TRACES means TDS Reconciliation Analysis and Correction Enabling System. It is the online portal for administration and implementation of TDS (Tax Deducted at Source) and TCS (Tax Collected at Source). When there is a sale of immovable property, the buyer makes payment to the seller after deducting TDS u/s 194IA. The buyer files Form 26QB and issues Form 16B to the seller. The TDS Return i.e. CPC-TDS processes Form 26QB. If the Statement Status of Form 26QB is ‘Processed with Default’, the buyer can submit a request to download ‘Form 26QB – Justification Report’ from their registered account on TRACES. The ‘Form 26QB – Justification Report’ is available AY 2014-15 onwards and consists of details of defaults or errors while processing the TDS Return filed. Once the taxpayer views the errors, he/she should file a correction TDS return to rectify the same.

Steps to Download Form 26QB Justification Report from TRACES

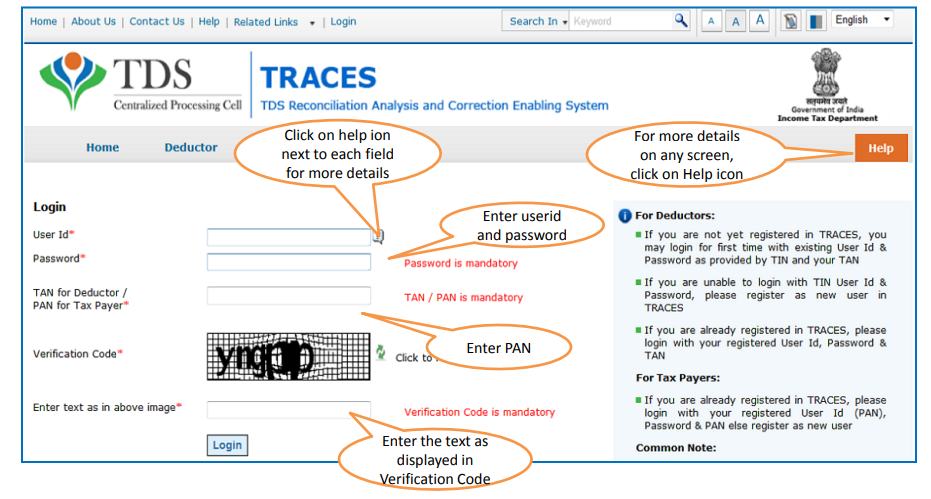

- Log in to TRACES

- Navigate to justification report download

Go to Statements / Forms > Request for Justification Report Download

- Form 26QB

Select Form Type – 26QB to submit the request for Justification Report

- Enter the required details

Select the ‘Assessment Year’ from the drop-down list. Enter ‘Acknowledgement Number‘ and ‘PAN of Seller‘. Click on ‘Proceed‘

- Enter CIN details

Enter Challan details as per Form 26QB statement filed for Acknowledgement Number, PAN of Buyer, and PAN of Seller. Click on ‘Proceed’

1. BSR Code i.e. Bank Branch Code

2. Date of Deposit – date on which tax is deposited. Enter in dd-mm-yyyy format eg: 10-Jan-2019

3. Challan Serial Number – 5 digit number eg: 00025

4. Challan Deposit Amount – enter the amount with decimal places eg: 1569.00

- Success Message

Success page will appear on the screen. A Request Number is generated. You can download the file from tab ‘Downloads’

- Navigate to requested downloads

Go to Downloads > Requested Downloads

- Enter the request number/date

Enter the Request Number or Request Date or View All. Click on ‘View Request’. A list of requests pertaining to the search criteria will appear. Select the relevant row and if the status is ‘Available‘, click on the download button.

Note: If the status is ‘Submitted’, please wait for 24 to 48 hours for the status to change to ‘Available’

- Download the file

Click on the HTTP Download button to download the file. A zip file is downloaded. Password to open ‘Form 26QB – Justification Report’ Zip file is ‘PAN of Buyer‘in capital letters. E.g. AABPA1212A

FAQs

1. Submitted – The taxpayer has submitted a request

2. Available – The system has processed the request. The taxpayer can download the Justification Report

3. Failed – The request has not been processed due to a technical issue. The taxpayer should submit the request once again or contact CPC(TDS)

The taxpayer can download ‘Form 26QB – Justification Report’ in a zip file. The Password to open ‘Form 26QB – Justification Report’ zip file is ‘PAN of Buyer’ of the property in capital letters. E.g. AABPA1212A

Hey @HarishMehta

Taxpayers or deductee cannot directly download form 16/form16A, the option to download Form 16/ 16A has been given to the Deductor. So, if you need Form 16 / 16A for TDS deducted by your current or previous employer or deductor you will have to contact them for the same. There is no option available on TRACES whereby you can download it yourself.

Hope this helps!

Hey @Dia_malhotra

Yes, individuals can still register as a taxpayer on TRACES even if they do not have TAN of the deductor by providing:

• Assessment Year

• Challan Serial Number and

• Amount of tax you have paid

Hope this helps!

In my Justification Report it shows an interest payable error whereas I’ve already paid the interest for that particular month According to the regulations what could be the reason for this?

Hi @saad,

According to regulations, interest payment default/errors may arise due to error in challan details , short deduction, short payment, late deposit of TDS amount. Here, you can file correction statement and revise the return.

Hope this helps!

@AkashJhaveri @Saad_C @Kaushal_Soni @Divya_Singhvi @Laxmi_Navlani can you help with this?

Hey @raopreetham, the first thing I would recommend you to do is to run the Emsigner as an administrator. Also, if it still does not seem to work, install the below mentioned JAVA fixer software and run it as an administrator and hopefully this would resolve your issue.

https://johann.loefflmann.net/downloads/jarfix.exe

The USB e-pass 2003 token device is particular type of a DSC.

hello, i want to cancel the TDS on sale of property (26QB) which i created in hurry. i have made login and tried the TRACES refund option. But the total amount of TDS is “Consumed” and Max refund amount is zero.

What is my option now? TDS was paid on 16th Oct ( 6 days back). Hoping for a solution on this.

Hi @nisshant

26QB is the challan cum return statement. As soon as you file the form, TDS amount paid by you gets utilized. There are few corrections that are allowed in form 26QB. You can refer to the article below. You cannot get the refund of the taxes paid through an online method. You can contact concerned Assessing Officer (AO) of the Income Tax Department (ITD).

You can also contact Aaykar Sampark Kendra (ASK) on Toll Free No. 1800-180-1961 to ask for help.

Hope this helps!

Hi @Jatin_Sahu

Yes, you can file 26QB correct request with registering a DSC and file te new request.

Here’s a read for your reference on TRACES: Form 26QB Correction DSC/ AO Approval - Learn by Quicko