The GST department issued a notification in April 2019 to introduce Form CMP-08. It replaced Form GSTR-4 i.e. GST Return for business under Composition Scheme. Form CMP-8 is applicable from FY 2019-20.

What is CMP-08 in GST?

Form CMP-08 is the statement with details of self-assessed tax payable of a dealer registered under the Composition Scheme. The form contains details of tax liability on sales and purchases (under the Reverse Charge Mechanism). This form has replaced Form GSTR-4.

The Composite Dealer needs to file CMP-08 on a quarterly basis on the GST Portal. He can calculate the tax liability and pay it online on the GST Portal. If there is no tax liability during the quarter, a Nil return should be filed.

CMP 08 Due Date

A Composite dealer should file Form GST CMP-08 on a quarterly basis. The due date to file is 18th of the next month from the end of the quarter. It was applicable from FY 2019-20. The Due Dates for FY 2019-20 are as follows:

|

Period |

Due date |

|

Oct-Dec 2020 |

18th January 2021 |

|

Jan-Mar 2021 |

18th April 2021 |

|

Apr-Jun 2021 |

18th July 2021 |

|

Jul-Sept 2021 |

18th Oct 2021 |

GST Late Fees – CMP-08

If the taxpayer does not file GST CMP-08 on or before the due date, he is liable to pay a Late Fee for each day of delay.

- If there are no transactions in the return period, the taxpayer should file a NIL Return to avoid late fee and penalty

- Late fee is calculated from the date after the due date up to the date of filing of the return

- A late fee of Rs.200 (CGST Rs.100 and SGST Rs.100) per day of delay is applicable. The maximum late fee that can be charged is Rs. 5000 per return

Note: While the GST Rules mention a late fee of Rs. 200 per day in the case of CMP-08, there is no option to enter such a late fee under the option of paying tax in CMP-08. Also, the GST Portal does not auto calculate late fees in the case of CMP-08, unlike other GST Returns.

How to file CMP-08?

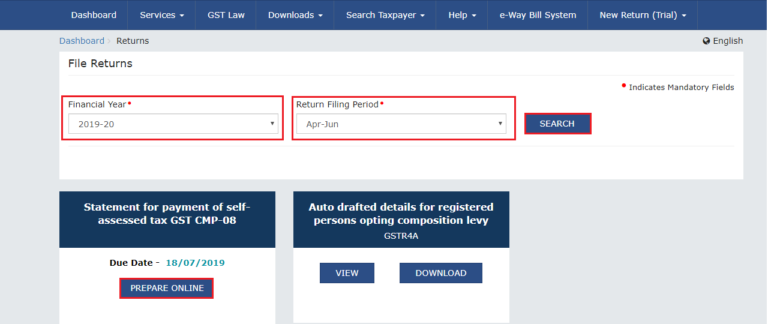

- Visit to GST Portal

Login to your account on the GST Portal

- Navigate to Returns Dashboard

Go to Services > Returns > Returns Dashboard OR click Returns Dashboard link on the dashboard.

- Select Financial Year and Return Filing Period

Select the financial year and return filing period. On tab, ‘Payment of self-assessed tax’, select Prepare Online.

- Summary of Self-Assessed Tax Liability

The summary of self-assessed tax liability appears on the screen. It reflects the tax liability on sales, tax liability on purchases falling under reverse charge mechanism, and interest payable.

- File a Nil Return CMP-08

To file a Nil Return, select the checkbox – File Nil GST CMP-08. Once you select the checkbox, a list of conditions to file Nil Return appears. Make sure you meet the conditions.

- Tax Liability & Interest

Enter the tax liability and interest. Click on Save, a success message will appear on the screen.

- Preview Draft GST CMP-08

To download the draft, click on Preview Draft GST CMP-08. Review the details before proceeding.

- Payment of Tax

Click on Proceed to File. A page showing Payment of Tax will reflect on screen.

- Cash Balance in Electronic Cash Ledger

The cash balance available in the Electronic Cash Ledger is reflected.

* If the available balance in E-Cash Ledger is more than the tax liability – proceed with next step.

* If the available balance in E-Cash Ledger is less than the tax liability – click on Create Challan. Pay the GST Challan and proceed with filing return. - File using DSC or EVC

Select the checkbox, select authorised signatory and click on File GST CMP-08. File the return using DSC or EVC.

- Success Message with ARN

Once you file the return, a success message will appear with the ARN i.e. Acknowledgement Reference Number. To download the filed return, Click on Download Filed GST CMP-08.

FAQs

A dealer registered under Composition Scheme cannot claim Input Tax Credit. Thus, the tax liability under CMP-08 cannot be paid using Input Tax Credit. The Composite Dealer can pay the liability only through depositing cash in the E-Cash Ledger.

Negative Liability Adjustment means if there is any negative entry in the return of a present quarter, it will be carried forward to the next quarter. The taxpayer can adjust this negative entry with the tax liability in the return of next quarter. Such negative entry is reflected under the column ‘Adjustment of negative liability of previous tax period’ in the CMP-08 of next quarter.

Yes. It is mandatory for a dealer registered under Composition Scheme to file CMP-08 every quarter. Even if there is no business or no self-assessed tax liability, the Composite Dealer must file CMP-08 on the GST Portal.

1.I am not able to know the late fee on CMP 08 in liability ledger

2. In which coloum I have fill the late fee in CMP 08

Thanking You

While the GST Rules mention late fee of Rs. 200 per day in case of CMP-08, there is no option to enter such late fee under the option of paying tax in CMP-08. Also, the GST Portal does not auto calculate late fee in case of CMP-08 unlike other GST Returns. Further, one of the FAQs on the help content of GST Portal, it is mentioned that there is currently no late fees on late filing of CMP-08. Thus, you can file GST CMP-08 without late fee since it is neither auto-populated nor you have an option to enter it manually.

Composition scheme deler not file annual return late fees paid ya wave

Good Afternoon कृपा येजानकारी दीजियेगा की CMP-08 तिमाही में कुल बिक्री 400000 हे, तो कितना टेक्स Paid करना होगा

Thank you.

Portal does not auto calculate late fee in case of CMP-08 unlike other GST Returns. where we file late fee in case due date is over.