A registered GST user can view their applications on the GST Portal. In order to do so, they have to sign in to the GST portal using their credentials. Users cannot view all of their submitted applications by entering the submission date on the “My Applications” page. It is mandatory for the user to choose the “Application Type.” This means that the user can view one type of application of a particular submission period at once.

Steps to View the Applications in GST Portal

- Access the GST Portal.

Firstly, log in to the GST Portal using valid credentials.

- Click on Services > User Services > My Applications

Clicking ‘Service’ will toggle a menu. Click on ‘User Services’ and then ‘My Applications’

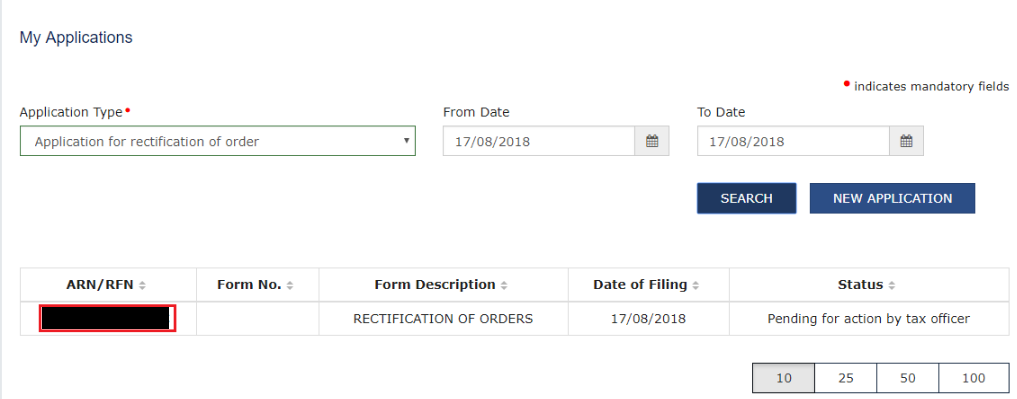

- The “My Applications” page is displayed. Select the Application Type from the drop-down list.

Note: This field is mandatory.

- Additionally, select the submission period from the calendar given.

Note: This field is not mandatory.

- Search option

Finally, click on the option to search.

The result is displayed as per the search criteria. Click on the ARN hyperlink you want to open.

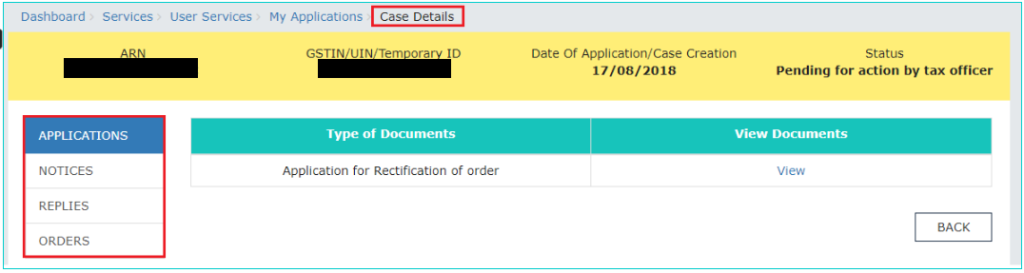

We move to the “Case Details” page. You can click on the tabs on the left side of the page to view or download the related details.

FAQs

ARN i.e Application Reference Number is a sort of an acknowledgment number issued by GSTN system portal to the taxpayers who have successfully submitted their application after completing the full process

– Go to the GST Portal

– Register with your details

– Click ‘Services’ > ‘Registration’ > ‘Track Application Status’

– Enter the ARN you received

– Enter captcha code and click om search

No. ARN cannot be used in the replacement of the GST number. ARN and GST numbers are meant for two different purposes. They can’t be used interchangeably.

Hey @Joe_Fernandes

To understand the steps for logging in to the GST portal, please refer to this article.

The password the user has created while logging in for the first time is valid for 120 days.