A 15-digit Provisional Receipt Number (PRN) gets generated once the e-TDS or e-TCS return is filed. The deductor can file TDS/TCS Return either on Income Tax E-filing Portal or with TIN FC. PRN is nothing but an acknowledgment of e-TDS/ e-TCS Return filed. Furthermore, there are two different ways to gain access to the Provisional Receipt. They are as follows:

- Download the Provisional Receipt from the Income Tax e-Filing portal

- File a request letter to the NSDL e-Governance to obtain a duplicate Provisional Receipt

Steps to Download Provisional Receipt Number from the Income Tax e-Filing Portal

- Visit the Income Tax e-Filing Portal and Log into your Account.

Select the TDS > View Filed TDS option from the dashboard.

- Fill in TAN, Financial Year, Form Name, Quarter, Upload Type

Click on View Details

- Click on the Token Number.

Details of Return along with PRN will appear

- Click on the option to download the Provisional Receipt.

It is password protected and password is TAN in lower case.

Steps to Apply for Duplicate Provisional Receipt on TIN NSDL

- Step 1: Visit the TIN-NSDL portal.

- Step 2: Click on the Services > Form 24G from the dashboard.

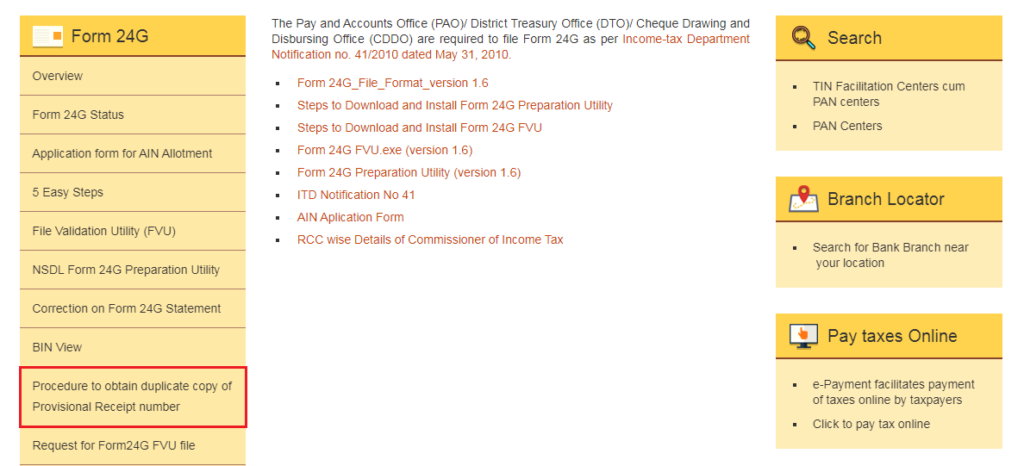

- Step 3: Click on the “Procedure to obtain a duplicate copy of the “Provisional Receipt Number” option under the Form 24G section.

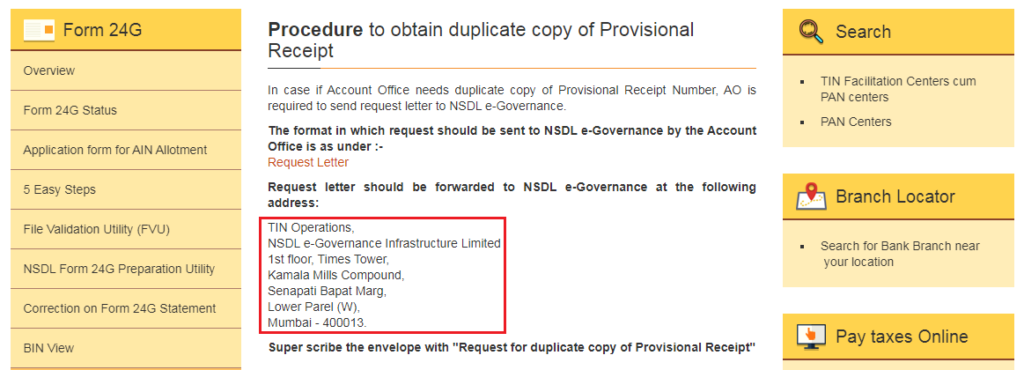

Hence, the address where the request letter should be forwarded to is mentioned.

Therefore, the format of the letter to be submitted is given below.

FAQs

It is required under the following 2 scenarios:

– To prepare Correction statement: While preparing correction statement, the Original Provisional Receipt Number of the last statement is required.

– Submission of Correction Form statement through TIN FC: While submitting correction Form statement through TIN FC, the copy of Original Provisional Receipt needs to be mandatorily submitted along with the Form statistic report.

NSDL e-Gov shall email the duplicate copy of Original Provisional Receipt or Provisional Receipt Number (regular or correction) on the email ID as mentioned in the last Form 24G statement accepted at TIN Central System.

The password to open PRN is TAN of the deductor in Lower Case Format. The Receipt will open in a new tab and the deductor can download the same for future reference.

Hey @HarshitShah

Yes, in case you have not deposited TDS by the due date, the following penalties might be applicable:

Interest (if you do not deposit the TDS amount in time)

Late filing fee (if you do not file by the deadline)

Penalty (if TDS is not filed within one year of the due date)

Hope this helps!

Hey @HarishMehta

Form 24, 27 and 27E are forms to file TDS/TCS returns:

Form 24 is to file TDS return detailing Salary Payments

Form 27 is to file TDS return detailing Foreign or NRI payment other than salary

Form 27E is to file TCS returns

Hope this helps!

Hi @KrishnaAgarwal

Hey @taxpayer, you can file your Income-tax return can claim the tax refund for any excess tax credits available to you.

If your total taxable income is below the basic exemption limit then you won’t have any tax payable.

You can check the total tax credits available to you in your Form 26AS

@Muskan_Balar @Bharti_Vasvani can you help here?

Hello @abhaykk90,

As per section 194IB of the income tax act, if you’re liable to deduct TDS on rent paid, the rate applicable will be 5%.

Hope this helps!

Hi @t_bovee,

Here are answers to your various questions

However, you can file TDS return 26QC within 30 days from the end of the financial year.

Here’s a read on What is Form 26QC? Who needs to file form 26QC? - Learn by Quicko for your reference. Hope this helps.

Hi @t_bovee

It would not be possible for us to tell you the mismatch of amounts, without seeing the documents.

However, for expert assistance with your taxes, here’s how you can Book a MEET.

Hi @paliya_hitesh

Here’s read on Form 26Q: TDS on other than Salary - Learn by Quicko for your refrence.

Thank you for the reference @Shrutika_Shah