What is TDS Challan?

The payer must deposit TDS with the government after they deduct it. The Tax department has defined different challans for the deposit of different types of taxes. Through Challan ITNS 281 you can make online payments of TDS/ TCS.

Challan needs to be kept in record since it is used for TDS return filing. While filing TDS returns quarterly details such as Challan Serial Number, BSR code, and Tax Amount is compulsory

When to deposit TDS/TCS through challan ITNS 281?

Due dates for TDS/TCS challan deposit through challan ITNS 281 are as below:

| Period | Due Date of Deposit |

| Tax Deducted from April to February | 7th of the next month |

| Tax Deducted in March |

TDS: 30th April TCS: 7th April |

| Tax Deducted on Purchase of Property | 30th of the next month in which sales consideration is paid to the seller. |

In case of delay in the deposit of tax, penalty interest is levied u/s 201(1A) of the act at the rate of 1.5% per month or part of the month from the due date of the deposit.

How to make online payments of TDS/TCS challan?

One can make the online payment of TDS challan from the Income Tax with the help of the following steps:

- Login to the Income tax portal

Enter the TAN to login to the income tax portal

- Click on E-pay tax

After login to the income tax portal click on e-pay tax

- Click on New Payment

On the right-hand side, click on the new payment

- Select the Assessment year

First select the assessment year and then click on Proceed

- Select the Nature of the Payment

Nature of payment is a section under which tax is deducted by the deductor and it is also mandatory to deposit TDS/TCS with the government.

- Enter details of payment

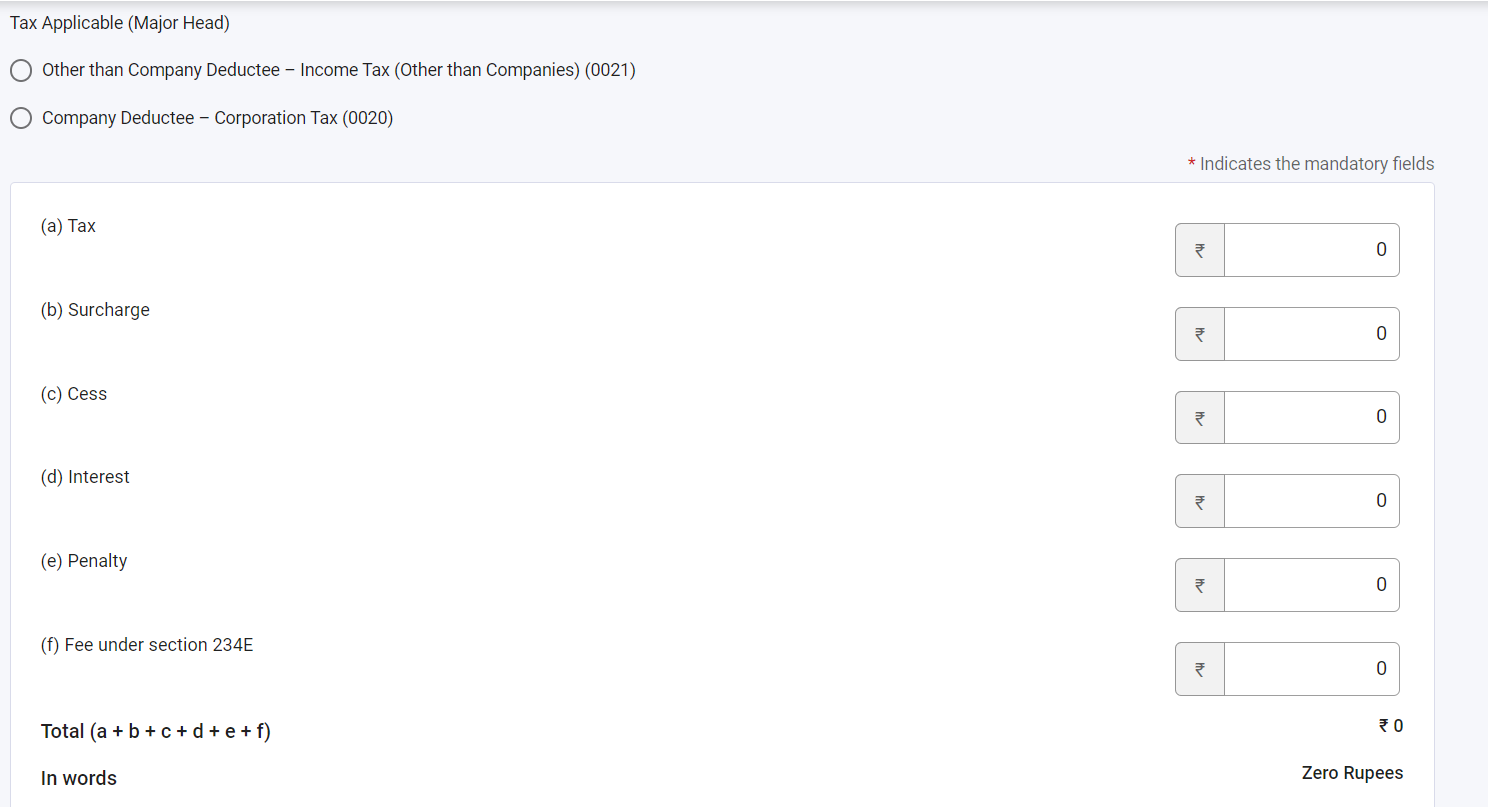

Select the deductee and then enter details of payment such as the TDS amount, Surcharge, Cess, and Late Fees that need to be entered at the time of deposit of tax.

- Select the bank

After entering the amount select the bank through which you want to make payment.

What is the proof of deposit made?

After the deductor deposits tax then a counterfoil as an acknowledgment will be generated. This counterfoil will contain details of tax deposited as well as CIN (Challan Identification Number). CIN is comprised of various details such as BSR code, Challan Serial Number, and Date of deposit. If CIN is not present on the counterfoil then contact your bank branch.

FAQs

Tax Collected at Source (TCS) is an income tax, collected by the seller of specified goods, from the buyer at the time of sale of such goods, whereas TCS is a concept where a person selling specific items is liable to collect tax from a buyer at a prescribed rate and deposit the same with the Government.

Whereas, Tax Deducted at Source (TDS) is an indirect method of collecting Income Tax. TDS is based on the principle of “Pay as you earn” which is beneficial for both Governments as well as taxpayers. Tax Deducted at Source (TDS) is a concept where a person making a payment of specified nature is liable to deduct tax at source at a prescribed rate and also deposit the same with the Government.

There are two modes via which tax deducted or collected at source can be deposited to the credit of the central government account.

1. Electronic Mode

E – payment of TDS is mandatory for:

-All corporate assesses

-Assesses other than the company to whom the provisions of section 44 AB of the Income Tax Act, 1961 are applicable

2. Physical Mode

Through this mode, the deductor is required to furnish challan 281 in the authorized bank branch and deposit cash there.

No, you should deposit separate cheques for each challan.

Hey @ViraajAhuja47

TDS and TCS both come under Income Tax.

TDS: Tax Deducted at Source

TDS is a taxation method, where a person making a payment of specific nature is liable to deduct tax and deposit it with the government.

The rate at which TDS is deducted and paid is based on the specified based on nature of the payment.

The person making the payment is required to make deduct and deposit the TDS.

TCS: Tax Collected at Source

TCS is collected by the seller from the buyer at the time of sale made. Sellers selling any specified item are liable to collect tax at a predefined rate from the buyer the time of making a sale. This TCS collected has to be deposited by the seller with the government.

Hope this helps!