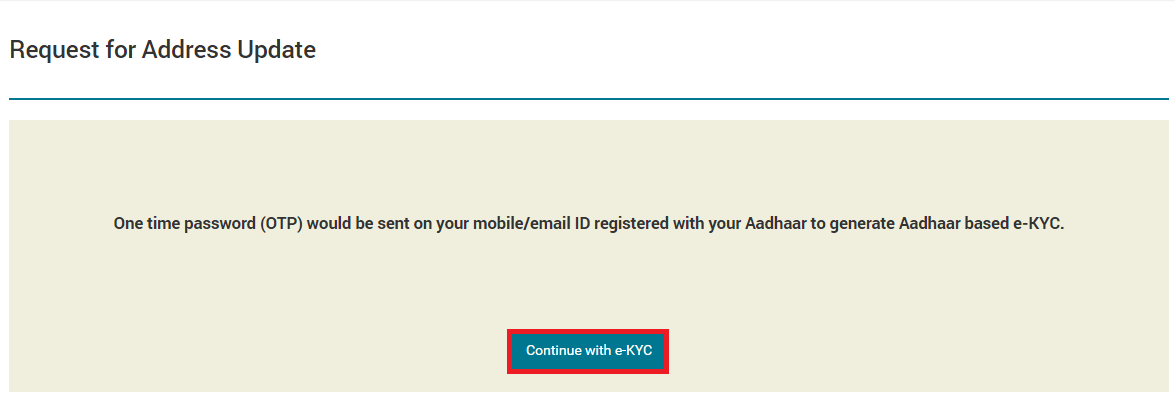

- Enter the OTP received.

And click on the “Submit” option.

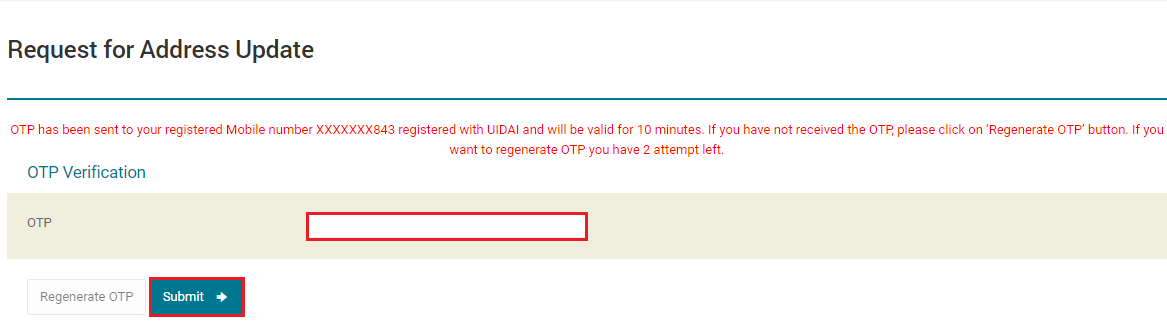

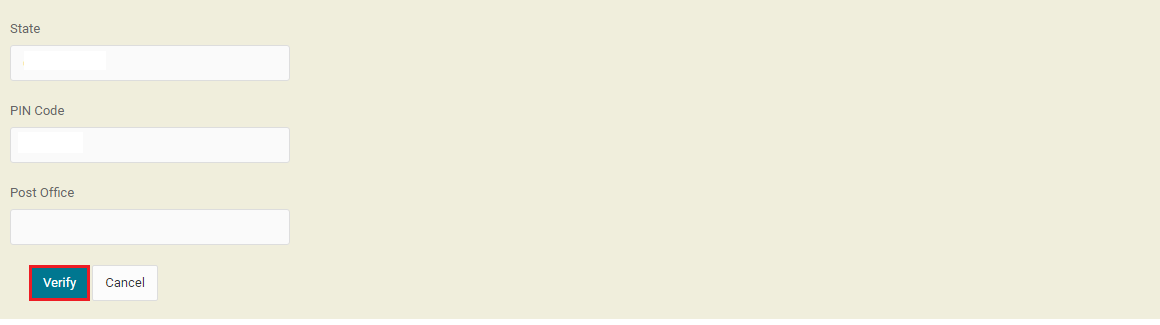

- Click on the “Verify” option.

This will update the address details entered in application.

Therefore, after updating the address in the PAN database, an intimation of the same will be sent via message to the mobile number and E-mail ID mentioned by the user while using this facility. Mobile number & E-mail ID would be updated in the PAN database of the Income Tax Department (ITD).

FAQs

In the case of Individuals, HUF, AOP, BOI or AJP, the residential address is mandatory. Other applicants should leave this field blank.

For a Document to be considered as Address Proof, it must contain the Address. In any PAN Card, the Address is nowhere mentioned and hence PAN Card cannot be considered as Address Proof. PAN Card consists of Your Name, Father’s Name, Date of Birth, Photograph and Signature.

Visit the NSDL PAN portal to download the PAN card by Acknowledgement number. Enter the Acknowledgement number issued after submitting the PAN card application and click on “Generate OTP” Enter the OTP and click on the “Validate” button to download your e-PAN. Click on “Download PDF” to download the e-PAN instantly.