As part of the incorporation process of a Company, it should apply for name reservation through RUN Form on MCA Portal. A Company can file RUN (Reserve Unique Name) on MCA for the following purposes:

- To Reserve the name of New Company,

- To Change the name of any Existing Company.

Before applying for name reservation, the applicant must check the available names of the proposed company before filing RUN form to avoid rejection.

Steps to file RUN for Name Reservation for Incorporation of Company

- Login to MCA Portal

Log in to your account on MCA Portal

- Navigate to RUN Service

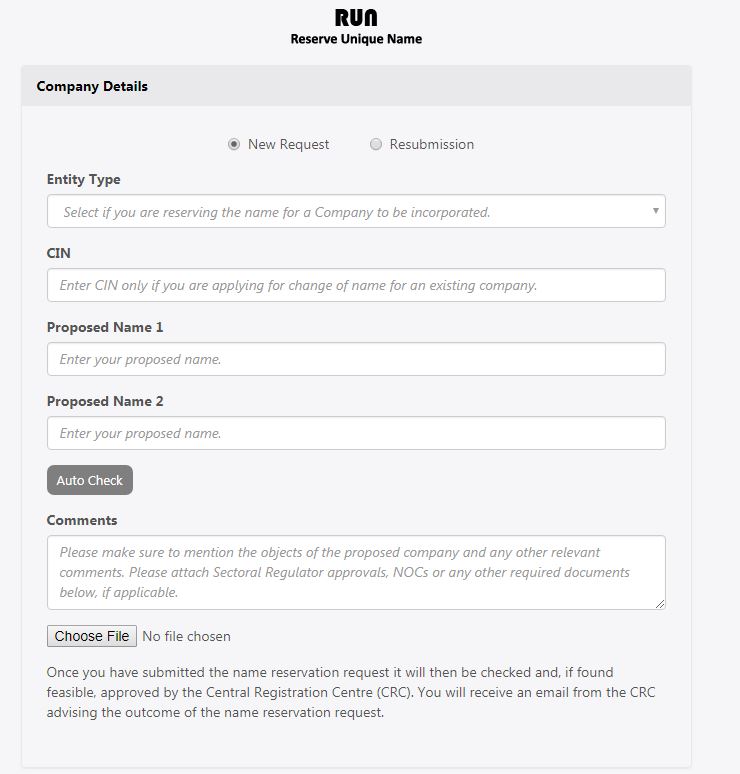

Go to MCA Services > Company Services > RUN (Reserve Unique Name). Click on New Request

- Select Entity Type

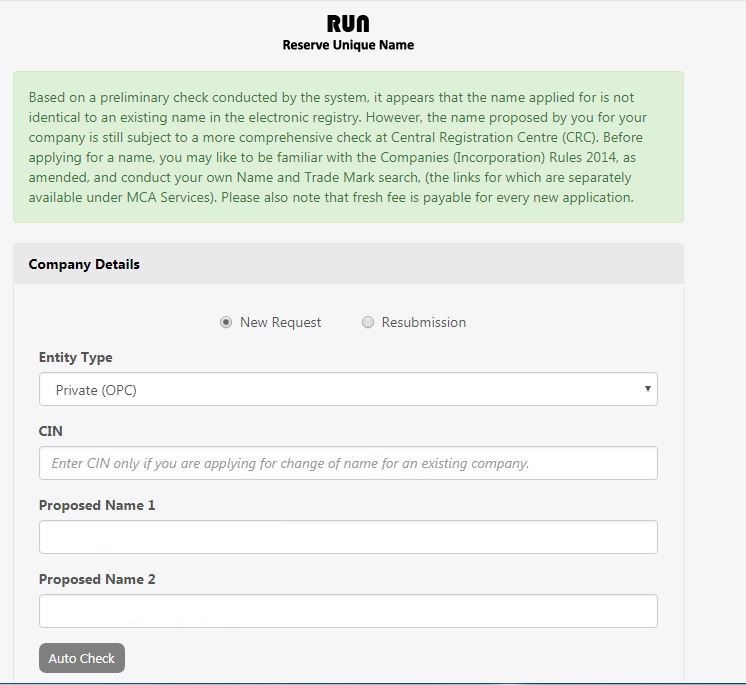

Select Entity Type i.e. Type of Company. Select New Company (Others) if reserving name for Private Limited Company. Select Private (OPC) if reserving a name for One Person Company

- Enter Proposed Name

Enter the new Proposed Name 1 and Proposed Name 2 with a suitable suffix

- Click on Auto Check

The system performs the primary check for the name entered and displays the message whether it is valid or invalid

- Enter Objective of Company

Enter the objective of the new company in brief under Comment

- Attach Documents

Attach NOC i.e. No Objection Certificate or any other certification by clicking on Choose File. It is not mandatory to attach relevant documents

- Success Message

Click on Submit, a pop up with the successful submission will appear

- Payment of Fee

Make a payment of fees. INR. 1,000 is charged as fees. You can not file RUN without making payment. There is no Pay Later Option available in case of RUN

- SRN generated

Upon successful submission, SRN and a Challan will be generated. Save the SRN and challan. You can track the status of RUN through its SRN on MCA portal

Once the Company files RUN Form, it is approved or rejected by MCA. You will receive an email from MCA Administrator on approval or rejection of an application. In case of rejection of RUN, Resubmission of RUN is allowed in certain specific situations. You will have 15 days for resubmission of RUN.

FAQs

An applicant can pick up any suitable name for the company, provided that

(i) the company cannot be registered with a name which is undesirable as per the Central Government

(ii) the name of the company has to end with ‘Private Limited

(iii) the name which is chosen for the company should not resemble or be identical to the name of another registered company. One can reserve the name of its company via Reserve Unique Name form (“RUN”).

An approved name is valid for a period of twenty (20) days from the date of approval of such name.You can file the remaining incorporation forms i.e, SPICe INC -32, 33 & 34 from the date of the name approval letter to incorporate a company

No, it is not compulsory to reserve a name through the RUN service. The approval of a name can also be sought while filing the SPICe (INC-32) form.One can apply for the proposed name through SPICe (INC-32) form on the MCA portal. Only one name can be applied for under this form. However, in case of rejection due to non-approval of the name, the applicant in this case gets a second chance of refilling the same SPICe (INC-32) form without any further charges.

Hello @Dixita

One Person Company (OPC) is a company where there is only one members and one director. Similar to a Company, a One Person Company is a separate legal entity from its promoter and it is easy to incorporate. In order to reserve the name for an OPC, one must file the web-form SPICe+ Part A on the MCA Portal.

You can read the rules to select name of a Company here:

Hope this helps!

What is SPICe+? Can I incorporate an OPC through SPICe+?

Hello @Dixita

SPICe+ is an integrated Web form for incorporating a company offering 10 services. Through SPICe+, you can apply for the name of your company, incorporation of the company, DIN of the directors, PAN and TAN registrations, PF and ESI registration of the company, GST registration, Professional Tax (only in Maharashtra), open a bank account. One can incorporate any kind of Company with SPICe+ be it Private Limited Company, Public Limited Company, OPC, Section 8 Company, etc.

You can learn about the process of incorporating a company through SPICe+ here:

Hope this helps!

Which documents are required to incorporate OPC?

Hey @Dixita

To incorporate an OPC, various documents like self-attested copies of PAN card, Aadhaar Card, Identity Proof, Address Proof, etc., are required of the proposed director and the nominee.

You can find the complete checklist here:

Hope this helps!

Hello @Paritosh_Trivedi

The first director in OPC shall hold the office until the holding of a general meeting. However, the first director can be re-appointed or another person can appointed on that meeting.

An individual CS does not have the authority to change the nominee. After the death of a member, the nominee will become the new member and only that new member will appoint another nominee.

You can refer to the procedure of change in nominee of an OPC here:

Hope this helps!

Hey @Dia_malhotra

It is mandatory for an OPC to convert into a Private Limited Company within 6 months if it surpasses the below-given parameters:

You can read the entire process of conversion of an OPC to Pvt Ltd Co. here:

Here are the key differences between a Private Limited Company and an OPC

Hope this helps!

Hello @CSDEV999

Conversion of OPC to any other Company is only possible by way of:

Hence, in your case it is not possible to convert the OPC to a Pvt Ltd Co., since none of the above-mentioned conditions are satisfied.

Hope this helps!

does a director can get loan from OPC or give loan to opc?

Hello, @Private

As per Section 185, it prohibits loans, advances, etc. to Directors of the company or its holding company or any partner of such Director or any partner of such Director or any firm in which such Director or relative is a partner. Whereas for giving a loan, yes a public company can accept a loan from its directors, but not from the relative of the director.