TRACES means TDS Reconciliation Analysis and Correction Enabling System. It is the online portal for administration and implementation of TDS (Tax Deducted at Source) and TCS (Tax Collected at Source). When a tenant pays rent exceeding Rs. 50,000 per month to the landlord, he/she deducts TDS u/s 194IB. The tenant files Form 26QC and issues Form 16C to the landlord. The TDS Return i.e. Form 26QC is processed by CPC-TDS. If the Statement Status of Form 26QC is ‘Processed with Default’, the tenant should:

- Step 1: View ‘Form 26QC – Default Summary’ on TRACES – to view a summary of defaults or errors made in Form 26QC filed

- Step 2: Download ‘Form 26QC – Justification Report’ on TRACES – to download the details of errors or defaults in Form 26QC filed

- Step 3: File ‘Form 26QC – Correction Statement’ on TRACES – to file a correction statement to rectify the errors made in Form 26QC filed

The Tenant registered on TRACES can submit Correction Request for Form 26QC from FY 2017-18 onwards.

Steps for Form 26QC Correction on TRACES – DSC / AO Approval

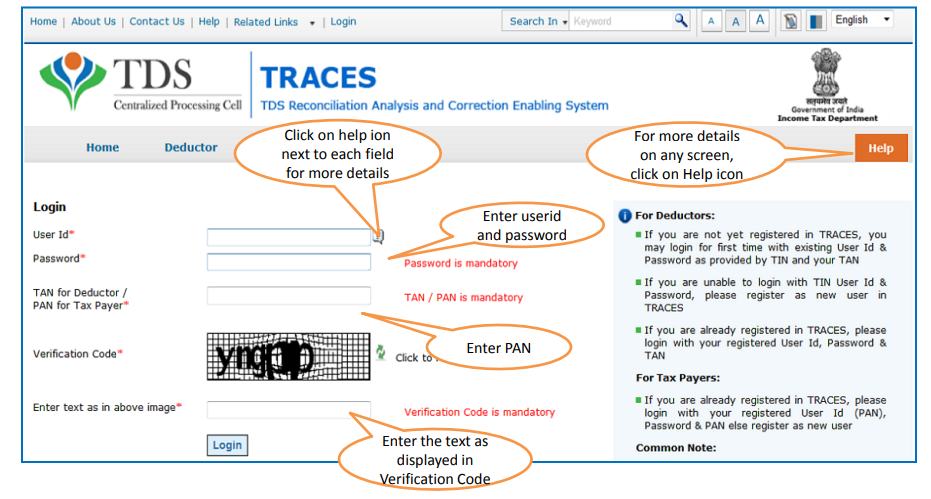

Step 1: Log in to TRACES – Enter User Id, Password, PAN and captcha

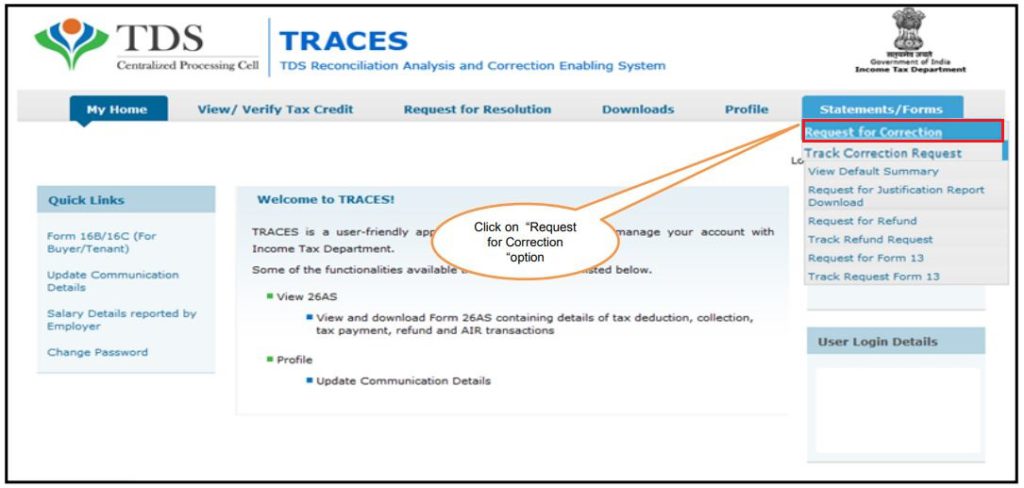

Step 2: Go to Statements / Forms > Request for Correction

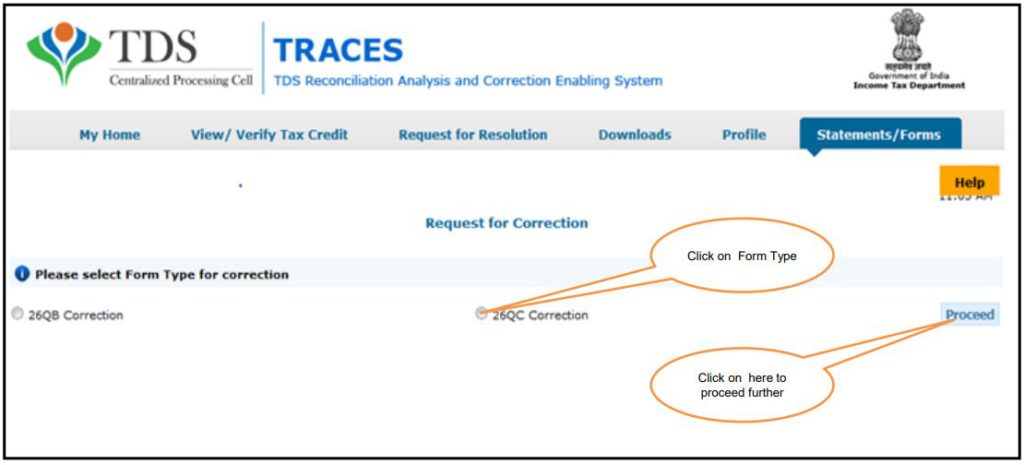

Step 3: Select Form Type – 26QC to submit the Correction Request

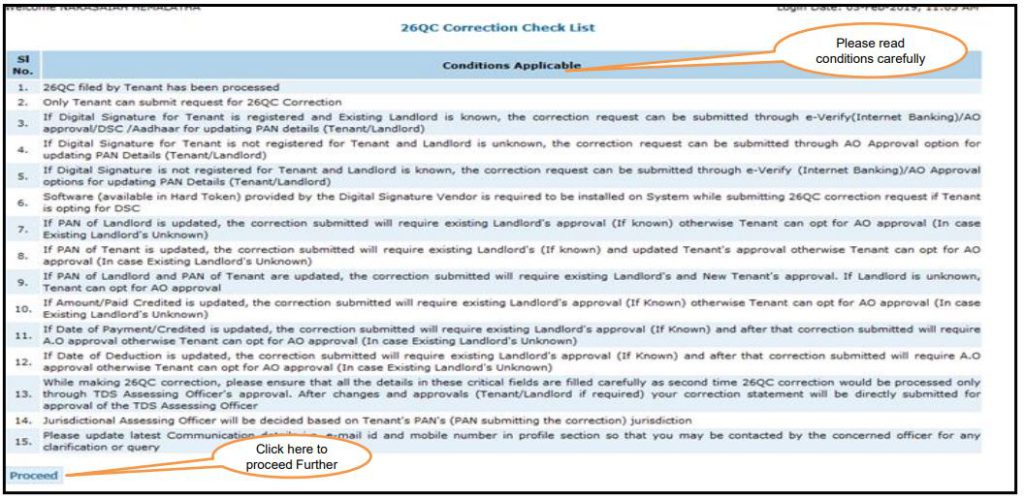

Step 4: Review the checklist and click on ‘Proceed‘

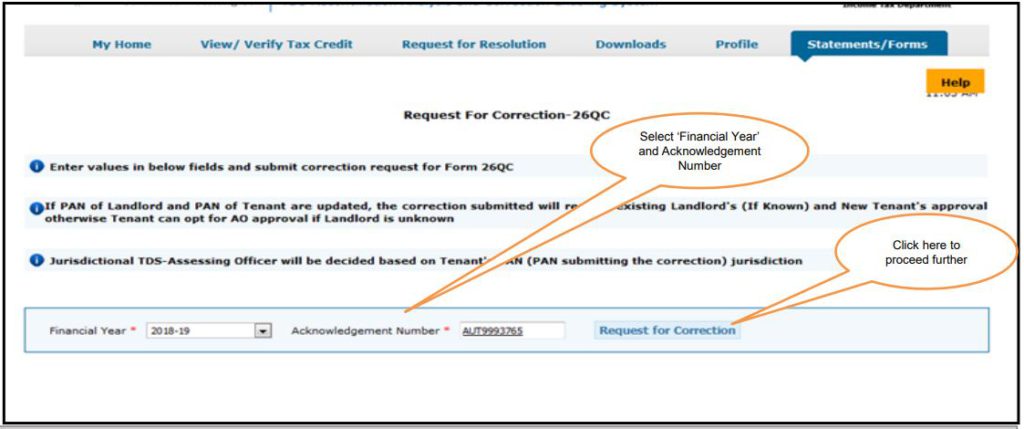

Step 5: Select the ‘Financial Year’ from the drop-down list. Enter ‘Acknowledgement Number‘ and click on ‘Request for Correction’

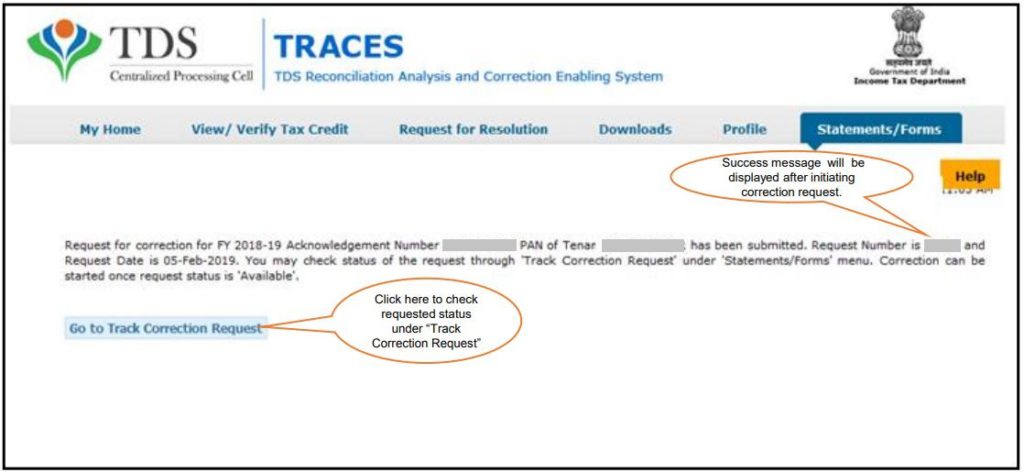

Step 6: Success page will appear on the screen. A Request Number is generated. You can track the correction request under the tab ‘Statements / Forms’

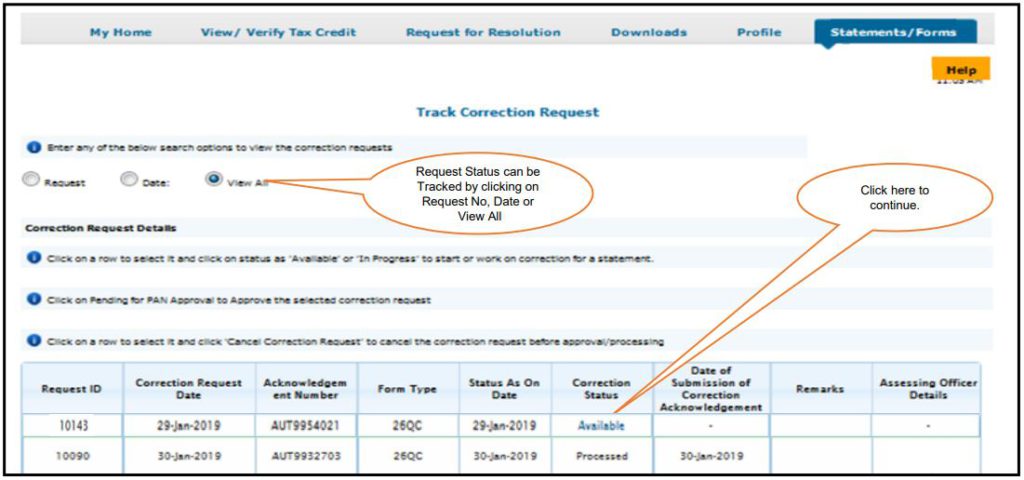

Step 7: Go to Statements / Forms > Track Correction Request

Step 8: Enter the Request Number or Request Date or View All. Click on ‘View Request’. List of requests pertaining to the search criteria will appear. Select the relevant row and if the status is ‘Available‘, you can start the correction

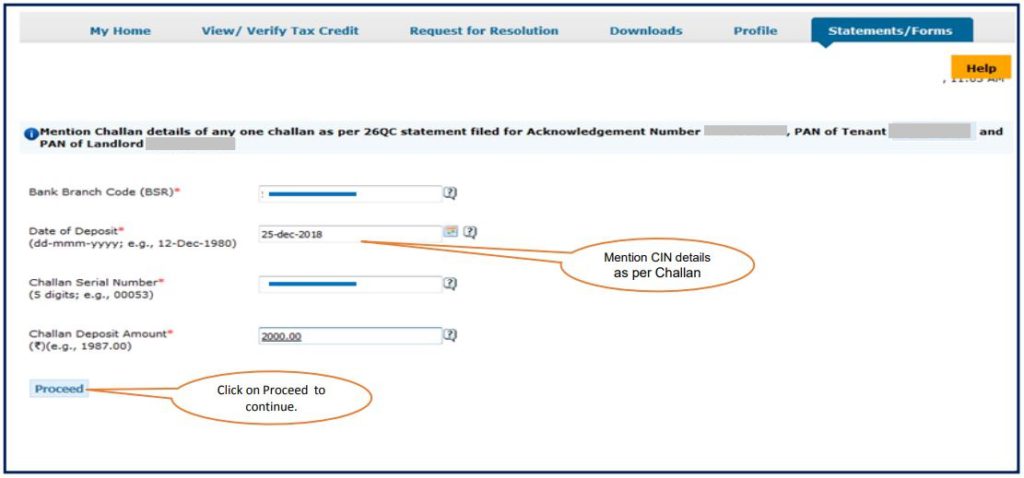

Step 9: Enter Challan Details of any challan paid while filing Form 26QC. Click on ‘Proceed‘

- BSR Code

- Date on which tax is deposited – enter in dd-mmm-yyyy format eg: 10-Jan-2019

- Challan Serial Number – 5 digit number eg: 00025

- Challan Deposit Amount – enter amount with decimal places eg: 1569.00

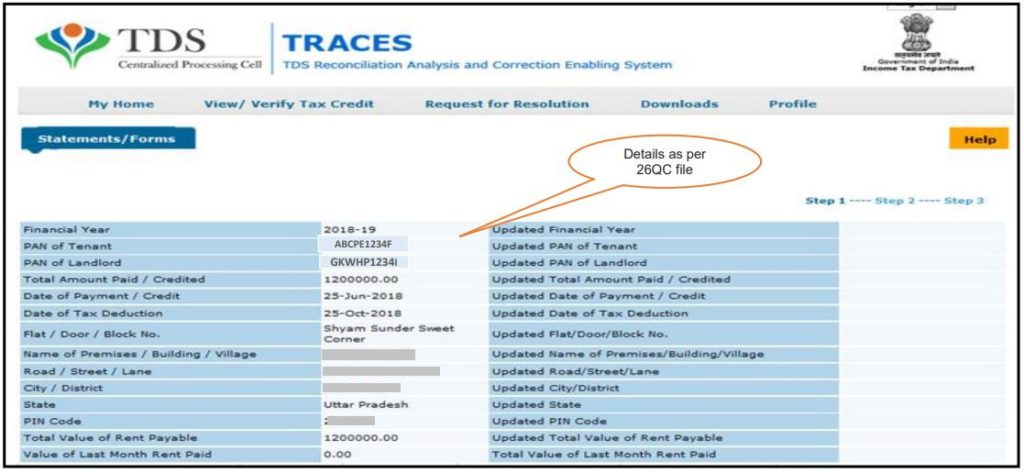

Step 10: Details as per Form 26QC filed will appear on the screen. Click on ‘Edit’ for correcting the details

Step 11: The taxpayer can make changes in the following fields:

- PAN details of Tenant or PAN details of Landlord

- Date of Payment or Date of Credit

- Date of Deduction

- Amount Paid or Amount Credited

- Property Details if Let Out

- Total Value of Rent

- Value of last month rent paid

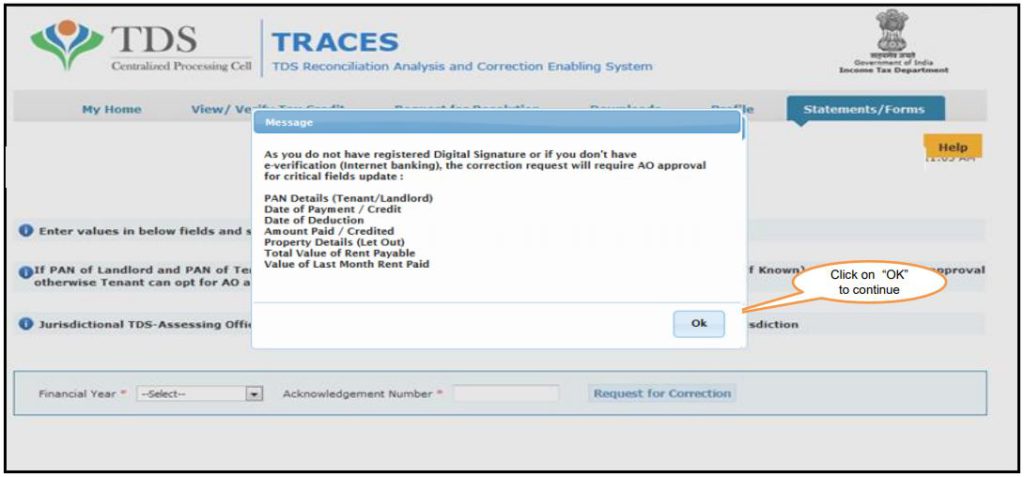

Note: If your DSC is not registered on TRACES or if you don’t have e-verification (internet banking), the correction request for the fields listed below would require the approval of AO i.e. Assessing Officer.

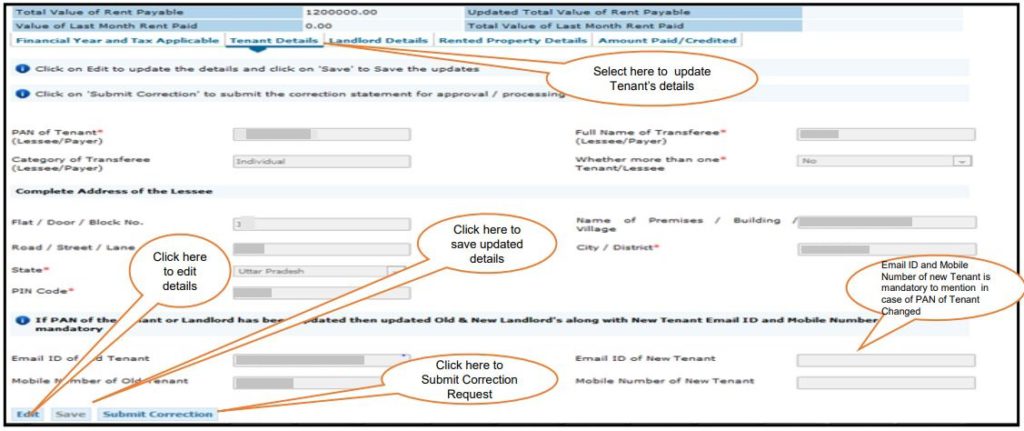

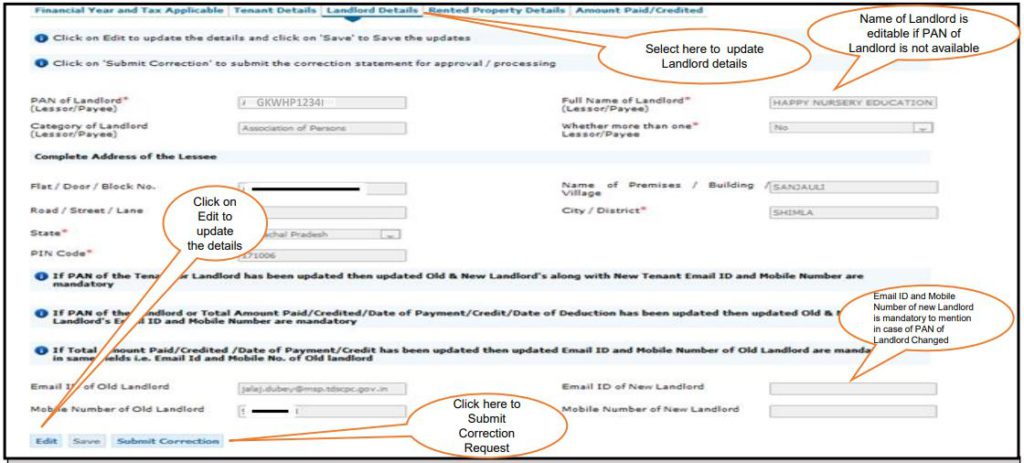

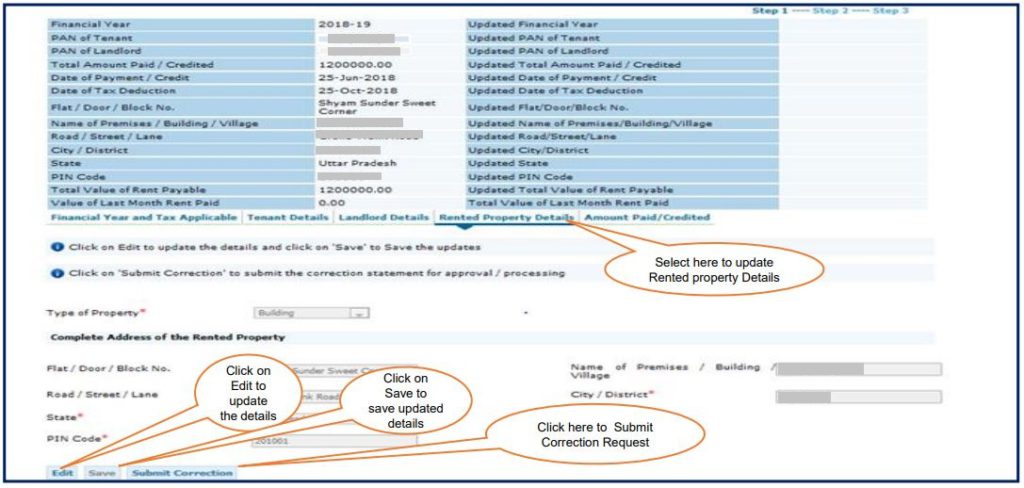

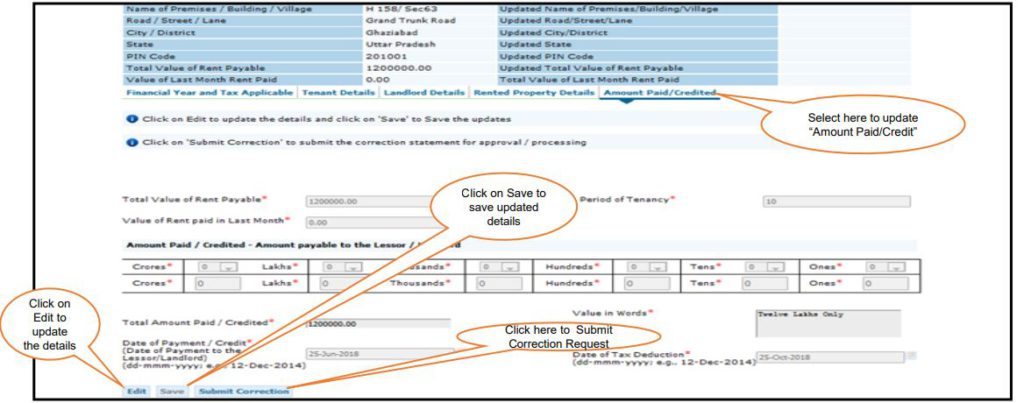

Step 12: Make the required correction. Click on ‘Save‘. Click on ‘Submit Correction‘ once you make all the corrections

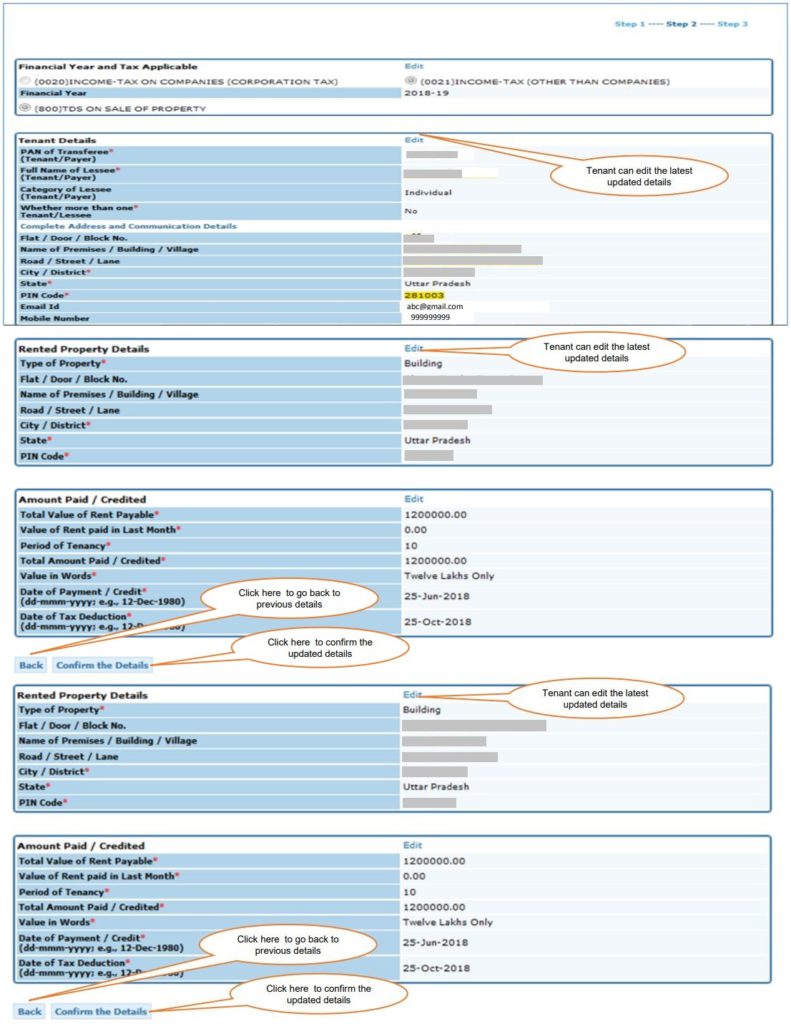

Tenant Details

You can make corrections in the PAN, Name or Address of the Tenant

Landlord Details

You can make corrections in the PAN, Name or Address of the Landlord

Rented Property Details

You can make correction in the Type of Property and Address of the Rented Property

Amount Paid / Credited

You can make corrections in the amount paid or amount credited as rent. If amount paid or amount credited is updated, correction submitted will require Landlord’s approval.

Step 13: Confirmation Screen will appear. The updated details are highlighted in yellow colour. You should review the updated details and click on ‘Confirm the Details‘

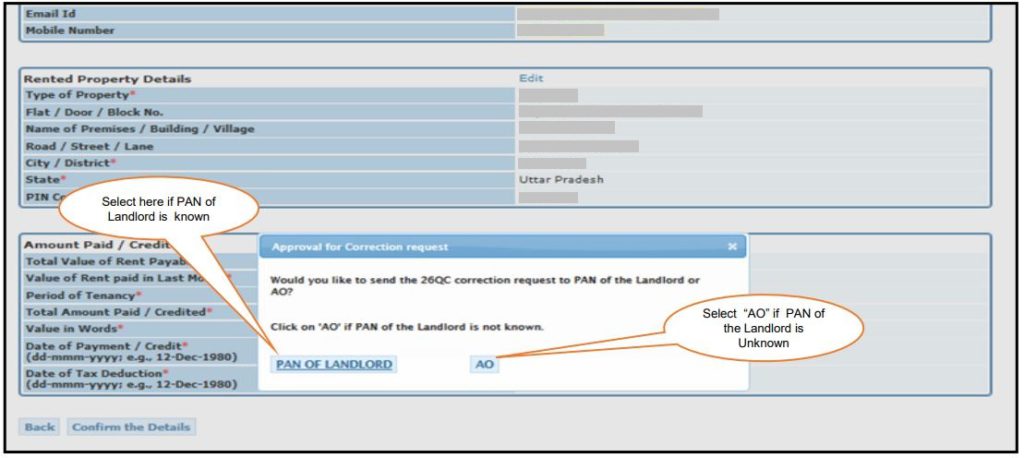

Step 14: Confirm whether the PAN of Landlord is known or unknown. Click on ‘PAN of Landlord’ if the PAN is known. Click on ‘AO’ if the PAN is unknown

If PAN of Landlord is Unknown – Click on ‘AO’

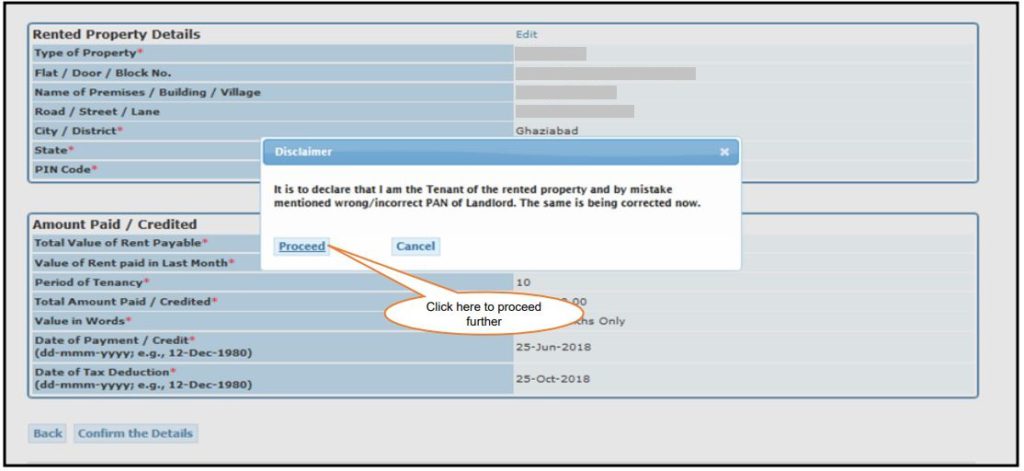

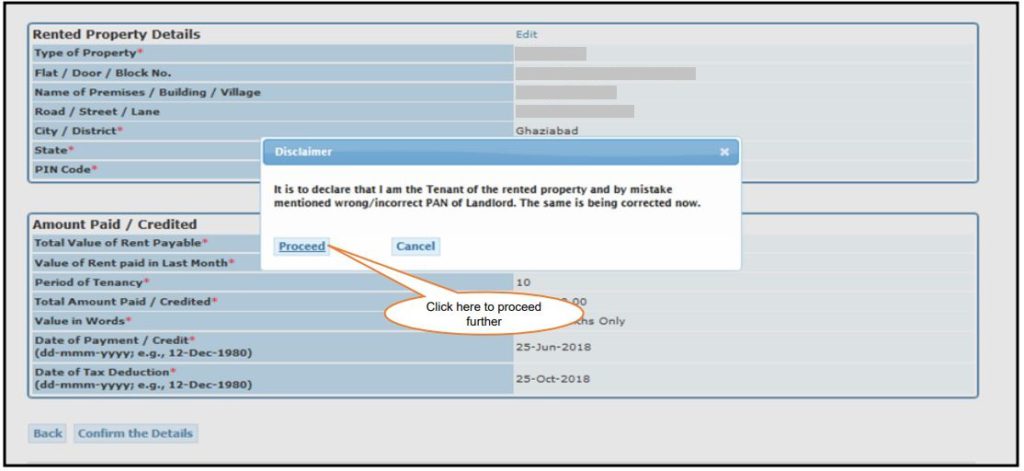

- A pop-up will appear with a message to declare that the tenant of the rented property mentioned wrong or incorrect PAN of Landlord and is filing a correction statement to rectify this mistake. Click on ‘Proceed‘

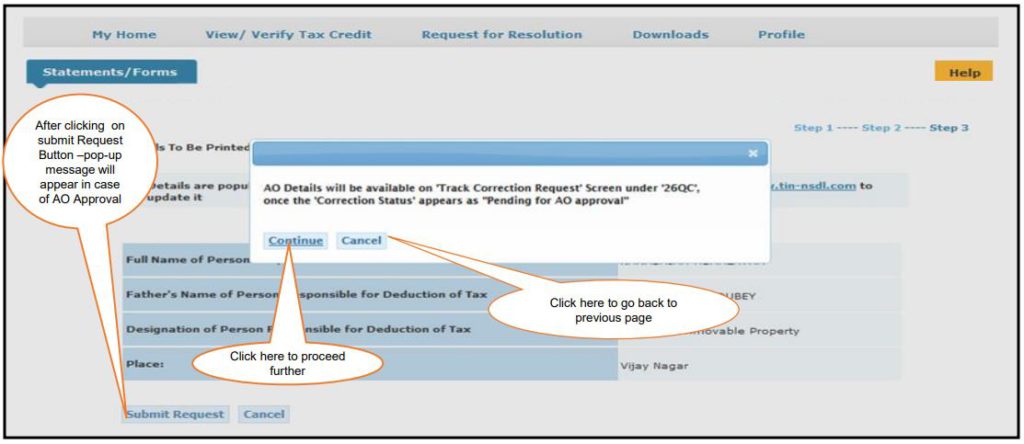

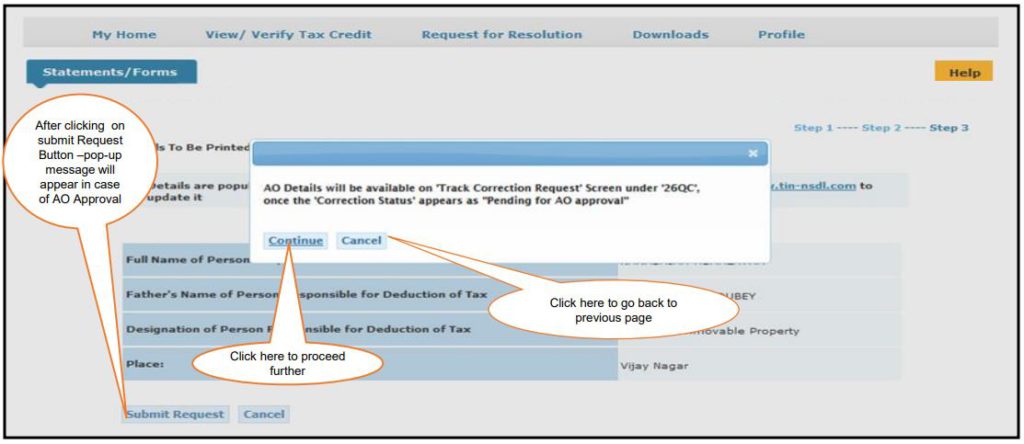

- Click on ‘Submit Request‘. A pop-up will appear to track correction status. Click on ‘Continue’. The AO Details will be available once the ‘Correction Status’ changes to ‘Pending for AO Approval’

If PAN of Landlord is Known – Click on ‘PAN of Landlord’

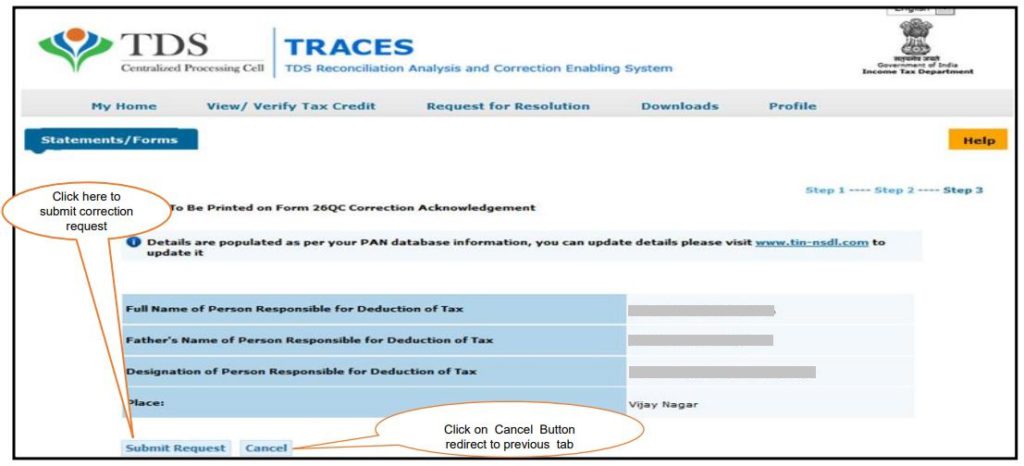

- The details of PAN database will appear on the screen. These details would be printed on the Form 26QC Correction Acknowledgement. Click on ‘Submit Request‘

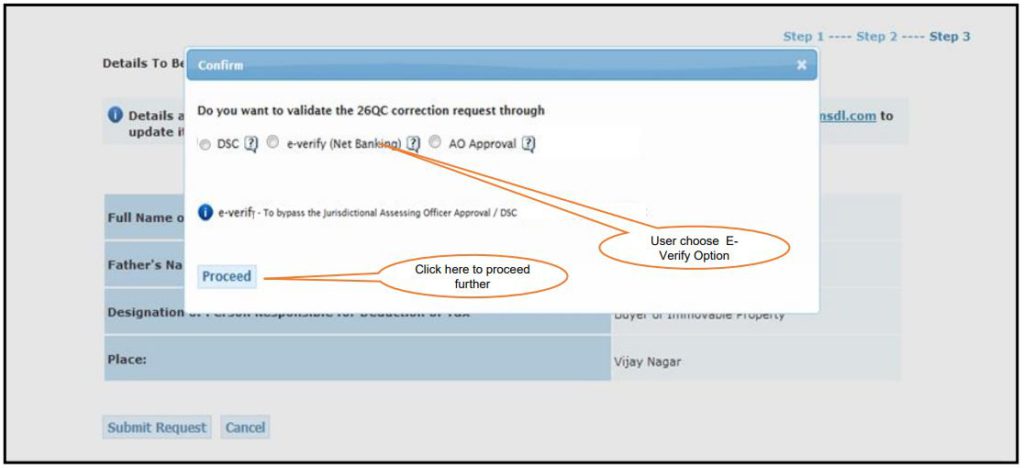

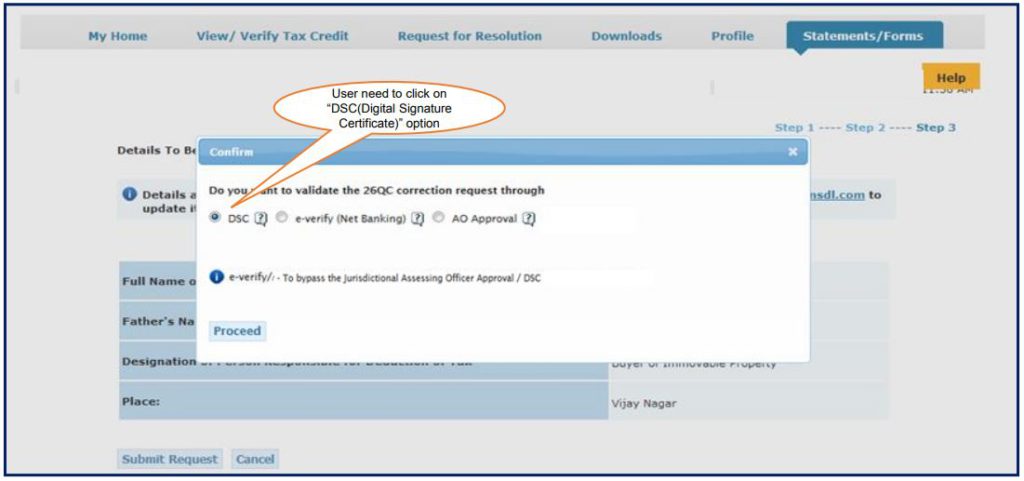

- If the DSC is registered on TRACES, taxpayer can validate correction through options – E-Verify (Internet Banking), AO Approval, DSC (Digital Signature Certificate)

- If the DSC is not registered on TRACES, the taxpayer can validate correction through options – E-Verify (Internet Banking), AO Approval

Option 1: Validate Correction Request using AO Approval – Click on AO Approval

- A pop-up will appear with a message to declare that the tenant of the rented property mentioned wrong or incorrect PAN of Landlord and is filing a correction statement to rectify this mistake. Click on ‘Proceed‘

- Click on ‘Submit Request‘. A pop-up will appear to track correction status. Click on ‘Continue’. The AO Details will be available once the ‘Correction Status’ changes to ‘Pending for AO Approval’

Option 2: Validate Correction Request using DSC – Click on DSC

- Click on the option ‘DSC’. Click on ‘Proceed’

- Choose DSC i.e. Digital Signature Certificate of the Authorised Person. Click on ‘Sign’. To use DSC on TRACES, it is mandatory to download and install WebSocket emSigner

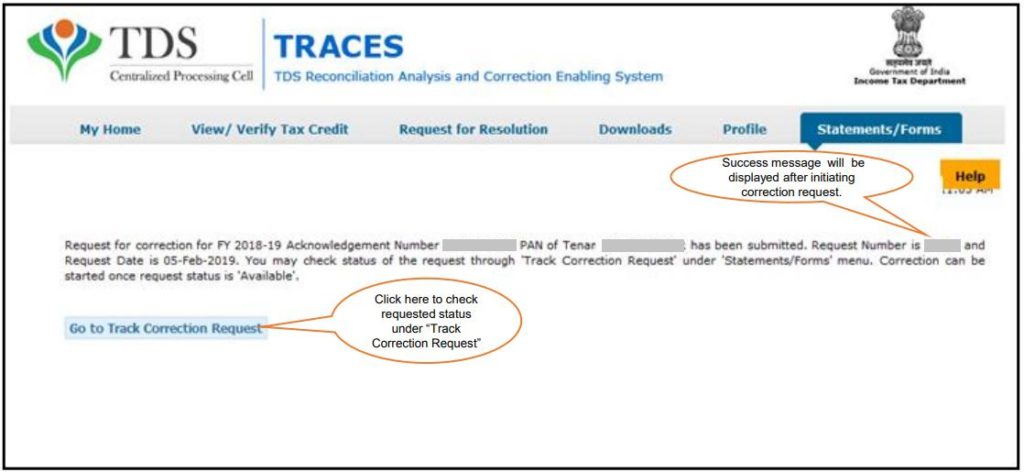

Step 15: Once you submit the request using any of the above options, a success message will appear on the screen. You can track the correction request under the tab ‘Statements / Forms’

Step 16: Go to Statements / Forms > Track Correction Request. Here are the types of status of the Correction Statement.

- Pending for PAN Approval – If Correction Statement is submitted for approval of Tenant or Landlord

- Pending for AO Approval – If Correction Statement is pending for approval from the Assessing Officer. User can check AO details in the column ‘Assessing Officer Details’

- Submitted to ITD – If Correction Statement has been approved by AO or Tenant or Landlord and is now submitted to the Income Tax Department

- Processed – If Correction Statement is processed by TDS CPC

- Cancelled – If Correction Statement is cancelled by Tenant

- Rejected – If Correction Statement is rejected by Tenant, Landlord, AO or TDSCPC

FAQs

Under section 194-IB of the income tax act, if any individual or HUF to whom tax audit is not applicable makes payment of rent to a resident landlord exceeding Rs. 50,000 per month, then he/she needs to deduct TDS from rent and needs to file Form 26QC. TAN is not compulsory for filing Form 26QC.

1. Pending for PAN Approval – If Correction Statement is submitted for approval of Tenant or Landlord

2. Pending for AO Approval – If Correction Statement is pending for approval from the Assessing Officer. User can check AO details in the column ‘Assessing Officer Details’

3. Submitted to ITD – If Correction Statement has been approved by AO or Tenant or Landlord and is now submitted to the Income Tax Department

4. Processed – If Correction Statement is processed by TDS CPC

5. Canceled – If Correction Statement is canceled by Tenant

6. Rejected – If Correction Statement is rejected by Tenant, Landlord, AO or TDSCPC

Hey @HarishMehta

Taxpayers or deductee cannot directly download form 16/form16A, the option to download Form 16/ 16A has been given to the Deductor. So, if you need Form 16 / 16A for TDS deducted by your current or previous employer or deductor you will have to contact them for the same. There is no option available on TRACES whereby you can download it yourself.

Hope this helps!

Hey @Dia_malhotra

Yes, individuals can still register as a taxpayer on TRACES even if they do not have TAN of the deductor by providing:

• Assessment Year

• Challan Serial Number and

• Amount of tax you have paid

Hope this helps!

In my Justification Report it shows an interest payable error whereas I’ve already paid the interest for that particular month According to the regulations what could be the reason for this?

Hi @saad,

According to regulations, interest payment default/errors may arise due to error in challan details , short deduction, short payment, late deposit of TDS amount. Here, you can file correction statement and revise the return.

Hope this helps!

@AkashJhaveri @Saad_C @Kaushal_Soni @Divya_Singhvi @Laxmi_Navlani can you help with this?

Hey @raopreetham, the first thing I would recommend you to do is to run the Emsigner as an administrator. Also, if it still does not seem to work, install the below mentioned JAVA fixer software and run it as an administrator and hopefully this would resolve your issue.

https://johann.loefflmann.net/downloads/jarfix.exe

The USB e-pass 2003 token device is particular type of a DSC.

hello, i want to cancel the TDS on sale of property (26QB) which i created in hurry. i have made login and tried the TRACES refund option. But the total amount of TDS is “Consumed” and Max refund amount is zero.

What is my option now? TDS was paid on 16th Oct ( 6 days back). Hoping for a solution on this.

Hi @nisshant

26QB is the challan cum return statement. As soon as you file the form, TDS amount paid by you gets utilized. There are few corrections that are allowed in form 26QB. You can refer to the article below. You cannot get the refund of the taxes paid through an online method. You can contact concerned Assessing Officer (AO) of the Income Tax Department (ITD).

You can also contact Aaykar Sampark Kendra (ASK) on Toll Free No. 1800-180-1961 to ask for help.

Hope this helps!

Hi @Jatin_Sahu

Yes, you can file 26QB correct request with registering a DSC and file te new request.

Here’s a read for your reference on TRACES: Form 26QB Correction DSC/ AO Approval - Learn by Quicko