The Digital Signature Certificate (DSC) is an electronic signature of a taxpayer. It is issued for the purpose of validating and certifying the identity of the person holding this certificate. The DSC contains information such as user name, PIN code, E-mail address, date of issuance of the certificate, etc.

The registered users on the e-Filing platform can upload their returns using the DSC. The users have to sign their return digitally or online by using their DSC. The users have to register their digital signature on the e-Filing portal. In order to register the DSC on the e-Filing portal, the user needs to have the latest version of Java software installed in their system.

The users registered on the e-filing portal can perform the following functions:

- Register DSC

- Re-Register when registered DSC has expired

- Re-Register when registered DSC has not expired

- Register DSC of Principal Contact

Prerequisites

- Registered user of the e-Filing portal with valid user ID and password

- Downloaded and installed the emsigner utility (the utility can also be downloaded and installed while registering DSC)

- The USB token procured from a Certifying Authority Provider should be plugged into the computer

- DSC USB token should be a Class 2 or Class 3 Certificate

- DSC to be registered should be active and not expired

- DSC should not be revoked

Steps to Download & Install Embridge

- Visit the income tax portal

- Click on the downloads option from the dashboard

- Click on the DSC Management utility option from the sidebar on the left

- Download Utility (emBridge)

- Extract the files from the zip folder.

- Open the setup application to install the software after accessing the extracted folder

- Select the destination location when prompted and click on next.

- Upon completing the installation process, click on the finish option after reaching the last screen of the setup.

DSC Certificate Installation Procedure

As soon as the DSC token is attached to the system, the taxpayer receives a pop up asking them to go through the installation process for the DSC Certificate. Here is the procedure for the same (we have used the ePass token):

- The first pop-up you receive should allow you to select a language, choose the one you are comfortable with, and click on next.

- You will now move to the setup window, click on the next option

- Choose the installation location

- Choose the CSP option as Private CSP

- The extraction process begins. Next, you will receive a confirmation window to commence the installation process. Click on yes.

Once the process is complete, click on finish.

Process to Change PIN for DSC Certificate Token Manager

- Launch ePass software or the relevant DSC certificate manager

- Click on the change user PIN option from the left sidebar

- Enter the required details in the required fields.

Hence, you will receive a success message on the successful change of the PIN.

Steps to Register DSC on the Income Tax e-Filing portal

- Visit the Income Tax e-Filing portal

Login to the e-Filing portal.

- My Profile

Click on the my profile option from the top right.

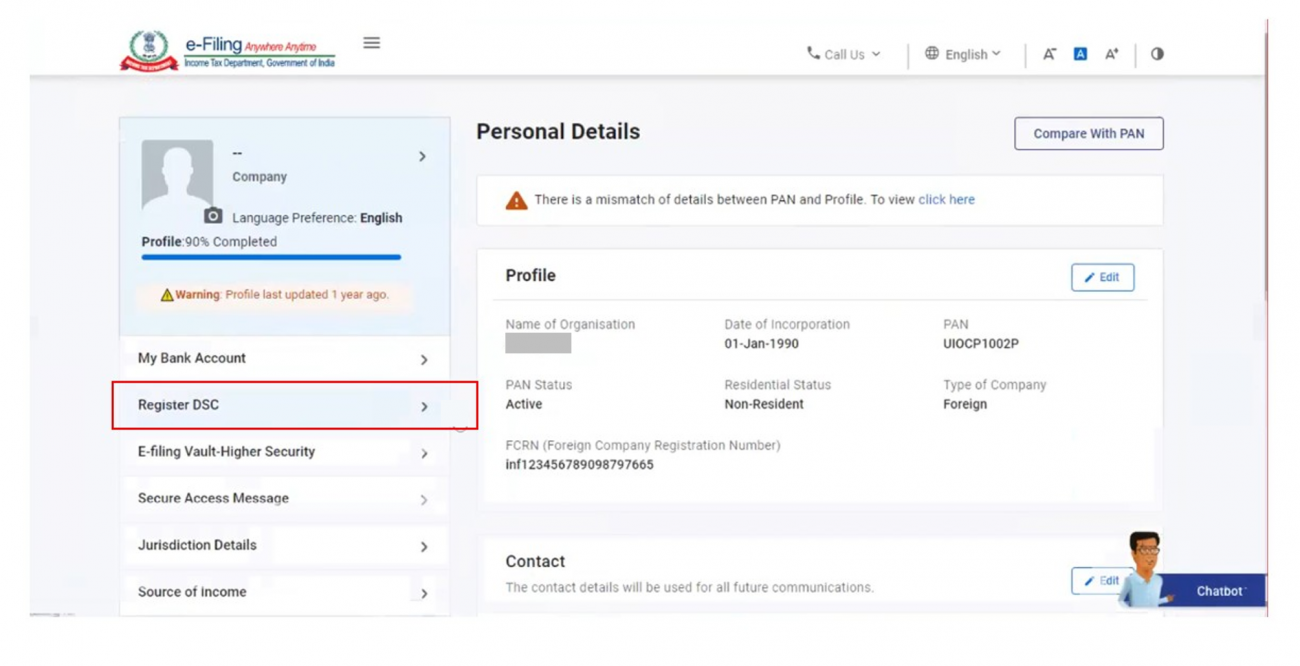

- Register DSC

Click on the option to register the DSC from the left side.

- Provider and Certificate

Select the Provider and Certificate. Enter Provider Password. Click Sign.

- Successful Validation

On successful validation, a success message will be displayed with the option to go to the Dashboard.

FAQs

There are 2 types of digital signatures:

1. PFX File is a Digital Signature Certificate that is in a file format (.pfx format). This type of signature can be easily circulated through e-Mail, which makes it easier for users. However, there is a risk of misuse if not handled properly.

2. Digital Signature certificate in a USB Token, looks similar to a pen drive, which is attached to the PC for using a digital signature. The main advantage of it is that it safeguards DSC from misuse which is more likely in the pfx file.

The steps to generate the Digital Signature are given below:

1. Download the DSC utility

2. Extract the JAR File

3. Upload the required details in the file

4. Generate the Signature File

You can verify your return using the DSC on the Income Tax e-Filing portal:

1. Log in to the Income Tax e-Filing portal and click on the e-File > Income Tax Return option

2. Select the required details from the drop-down list: Assessment Year, ITR Form Number and Submission Mode

3. Select the DSC option to verify your return

4. Upload the DSC file

A valid DSC can be procured from a certifying authority and the same must be registered on the e-Filing portal post login.

DSC is mandatory for some services/user categories such as e-Verification of returns filed by companies and political parties as well as other persons whose accounts are required to be audited under Section 44AB of the Income Tax Act. In other cases, it is optional.

Hey @TeamQuicko

Can you tell me about ITD’s new ITR filing utility for AY 2021-22?

Hey @HarshitShah

To improve the tax filing process, the Income Tax Department has decided to do away with the excel and java-based utility and has launched a new offline JSON-based utility for the AY 2021-22. The new utility will help taxpayers import prefilled data and edit it before filing the income tax return (ITR).

The taxpayers can download the pre-filled data from the income tax e-filing portal and fill in the rest of the data. This imported prefilled data can be edited to change basic information such as address and all. Currently, the utility can be used to file ITR1 to ITR 4. ITD has also released a step-by-step guide to using the utility.

Hope this helps!

Is it possible to file ITR online without an account on the Income Tax e-filing portal?

What should be done in case of discrepancies in actual TDS and TDS credit under Form 26AS?

Hey @Amitabh_Verma

It is mandatory to create an account on the Income Tax e-filing portal to file your ITR online. It is a hassle-free quicko process. One can register on the portal by providing relevant details such as user type, PAN, first name, surname, date of birth, and fill in the registration form.

Hey @Niraj

Many times mismatches and discrepancies in actual TDS and TDS credit under Form 26AS happen because of wrong information provided in the TDS return. One can approach the employer/deductor to file a revised TDS return after making the necessary corrections.

The income-tax department allows an assessee to mention the reason for mismatch in the online portal in answer to a notice sent by them.

Hope this helps!

Hi, actually I filed ITR 1(A.Y. 2013-14) due to notice served in Jan month.

The ITR is pending for verification. Ask the options aren’t available for me client i.e Aadhar verification,evc etc. Only thing is I got my clients DSC. but option of DSC for e-verification is not showing. I can’t send CPC to Bengaluru since it will take time. How can I use DSC to e-verify my already filed return

Hi @Arsheen

The option to e-verify ITR using DSC is to be selected while filing. Once you have filed your ITR only option available for e-verification is EVC/Aadhar OTP or sending ITR V to CPC Bangalore. You have 120

days from the date of e-Filing to e-verify your ITR.

So if 120 days are not over you can send the signed ITR V to CPC Bangalore to get it e-verified and processed.

Hope this helps

Hi @Sharath

It is suggested to file ITR as NRI in India if you have trading transactions even if there are losses.

If you do not file ITR then there are high chances of your PAN getting flagged by the IT department for non-filing of ITR.

Also, If you file the ITR on time you can take benefit of carry forwarding the losses and setting off those losses against the profits in future years.

I have started an HUF by infusing funds by collecting gifts from HUF members. If I invest in Shares, Equity MF, from that Capital (Collected as gifts from members), and earn income in the name of HUF, will that income be clubbed with the income of the members?

In a way that will be the outcome of the business (trading and investing of shares) done by HUF. And there will be a degree of efforts and luck involved, not a fixed income instrument as FD, etc.