Completed e-filing? Well, the process doesn’t end there. e-Verification is compulsory after e-filing. e-Verification should happen within 120 days of e-filing your ITR. Because ITR is only processed once it is e-verified by a taxpayer. You can e-Verify ITR using Kotak net banking service.

e-filing helps you file your income tax return quickly over the internet. And e-Verification is quicker and less tedious than sending your signed returns and documents to CPC, Banglore.

Steps to e-Verify ITR-V using Kotak Net Banking

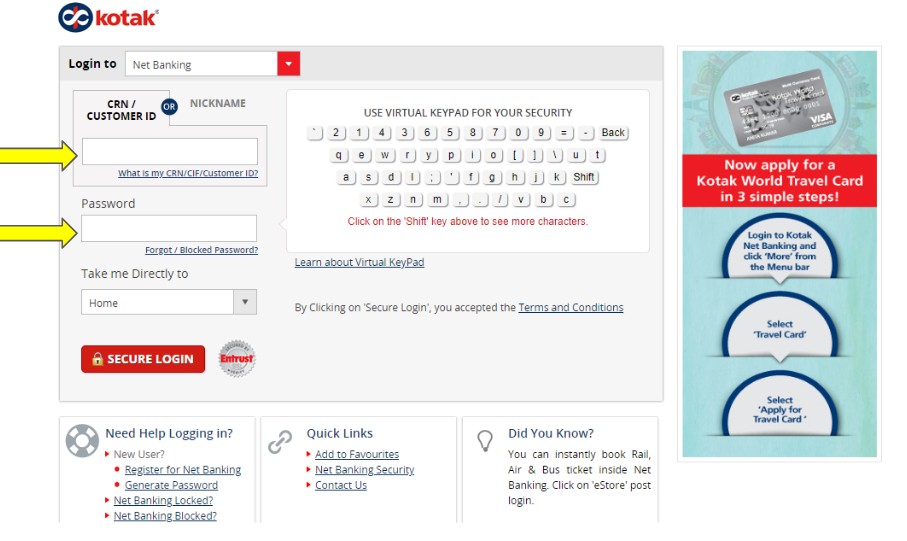

- Go to Kotak Bank Site

Log in to your Kotak Net banking account

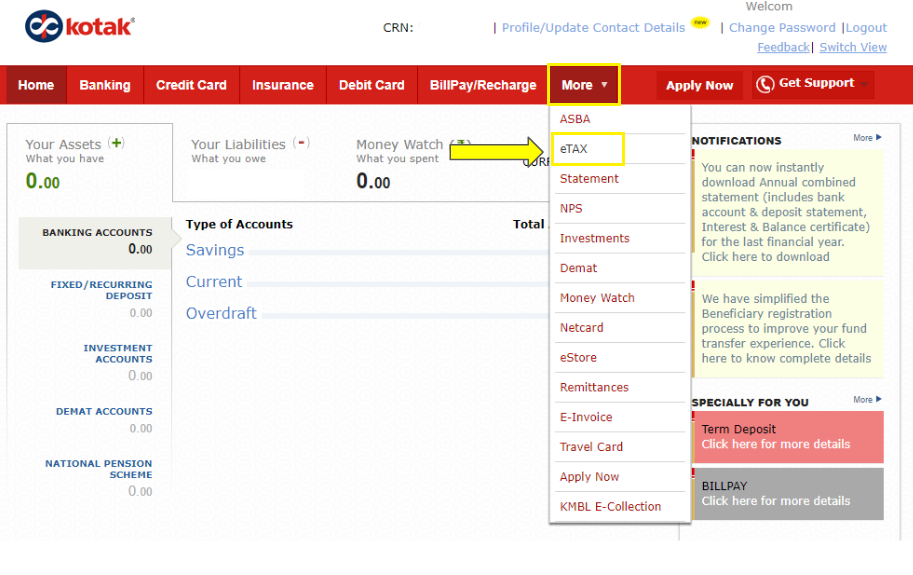

- Navigate to eTax

Click on “More > eTax” from the dashboard.

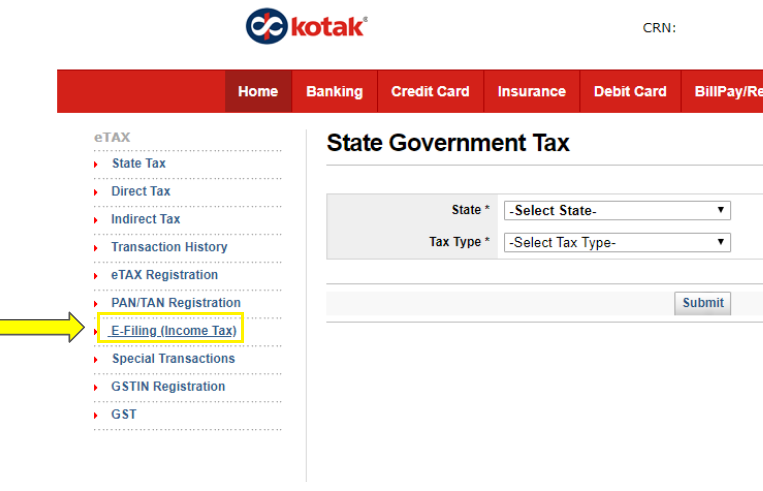

- Choose the eTax option

Select “e-filing (Income tax)” from the column on the left.

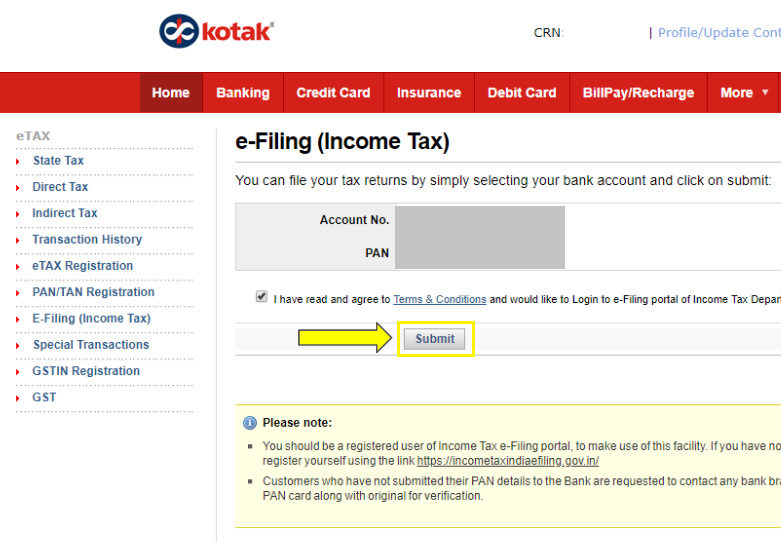

- Enter the required details if necessary

Your details will get loaded automatically. If not so, manually fill in your Account no. and PAN. Click on “Submit“.

- You will be redirected to the Income Tax Department E-filing portal

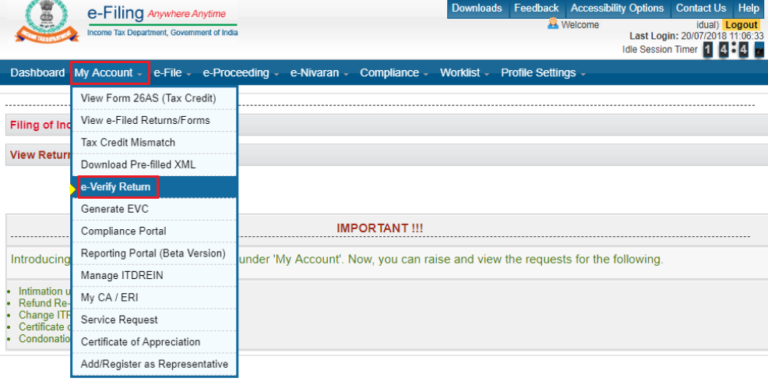

Click on “My Accounts > e-Verify Return” from the dashboard.

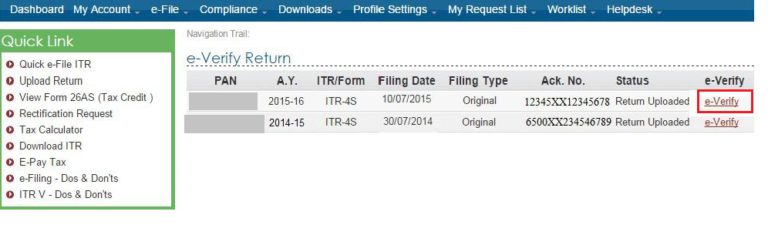

- Click on “e-Verify“

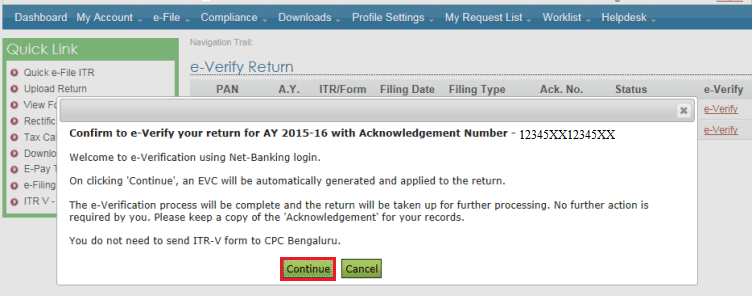

A pop up will be displayed asking for your confirmation.

- Click on “Continue“

ITR will be e-verified.

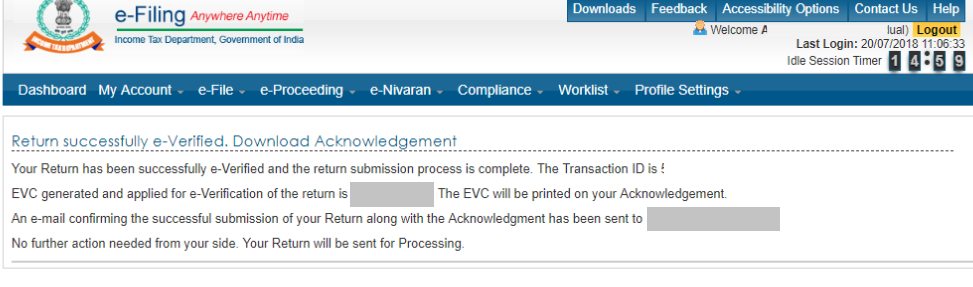

- Download the acknowledgement attachment

Your return is now successfully e-verified.

FAQs

Indeed. Just filing your return doesn’t end the process. e-Verification after filing is compulsory. e-Verification has to happen within 120 days of e-filing.

If you don’t have Kotak bank account you can use other bank accounts like HDFC, SBI, Axis, ICICI, etc. Moreover, you can also e-Verify using

Aadhar OTP,

Net banking,

Bank account

Demat account or

DSC

You can e-Verify your returns using

Aadhar OTP,

Net banking,

Bank account,

Demat account or

DSC.

First of all, by doing the e-Verification tax filer will not have to sign and submit the documents to the CPC office in Bangalore. Moreover, your returns will complete the procedure faster than compared to other means.

If I have filed a revised return, do I need to e-verify the original return or the previous return as well?

Hi @Joe_Fernandes,

If you are filing a revised return, you can only verify the latest revised return. If the previous versions of revised returns or original return is not verified, it will ve deemed to be invalid and won’t be processed by the ITD.

e-verification using Aadhaar OTP is the most widely used and fastest method to verify your return.

Hi,

I had filed and e-verified my return in November 2021. I still haven’t received my refund and got the same email. Do I need to do anything? and how long until I get my refund?

Hey @Nihal,

In case you have successfully e-verified the return, you do not need to worry and can ignore the email.

Usually, the refund takes 6-9 weeks from the ITR being processed. However, it may vary based on the case-to-case basis.

You can track your refund using this tool

Hope this helps

Hi @abhishek_ranjan

You can track you refund using this tool

hi @Archan434

No. There is no need to e-verify the ITR filed in response to defective return notice.

@Sakshi_Shah1

@AkashJhaveri

@CA_Niyati_Mistry

As per the rule ITR filing is mandatory if the Income is more than the basic exemption limit .

Query :

What is the penalty if the ITR not filed ?

Since the Tax liability is zero .

Hi @HIREiN

Income tax is mandatory in following cases:

Incase ITR is not filed:

(1) as you said : Income tax filing is mandatory in some cases …as you have mentioned above …

(2) Incase ITR is not filed : because : there are no loses incurred ; no taxable income etc ;

(3) you said : fees under section 234F may be applicable …

(4) BUT . : what if the taxable income is zero ?

because ; as you said : the quantum of the fees depends on the Taxable income of the taxpayer .

So , no fees ; no penalty ! right ?

===============================

so . even if : Income tax filing is mandatory in some cases ; if some one does not file the I.T. returns ; there is No harm in it !

am i right ?

Yes. Then there is no requirement to file. And no question of any penalty.

You may receive a notice from the tax department asking you the reason why the return has not been filed. Many people who are not filing returns are facing this situation nowadays since all information regarding interest, rent, purchase/sale of securities, immovable properties, etc is being reported in AIS (Annual Information Statement).

Then you will have to spend a lot of time and effort to comply with details requested from such a notice. So to save your time too - you can plan and file your returns well in advance of the due date.