Income Tax Department (ITD) issues Permanent Account Number (PAN) an alphanumeric ID in a form of card to any “person” who applies for it or to whom the department allows the number without an application. A taxpayer usually applies for a reprint/duplicate PAN on TIN-NSDL if they have lost or damaged the PAN card they have in their possession. In this application, the taxpayer gets a new PAN card. Not the new PAN Number. Therefore, you wouldn’t have to apply for a new PAN card.

Steps to Apply for a Duplicate/Reprint of PAN Card

- Visit the TIN-NSDL portal.

Go to “Reprint of PAN” on Home Page.

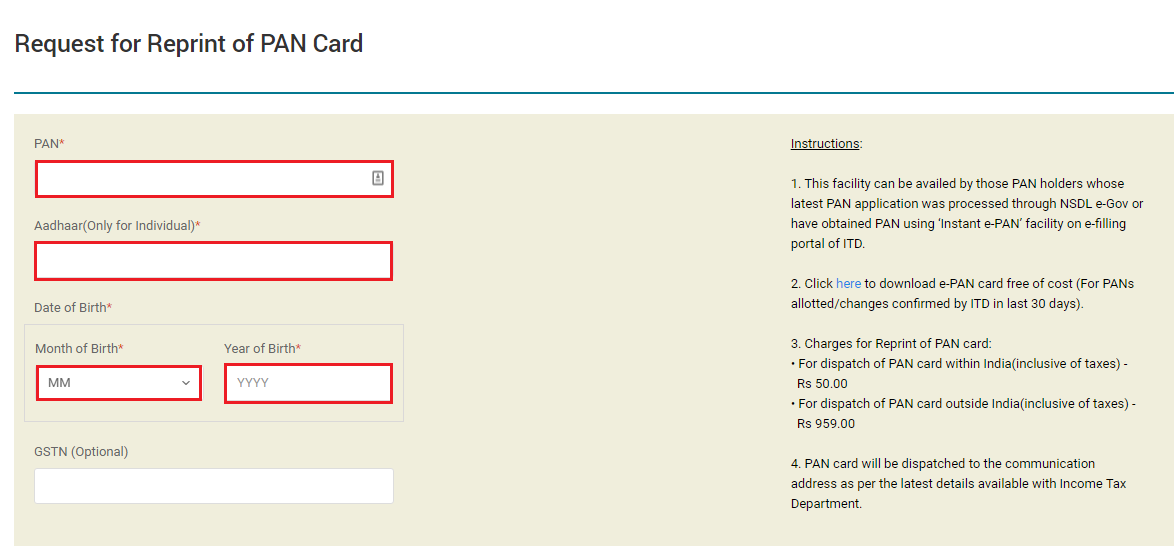

- After accessing the application form for “Reprint of PAN” enter in the following details

PAN Number, Aadhaar (Only in the case of individuals), Date of Birth (D.o.B).

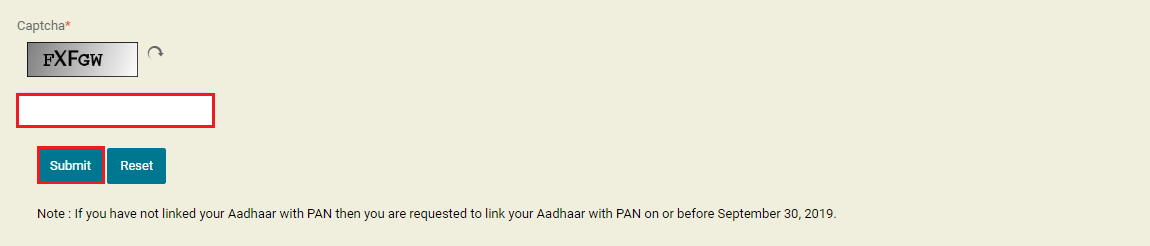

- Enter the Captcha code from the image given below

and click on the “Submit” option.

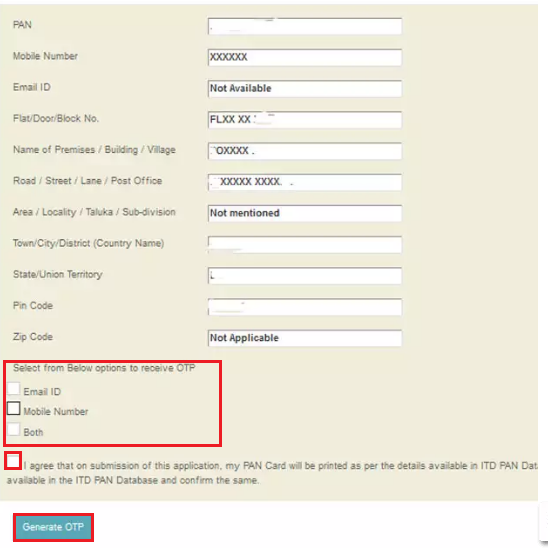

- Verify the personal information shown on screen.

And choose from the below options to receive the OTP:

e-Mail ID

Mobile Number

Both - Select the check-box.

And click on the “Generate OTP” option

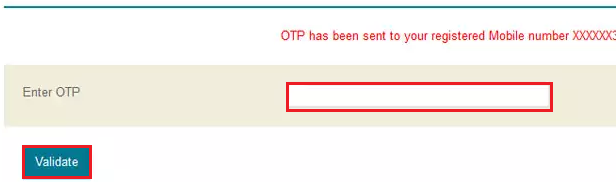

- Enter the OTP received in the respective field.

Click on the “Validate” option.

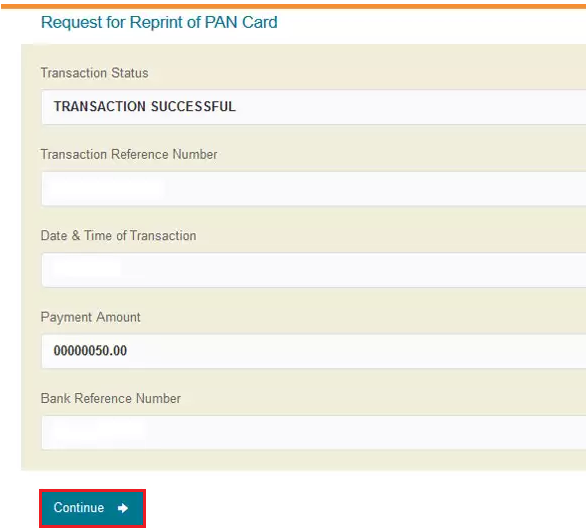

- Make Payment of Fees.

Click on the “Continue” option to generate and print the payment receipt.

Hence, an SMS will be sent on your registered mobile number with your acknowledgment number. The SMS will also provide you the link to download your e-PAN. Moreover, individuals can use this facility only if there is no change in the data such as name, address, etc. Remember you cannot update your details in the PAN using this facility.

PAN card will be dispatched to the communication address as per the latest details available with the Income Tax Department (ITD).

FAQs

You can submit the application in the form “Request for New PAN Card Or/and Changes or Correction in PAN data” in the following cases:

– When you already have PAN but want a new PAN card,

– When you want to make some changes or corrections in your existing PAN details

The PAN card is issued after nearly 15-20 days after the submission of the form on the portal.