What is JSON Utility?

Financial Year 2021-22 started with the Central Board of Direct Taxes introducing JSON Utilities for ITR filing. The Income Tax Department has decided to discontinue the current Excel and Java versions of the ITR Utilities from FY 2020-21/AY 2021-22. Follow this step-by-step procedure to download JSON from the Income Tax e-Filing Portal.

What Data is available in the Prefilled JSON?

The imported prefilled data can be edited to change basic information such as address, name, bank details, etc. However, you cannot change the PAN details. In such a case, you will have to edit the information of your PAN on the e-filing portal and then will have to again download the prefilled JSON file. Here is a list of the details present in the prefilled JSON file:

- Prefill Taxpayer Information: includes assessee name, contact details, residential status, date of birth, taxpayer category, PAN, and Aadhaar details.

- Prefill Bank Account: includes your pre-validated bank account

- Prefill Income Details: includes incomes like salary, house property, and other sources

- Prefill Tax Credits: includes TDS/TCS, self-assessment tax, advance tax

- Prefill Bought Forward Losses: Includes house property, capital gains, and business & profession losses reported when filing ITR within the due date in the previous year.

Step-by-Step Guide to Download JSON Offline Utility

- Visit the Income Tax e-Filing Portal

Go to the Income Tax e-Filing Portal

- Downloads

Now, click on Downloads > Income Tax Returns from the dashboard

- Download the Common Utility

Select the assessment year and click on the option to download the common utility

- Open the ITR Utility Folder

After the Zip Folder is downloaded, open the Utility from that folder, and if you receive a message asking to ‘Run Anyway’ the program, click on ‘Run Anyway’

- The utility will start installing

After you select ‘Run Anyway’ your ITR Utility will start installing

- Now, click on Continue

After you install the utility you land on the Homepage. Now Click on continue.

- File your ITR

From here you will be able to file your Income Tax Return for AY 2023-24

Download Prefilled JSON

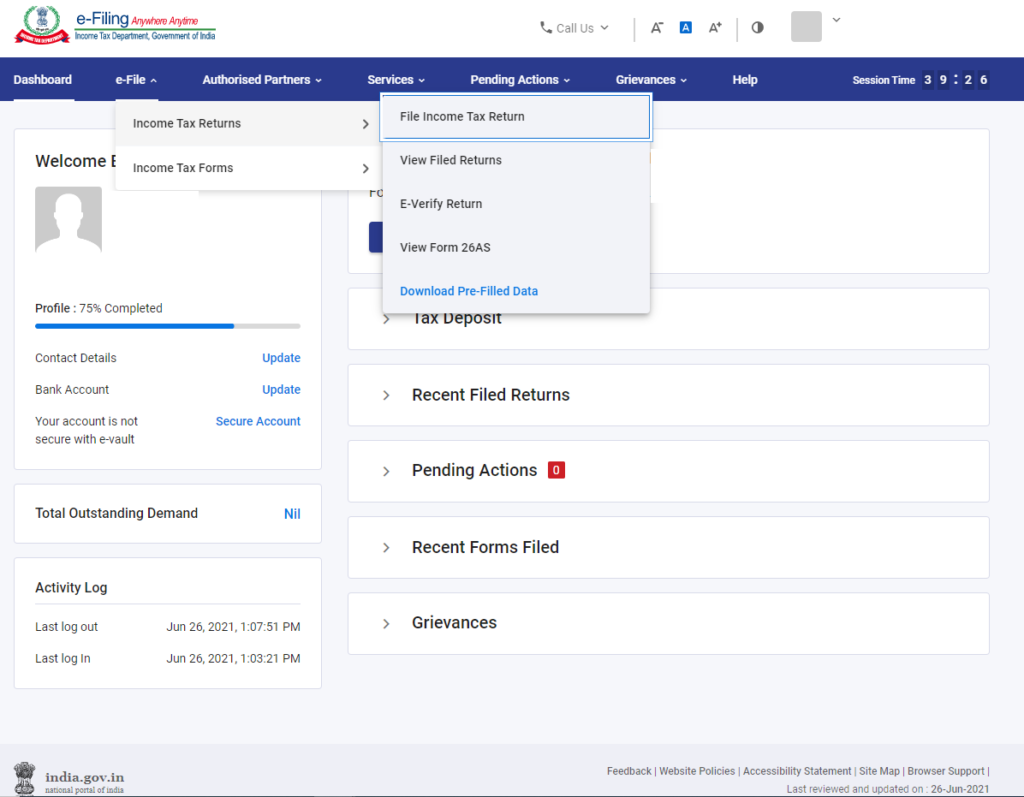

- Login to the www.incometax.gov.in and click on e-File > Income Tax Returns > Download Pre-Filled Data

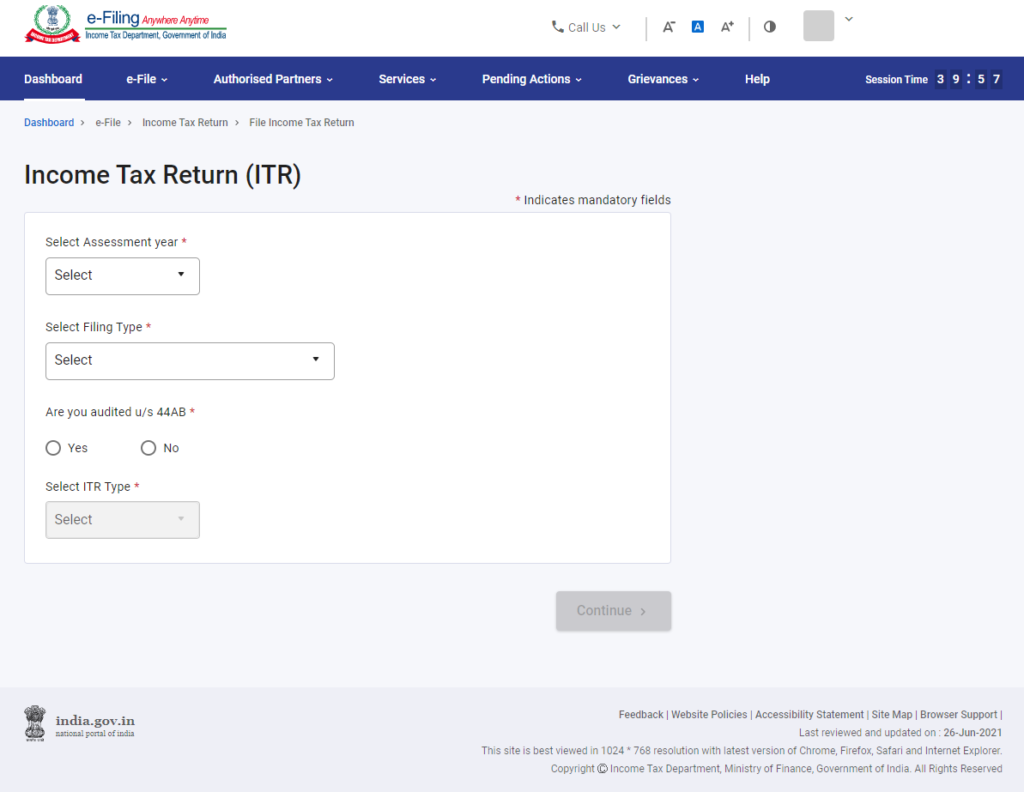

- Next, enter the details such as assessment year and click on continue.

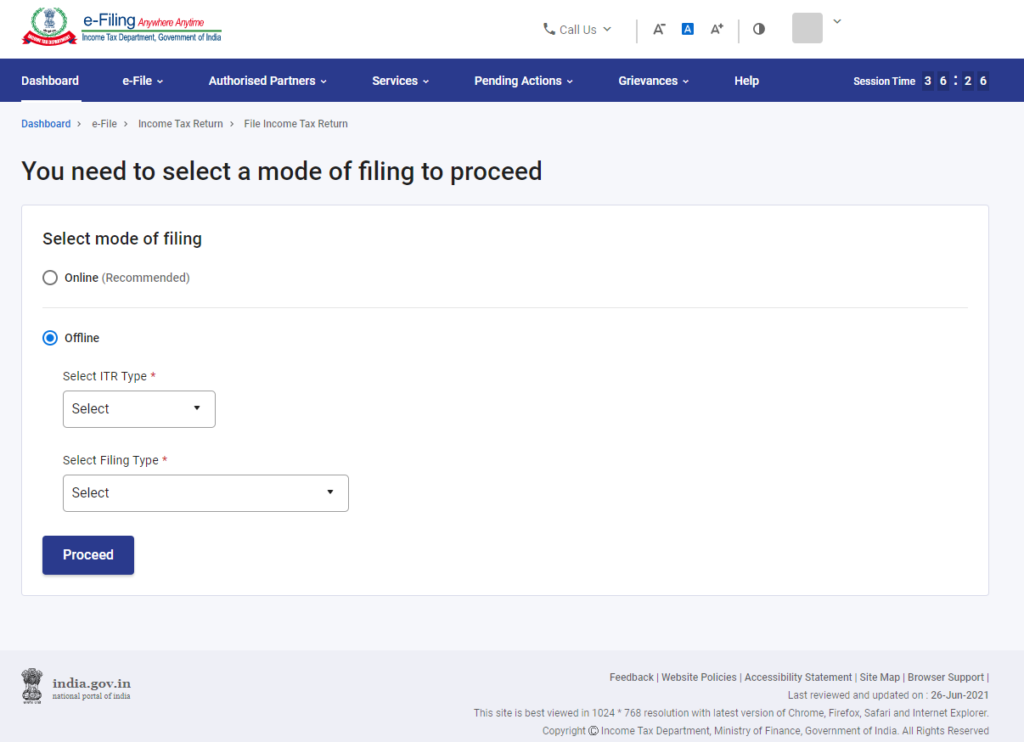

- Select the mode of filing as offline. You will be asked to select the ITR type and Filing type. Choose the appropriate options and click on proceed.

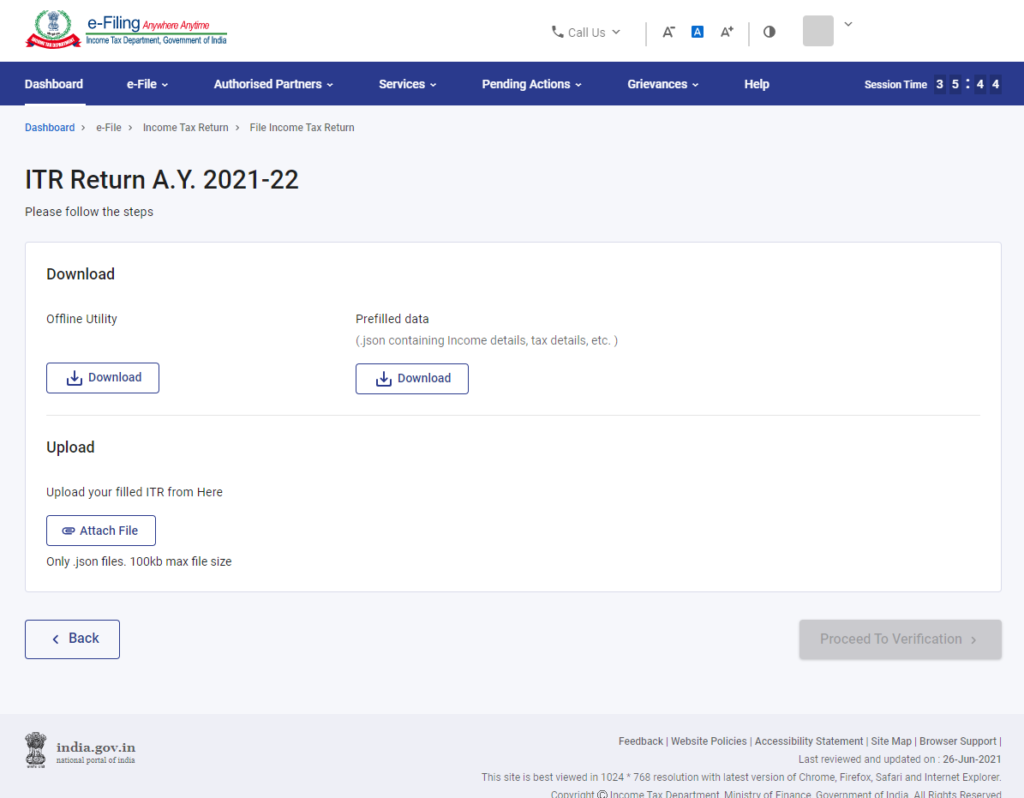

- Finally, click on the option to download the prefilled data.

You can attach this file to the income tax JSON utility you downloaded to file your ITR.

How to File ITR Using JSON?

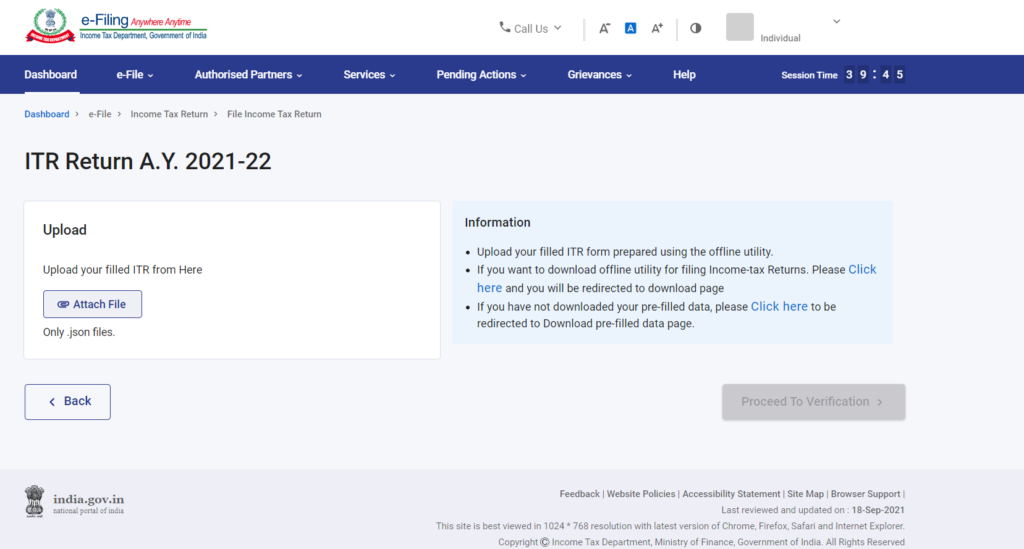

After preparing your ITR, you need to upload the prepared ITR JSON file on the e-Filing portal by following these steps:

- Visit the e-Filing Portal and login using valid credentials.

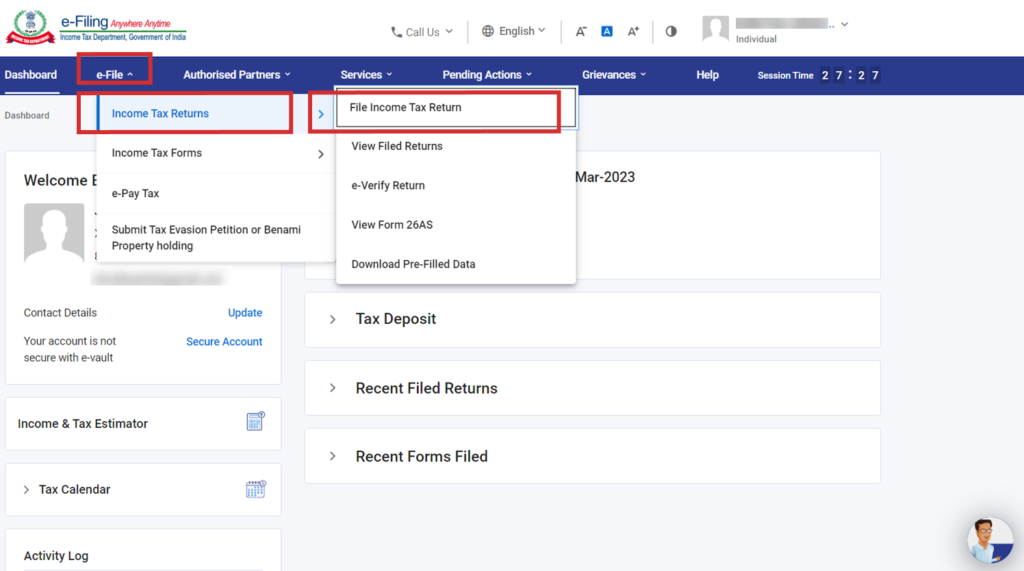

- Click on the e-File > Income Tax Returns > File Income Tax Return from the dashboard

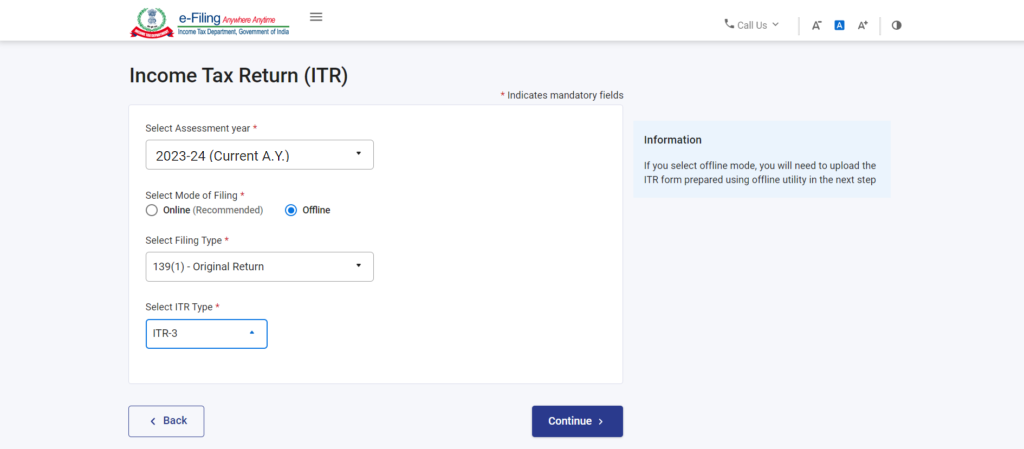

- In order to file the return using the JSON file, the taxpayer needs to select the mode of filing as offline.

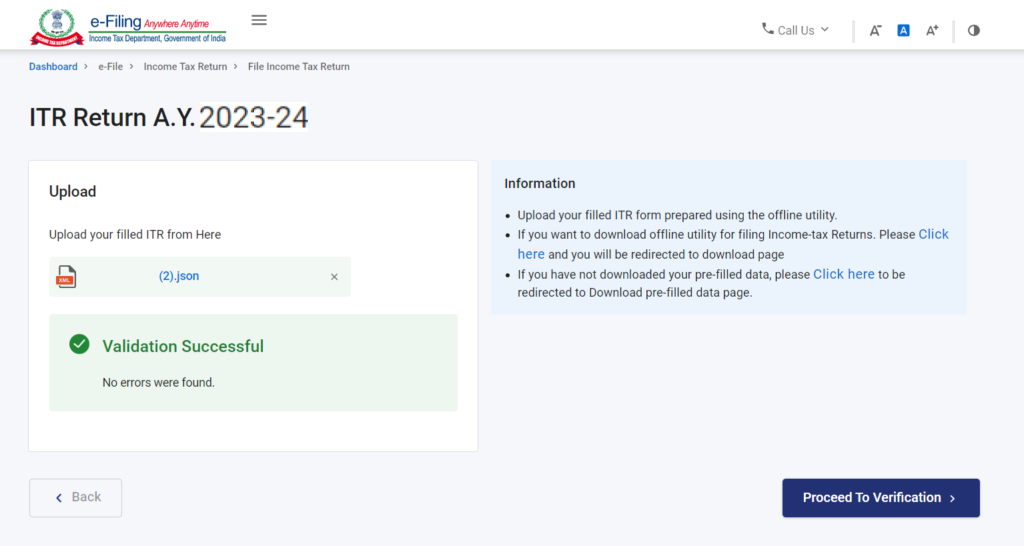

- Attach the JSON file

- In case there are no errors, the next screen would show you the message “Successful Validation“. Next, click on the “Proceed to Validation” option.

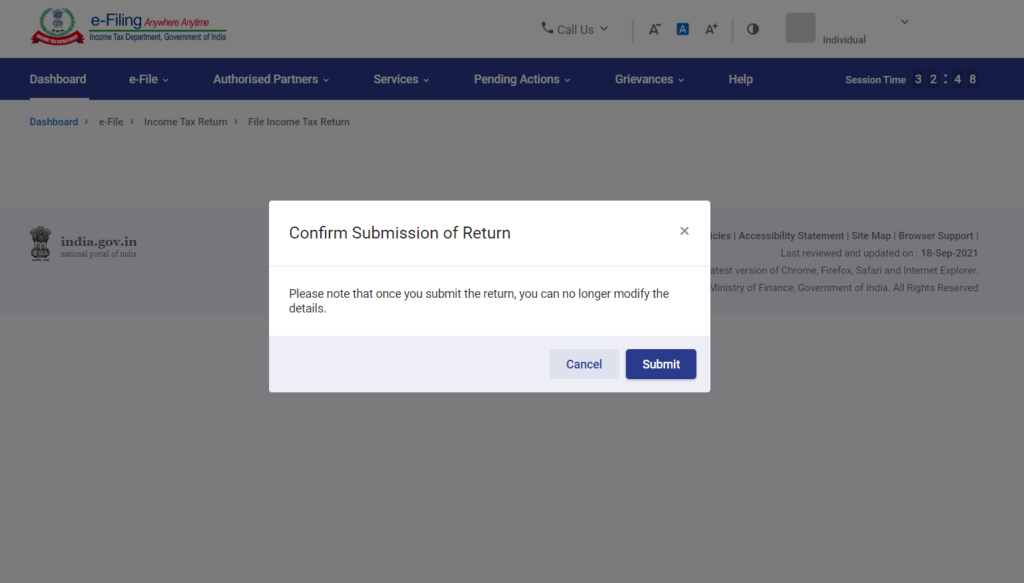

- Confirm the submission of the income tax return.

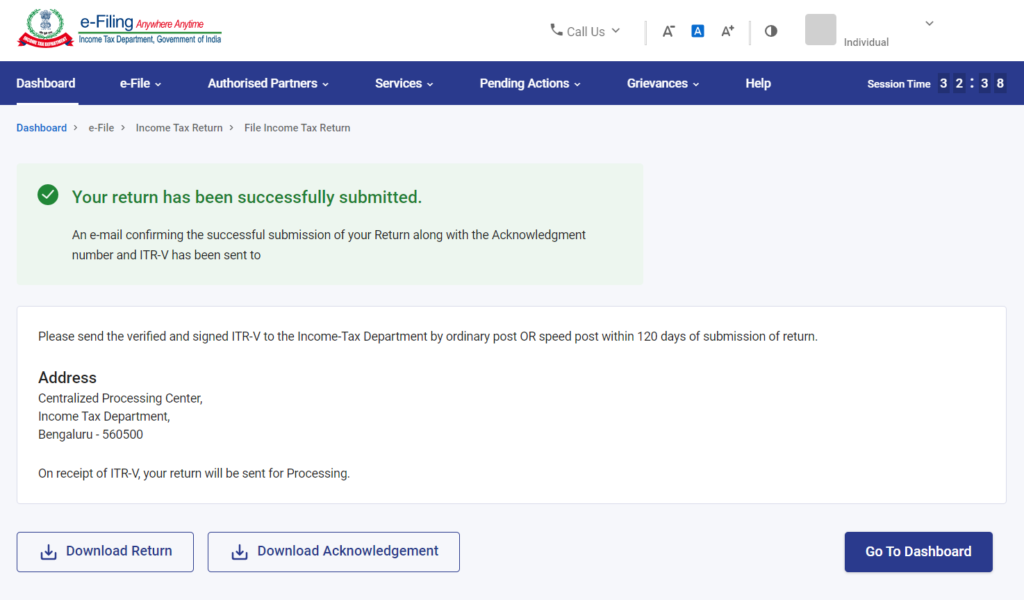

- Finally, you would receive the success message displaying the successful submission of the ITR. You will also receive an email along with the acknowledgment number and the ITR-V on the registered email ID.

Submitting the ITR to the ITD is not the last step of the process. You still have to e-Verify your return within 30 days of the submission of your return.

FAQs

No, currently the facility to upload ITR at the e-filing portal is not enabled. Taxpayers can fill and save the file either within the utility or export the output JSON file to their system.

JSON Utility is enabled to import and pre-fill the data from the e-filing portal. You will be able to fill in the balance data and also edit the profile data other than PAN details in the utility. However, it is suggested to edit the same in your Profile at the e-filing website and regenerate prefill data.

Prefilled JSON contains data such as name, father’s name, bank account details, Aadhaar, address, contact details income details & tax credits details.

I have been trying to explore the portal but I am not able to login to the portal, any idea what is going on?

Hi @Dia_malhotra

ITD have launched the portal yesterday night. Due to heavy traffic some of the features are not working properly. It will be resumed soon.

Stay tuned with us. Will update you with every feature new portal has!

In the meantime, you can check out all the features in the below post

https://twitter.com/HowToQuicko/status/1402125952138629123?s=20

Why I’m not able to file my ITR-3?

Hi @Niral_Koradia, this can help

Hi, @Nireka Thank you for your response. Is there any place where it announces whether it has been completed or not? I’m wondering about the last date of the filing.

@Niral_Koradia, we are expecting it around mid-August. The last date of filing ITR when Tax Audit is not Applicable for AY 2021-22 is 30th September 2021.

You can follow us on Twitter to get updates about new releases and ITR filing

https://twitter.com/HowToQuicko

HI @Nireka Hope you are doing well ! Do you happen to know the status for enabling E-Filling ? Is it still pending from ITD side or from quicko’s technical side ?

Hey @Niral_Koradia, the ITD has published the schemas for Income Tax Return and you will be able to prepare the ITR on Quicko. However, we are still awaiting APIs that are required to enable ITR filing from ITD. ITR filing will be soon enabled on Quicko.

Stay tuned for all the exciting product feature updates next week!

Hi @Abin_Babu, Yes ITR filing is now live on Quicko.

Hello, I have withdrawn my EPF & EPS completely in July this year. I had not completed 5 years service and hence some amount is taxable. I need help in understanding how this should be reported when I file ITR next year.

Here’s what I have already figured out -

A - Employee’s contribution - Not taxable, should be reported under exempted income under section 10(11)

B - Interest on employee’s contribution - Taxed as income from other sources

C - Employer’s contribution - Taxable as profits in lieu of salary under section 17(3)

D - Interest on employer’s contribution - Taxable as profits in lieu of salary under section 17(3)

E - I have claimed EPF for deduction under section 80C in past. Since I didn’t complete 5 years of service, this amount is now taxable as income in current year.

What I can’t figure out -

1 - Whether EPS (pension) is taxable, and under which section it should be reported

2 - With reference to point E above, under which section should I report this amount as income?

3 - With reference to point E above, let’s say in one of the previous years the deductions claimed under 80C were: 1.5 lakh PPF, 25k insurance premium, 28k EPF. In this case my 1.5 lakh investment limit under 80C is being exhausted by investments without taking EPF into consideration. Do I still need to report 28k EPF as salary income this year?

Thank you in advance for any helpful insight.