The Income Tax Department has prescribed different ITR Forms for various income situations. The taxpayer is required to prepare and file the ITR Form applicable to them for that particular financial year.

Index

- ITR Forms

- ITR Documents

ITR Forms Types

The Income Tax Department has prescribed 7 different ITR Forms. The ITR Form type should vary based on the income situation.

ITR 1

ITR-1 (SAHAJ) for Resident Salaried Individuals. Individuals earning income from the following sources can file ITR 1:

- Salary

- Pension

- One House Property

- Other Sources: Savings Interest, Fixed Deposit, etc

- Agricultural Income less than INR 5,000

List of documents required to file ITR 1:

- Salary Income: Form 16 or Salary Slips

- Pension Income: Pension Statement/ Bank Statement

- House Property: Address proof, co-owner details, loan interest/repayment certificate, rental agreement

- Other Incomes: Passbook, interest certificates, dividend warrants/counterfoils, other receipts

Steps to file ITR 1 using Income Tax Website:

- Log in to your income tax e-filing account and navigate to e-File > Income Tax Return

- Select the Assessment Year, ITR Form, Submission Mode (Prepare and Submit ITR online)

- Select the details you want to be prefilled form records available with the ITD

- Click on Preview and recheck the ITR prepared

- Submit the ITR

- e-Verify the ITR

ITR 3

ITR 3 is for individuals and HUFs having income from business or profession. ITR 3 can be filed by a taxpayer having:

- Partner Income from a partnership firm or LLP

- Businesses with income more than INR 1 crore not covered under presumptive taxation scheme.

- Professionals under presumptive taxation scheme with income more than INR 50 Lakhs

- Capital Gains

- House Property

- Salary

- Other Sources

Any other entity except Individuals and HUFs cannot file ITR 3. Entities like LLPs, Partnership Firm, Companies, Charitable Trusts, Local Authorities, etc. cannot file ITR 3.

List of Documents Required to file the ITR 3

- Business & Professional income: Bank account Statement/ Passbook

- Capital Gains: land/building Sales and Purchase Deed, Stock Ledgers, Trading Statement, expenses on a transfer of the capital asset, etc.

- House Property Income: Rent Agreement, co-owner details, Loan repayment certificate/statements.

- Salary: Form 16, Salary Slips, Pension Statement/Passbook

- Other Sources: Dividend warrants, interest certificates, other receipts

Methods to file ITR 3

ITR 3 can be submitted online or physically. However, if the income is more than INR 5 Lakhs, it is mandatory to file ITR 3 electronically.

- Physical Submission:

- paper form or

- bar-code return form

- Online/ Electronic Submission:

- After adding Digital Signature

- Sending the signed copy for verification to CPC Bangalore

- e-Verification of ITR

ITR 4

ITR 4 is for Individuals, HUFs and Partnership Firms that have opted for presumptive taxation scheme u/s 44AD, 44ADA, or 44AE. These taxpayer having income from the following sources can file ITR 4:

- Businesses eligible for presumptive taxation scheme

- Professionals and Freelancers eligible for presumptive taxation scheme

- Salary/ Pension

- One House Property (excluding cases with bought forward losses)

- Other Sources: Dividend warrants, interest certificates, other receipts

Taxpayers having income from capital gains, speculative business, foreign sources of income cannot file ITR 4.

List of documents required to file ITR 4

- Business/ Professions: Profit & Loss Statement, Balance Sheet, Supporting documents for expenses, Cash Register, etc.

- Salary Income: Form 16, Salary Slips, Passbook, Pension Statement

- House Property: Rent Agreement, co-owner details, Loan repayment certificate/statements

- Other Sources: Dividend warrants, interest certificates, other receipts

Methods to file ITR 4

- Physical Submission:

- paper form or

- bar-code return form

- Online/ Electronic Submission:

- After adding Digital Signature

- Sending the signed copy for verification to CPC Bangalore

- e-Verification of ITR

However, it is mandatory to file ITR-4 online for taxpayers who have:

- income more than INR 5 Lakh

- any assets outside of India, including financial interest in any entity; or signing authority in any account outside of India

- claiming relief u/s 90/90A/91 to whom Schedule FSI and Schedule TR to apply

ITR Documents

Form 16

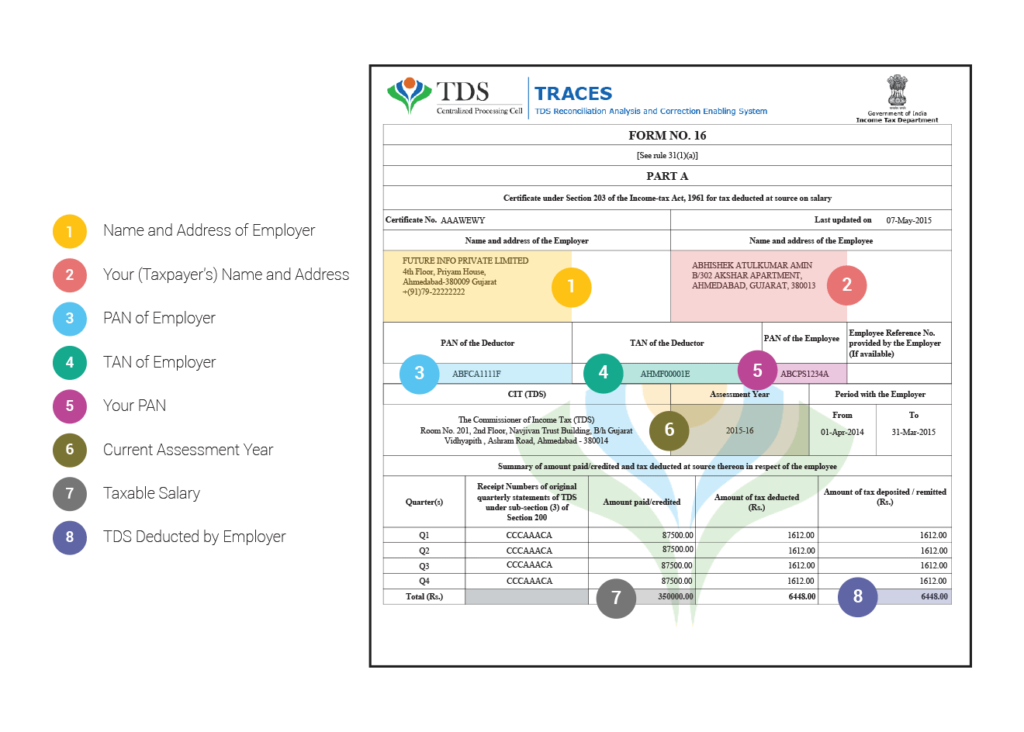

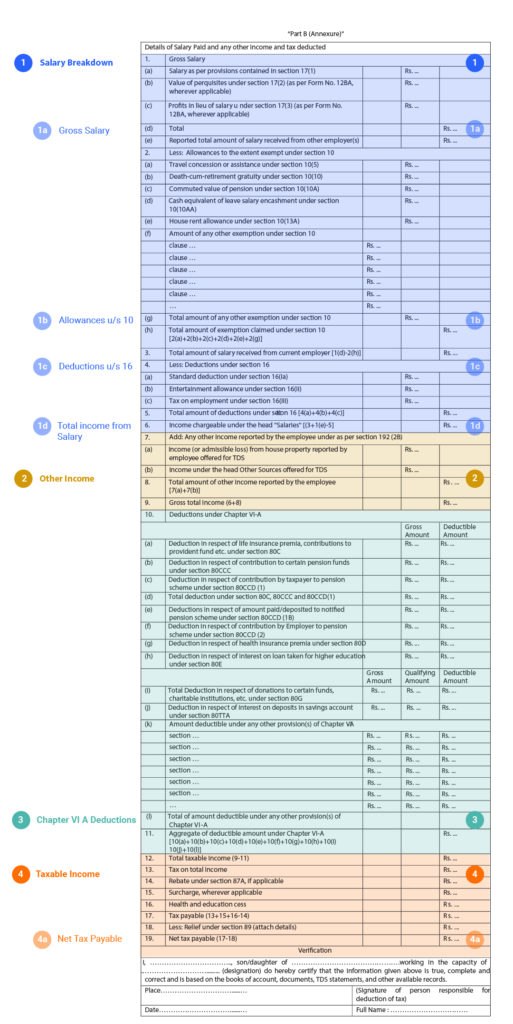

Form 16 is a TDS certificate on Salary. It contains details of income earned and taxes deducted on it. The employer issues Form 16 to its employee after the end of a financial year. The due date to issue Form 16 for FY 2018-19 is 15th June 2019. Form 16 is divided into 2 Parts:

- Part A: contains employer, employee details and TDS deducted by the employer

- Part B: is an annexure of income chargeable under the head of ‘Salary’. It contains a detailed breakdown of salary components.

Sample Form 16 Part A

Sample Form 16 Part B

You may have multiple Form 16 if you had multiple employers or changed jobs during the Financial Year.

Form 16A

Form 16A is a certificate on TDS income other than Salary, like commission, interest, professional fees, rent. Form 16A is issued by the deductor(Payer) to the deductee(Payee) within 15 days of from the date of filing the TDS return.

Form 26AS

Form 26AS is a consolidated Tax Credit Statement. It contains the following details:

- Tax Deducted from the taxpayer’s income

- Tax Collected from taxpayer’s payments

- Taxes paid during the financial year: Advance Tax, Self-Assessment Tax, Regular Assessment Taxes paid by the taxpayer

- Details of Tax Refund received during the financial year

- Details of any high-value transactions

You can set off the tax credit against your net taxable liability while filing the ITR.

You can view and download your Form 26AS from your account on the income tax e-filing website.

Form 12BB

Form 12BB is an investment declaration form submitted by an employee to its employer. The employer uses this Form 12BB for accurate TDS deduction on the employee’s salary, and avoid excessive TDS deduction.

What are the details required to file Form 12BB?

- HRA (House Rent Allowance)

- LTA (Leave Travel Allowance)

- Interest Deduction under the head “Income from House Property“

- Chapter VI-A deductions (u/s 80C – 80U)

Form 10BA

Form 10BA is for taxpayers to claim deduction u/s 80GG i.e. for rent paid on house property. Form 10BA contains details of the taxpayer, property, rent paid and the landlord.

How to submit Form 10BA?

You can submit Form10BA for a financial year using the Income Tax Department website.

- Go to Income Tax Forms under e-file on the Income Tax Website

- Select Form 10BA from the drop-down

- Choose the submission mode- Prepare and Submit online

- Enter the relevant details,

- Preview and Submit the Form 10BA

Form 15G & Form 15H

Form 15G & Form 15H is to avoid TDS deduction on the taxpayer’s income. It is usually submitted to banks to avoid TDS being deducted on the interest income. Form 15G & Form 15H is required to be at the beginning of the financial year.

Form 15H is for taxpayer above the age of 60 years i.e. senior citizens. Whereas, non-senior citizens use Form 15G.

When to submit Form 15G/15H?

Form 15G/15H can be submitted to avoid tax deduction in the following income sources:

- TDS on EPF withdrawal

- TDS on Rent

- TDS on the interest income from Fixed Deposits with bank/ post office

- TDS on Corporate Bonds

- TDS on Insurance Commission

Details required to file Form 15G or Form 15H

- PAN

- Residential Status

- Address Details

- Contact Information

- Estimated Income Details

- Previously Filed Form 15G/ 15H details

Methods file Form 15G & Form 15H

If the tax liability for the financial year is zero, you can file Form 15G & Form 15H with the deductor.

- Physical Submission

- Download Form 15G/H from the income tax website,

- Prepare and Submit it with the deductor

- Online Submission

- Go to the Deductor’s website (Bank website)

- Log in to your account

- Fill in and submit Form 15G/ 15H

@Muskan_Balar Is this Common ITR Form applicable from AY 2024-25?

Hi @akash_jhaveri,

It is expected that the proposed common ITR form will be applicable from financial year (FY) 2023-24 and assessment year (AY) 2024-25.

Hope it helps.