The residential status of a taxpayer is determined every year for Income Tax purposes. The taxability of a person depends on their residential status.

The residential status is different from the citizenship of a person. For instance, in a financial year, a person can be a citizen of India but not a resident. Hence, impacting their taxability.

Types of Residential Statuses as per Income Tax Act

- Ordinary Resident of India

- Resident but Not Ordinary Resident of India (RNOR)

- Non-Resident of India (NRI)

Primary Conditions:

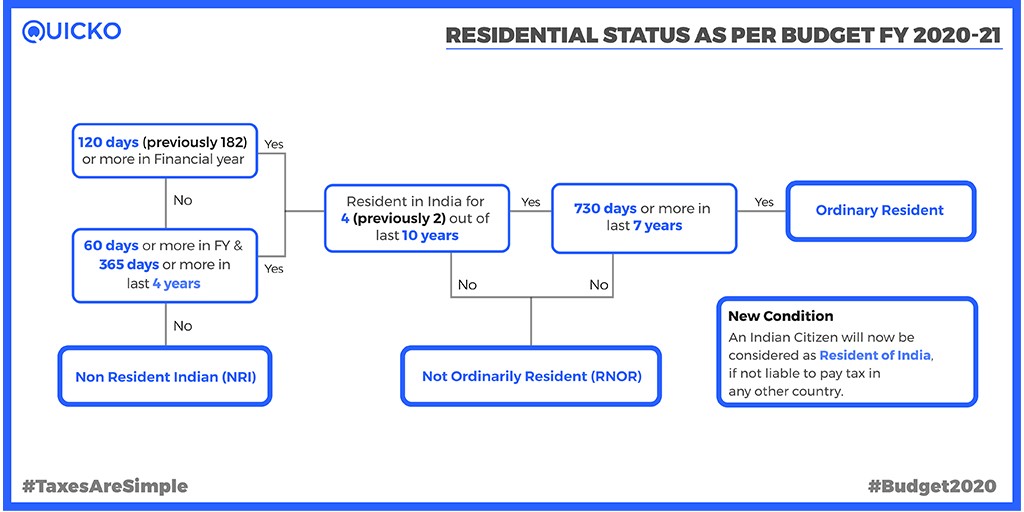

A person is a resident of India if:

- He/She lived in India for 182 days or more during the financial year OR

- He/She lived in India for at least 60 days in a financial year and at least 365 days in the last 4 years.

However, in respect of an Indian citizen and a person of Indian origin who visits India during the year, the period of 60 days as mentioned in the 2nd point above shall be substituted with 182 days. Similarly, it is also applicable to the Indian citizen who leaves India in any previous year as a crew member or for the purpose of employment outside India.

The Finance Act, 2020, w.e.f., Assessment Year 2021-22 has amended the above exception to provide that the period of 60 days as mentioned in point 2 above shall be substituted with 120 days, if an Indian citizen or a person of Indian origin whose total income, other than income from foreign sources, exceeds INR 15 Lakhs during the previous year. Income from foreign sources means income that accrues or arises outside India (except income derived from a business controlled in or a profession set up in India).

Individuals not fulfilling any of the above conditions will, hence, be a Non-Resident of India (NRI). The second condition mentioned above will not be applicable in the following cases:

- Any Indian citizen leaving India for the purpose of taking up employment (including self-employment) outside India.

- Indian citizens leaving India as a member of the crew of an Indian ship.

- Any person of Indian origin or Indian citizens residing outside India, if they come on a visit to India.

Additional Conditions

If anyone of the primary conditions is satisfied by a person then they are a resident of India. They also need to fulfill the following two conditions to become an Ordinary Resident of India:

- The person stayed in India for at least 2 years immediately before the current financial year out of 10 past financial years AND

- The person lived in India for at least 730 days immediately before the current financial year out of 7 past financial years.

A person becomes Not Ordinary Resident of India (RNOR) if they do not fulfill any one of the above conditions.

Sources of Income and its taxability

|

Source of Income |

Ordinary Resident |

Not Ordinary Resident |

Non-Resident |

|

Income earned in India. |

Taxable in India |

Taxable in India |

Taxable in India |

|

Any income received in India. |

Taxable in India |

Taxable in India |

Taxable in India |

|

Income earned outside India but received in India. |

Taxable in India |

Taxable in India |

Taxable in India |

|

Income earned and received outside India. |

Taxable in India |

Taxable in India |

Not Taxable in India |

|

Any income earned outside India for a business/ profession controlled in/from India. |

Taxable in India |

Taxable in India |

Not Taxable in India |

|

Income earned outside India from any source other than business/ profession controlled from India. |

Taxable in India |

Not Taxable in India |

Not Taxable in India |

FAQs

Currently, Refunds can be credited only to a bank account located in India.

The returns can be e-Verified by logging in to e-Filing account through Net Banking login. However, this facility is available for account holders who have linked their PAN with the account numbers in leading banks in India.

There are 3 different types of residential status:

Resident: If a person is in India for at least 182 days during the Financial Year or,

– If a person is in India for at least 60 days during the Financial Year and for at least 365 days during the last 4 Financial Years

Ordinary Resident: A person shall be treated as “Ordinary Resident” if he/she satisfies both the additional conditions:

– If a person is resident of India for any 2 out of last 10 Financial Years, and

– If a person is in India for at least 730 days during the last 7 Financial Years

Not Ordinary Resident: If any of the additional conditions specified above are not satisfied then that person is treated as “Not Ordinary Resident” for that Financial Year

Non-Resident: If none of the basic conditions are satisfied then the person is treated as “Non-Resident” for that Financial Year