API Access

Taxpayers can avail services of any ASP (Application Service Provider) or GSP (GST Suvidha Provider) to perform any GST compliance-related activities such as filing Returns. To use avail such services, taxpayers need to allow access to APIs for ASP/GSPs. This is an extra security feature, which allows Taxpayers to control the API access for their account on the GST Portal. Moreover, taxpayers can choose “No” to providing their API access. This is a security feature that prevents any unauthorized access to your information.

Taxpayers need to first activate the API session on the GST Portal. Furthermore, they can also define the period for which their session should remain active. The API sessions can be active for either a minimum of 6 hours or for a maximum of 30 days. Taxpayers need to choose a longer session if they want to allow the GST/ASP application to maintain an active session with the GST Portal without giving “OTP”.

Additionally, taxpayers can terminate the session if they no longer require it. They simply have to choose the option “No” under the “Enable API Request” field.

Steps to Manage (Activate/De-Activate) an API Access on GST Portal

- Go to the GST Portal.

Use valid credentials to Log in to the GST Portal.

- Click on the My Profile > Quick Links > Manage API Access

In order to Manage the API Access, click on the My Profile Button and then on Quick Links.

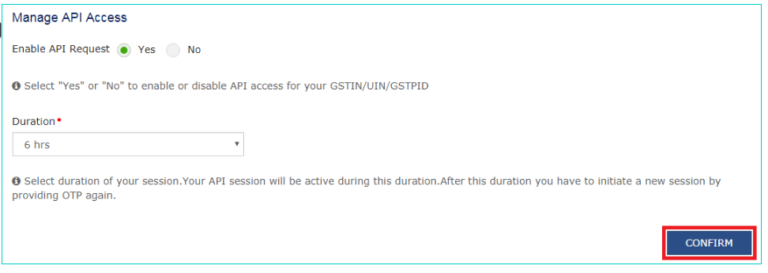

- Enable API Request by clicking ‘Yes’.

Under the Manage API Access, click ‘Yes’ to Enable API Request.

- Select the desired duration from the drop-down list.

You’ll be asked to select the duration for API Access. It ranges from 6 hours to 30 days. Select the desired duration.

- Finally, click on the “Confirm” option.

After selection the desired duration, you will need to click confirm to avail API Services.

FAQs

An Application Program Interface is a bunch of routines, tools, and protocols for building software applications. An API will dictate how software components interact with each other.

The GST Portal is a platform that allows individuals to file their GST returns online. Along with fling Returns, GST Portal also helps is addressing grievances, and GST Registration.

The DSC stands for Digital Signature Certificate. It is one of the options used for authentication purposes on GST Portal.

Quicko provides API for GSTIN Verification, and for bulk PAN verification.

Hey @Joe_Fernandes

To understand the steps for logging in to the GST portal, please refer to this article.

The password the user has created while logging in for the first time is valid for 120 days.

GST Portal Login Link

Visit: https://ssoid.net.in/gst.html

Steps to Login on GST Portal:

Open the GST Portal

Go to www.gst.gov.in

Click on “Login”

This button is on the top right corner of the homepage.

Enter Your Credentials

Username: Provided during registration.

Password: Enter your password.

Captcha Code: Type the characters shown in the image.

Click on “LOGIN”

Forgot Password?

If you’ve forgotten your password:

Click on“Forgot Password” on the login page.

Enter your username and captcha.

OTP will be sent to your registered mobile/email.

Set a new password.

Common Uses After Login:

File GST Returns (GSTR-1, GSTR-3B, etc.)

Check Payment Ledgers

Download GSTR Reports

Apply for refunds, etc.

Access the official GST portal at www.gst.gov.in to file returns, pay taxes, and manage your GST compliance online. Use your credentials to log in and navigate seamlessly through returns, invoices, and dashboard services.