If you miss the due date for filing an income tax return, you will receive a notice from the IT Department. The Due Date to file Original Income Tax Return under Sec 139(1) is 31st July from the end of the financial year if tax audit is not applicable. However, the due date is 30th September from the end of the financial year if the tax audit is applicable. Additionally, the Due Date to file a Belated Return under Sec 139(4) or Revised Return under Sec 139(5) is 31st March i.e. one year from the end of the financial year. If the ITR has not been filed within the Due Date, then the Income Tax Department would send out emails and SMS to the Non-Filers. For FY 2018-19 (AY 2019-20), ITD sent SMS to multiple taxpayers for not filing ITR.

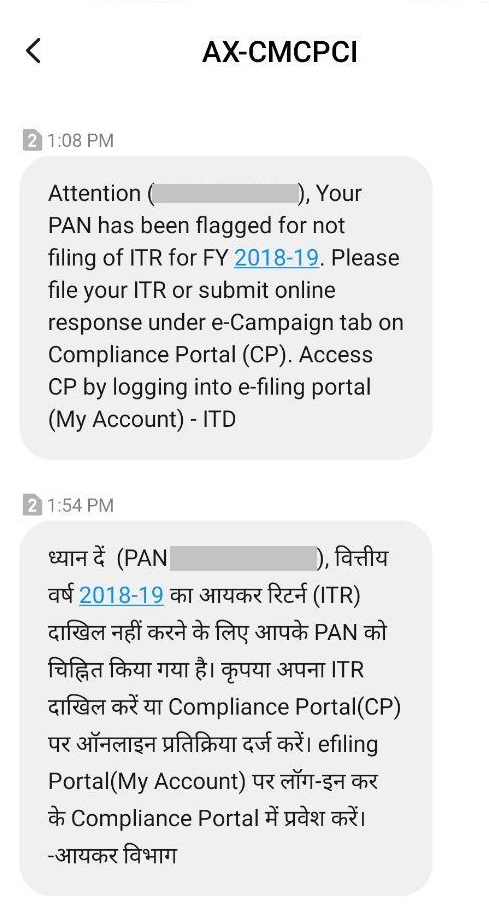

For example, here is a snapshot of SMS sent to taxpayers for not filing Income Tax Return:

Under the Non-Filers Monitoring System (NMS), the Income Tax Department captures information relating to the financial transactions of the taxpayers through the information reported under AIR (Annual Information Return), CIB (Central Information Branch) data or TDS/TCS Returns. Hence, on the basis of this information, the ITD issues notice to the non-filers of ITR with potential tax liability.

Annual Information Return (AIR)

Annual Information Return is a return submitted by specified entities to the income tax department. This is to report the ‘high valued transactions’ of Individuals and HUFs. For example:

- AIR-001: Cash deposits of Rs. 10,00,000 or more in a year in a savings bank account

- AIR-002: Credit Card Bills of Rs. 2,00,000 or more

- AIR-003: Mutual Fund Investment of Rs. 2,00,000 or more

- AIR-004: Investment in Bonds or Debenture of Rs. 5,00,000 or more

- AIR-005: Investment in shares of Rs. 1,00,000 or more

- AIR-006: Purchase of Immovable Property valued at Rs. 30,00,000 or more

- AIR-007: Investment in RBI Bond of Rs. 5,00,000 or more

Therefore, in the case of taxpayers who have not filed their Income Tax Return and have significant financial transactions reflecting on the e-Compliance Portal, the ITD has taken the following actions:

- Sent SMS for Non-Filing of Income Tax Return

- Raised query to confirm the information on e-Compliance Portal

Action to be taken for Income Tax Non-Filing Notice

Taxpayer who has received a notice for non-filing of the Income tax return through an SMS should take the following actions:

- File Income Tax Return or Submit Response

a. Login to your account on incometaxindiaefiling.gov.in

b. Go to Compliance > Compliance Portal

c. Click on e-Campaign

d. Under e-Campaign – Non-Filing of Return, click on Financial Year

e. Under e-Campaign – Response on Filing of Income Tax Return, click on Financial Year

f. Select Response from the dropdown, select Reason and Mode of filing.

g. Enter Date, Acknowledgement Number and Remarks

Click on Submit. - Next, you will need to confirm the information provided.

a. Login to your account on incometaxindiaefiling.gov.in

b. Go to Compliance > Compliance Portal

c. Click on e-Campaign

d. Under e-Campaign – Non-Filing of Return, click on Financial Year

e. Under e-Campaign – Information Confirmation, click on Financial Year

f. Click on the tab, select the transaction and choose the correct option to validate the information.

FAQs

The Due Date to file a Belated Return under Sec 139(4) or Revised Return under Sec 139(5) is 31st March i.e. one year from the end of the financial year.

AIR can be furnished through Form 61A (Part B) in a digitized form in a CD/Floppy. While Form 61A (Part A) in a paper format duly signed.

Securities Transaction Tax (STT) is a type of financial transaction tax that is similar to Tax Collected at Source (TCS). Therefore, STT is a direct tax levied on every purchase and sale of securities that are listed on the recognized stock exchanges in India.