A taxpayer can use the compliance portal to view an all their response history. A taxpayer can view all the responses pertaining to a particular e-Verification issue under the Related Information section.

The compliance portal enables e-verification for the display of compliance issues and related information and capturing response to such issues. The compliance portal uses the campaign management approach to contact taxpayers for online submission of response. It will contact the taxpayers via e-Mails, SMS, phone calls, notices, and letters to visit the compliance portal and submit the response against the identified issue.

Steps to view Response History on the Compliance Portal

- Log in to the compliance portal with valid credentials

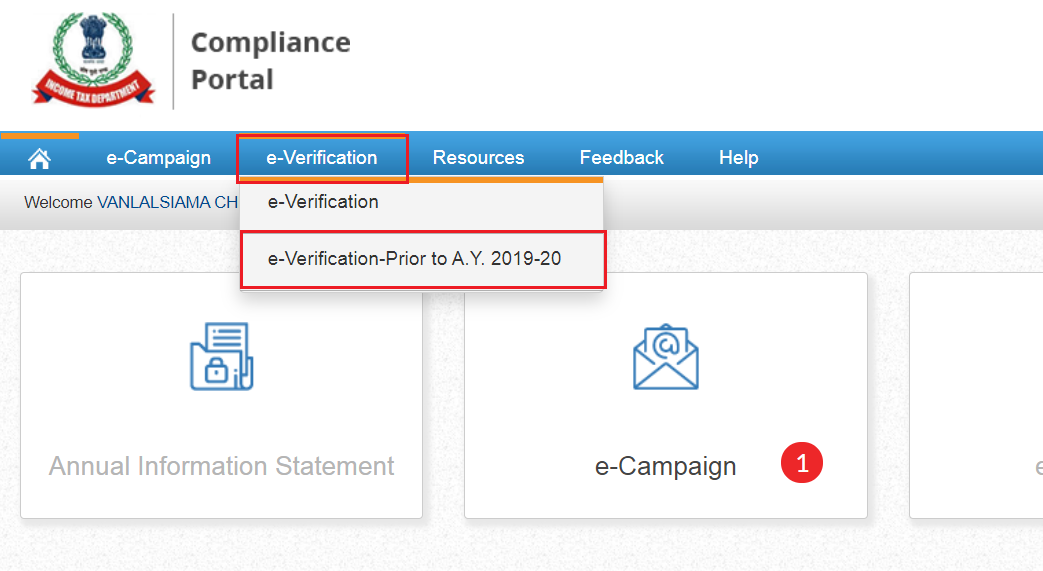

Click on the e-Verification tab

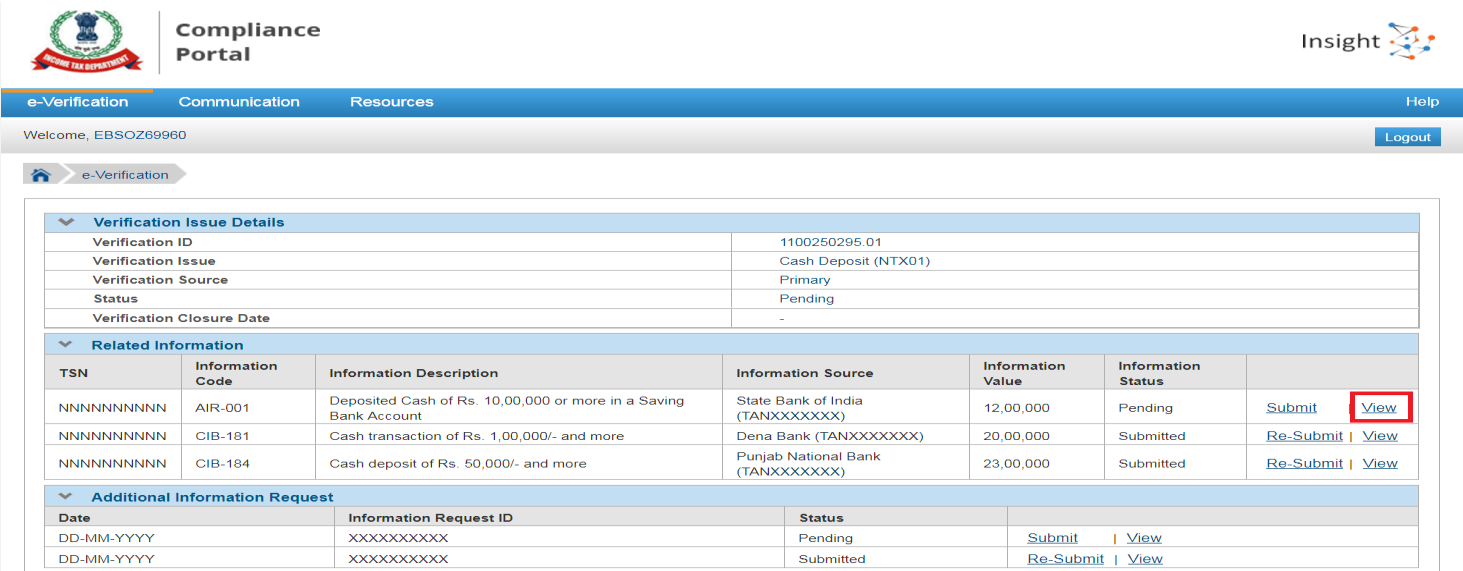

- Go to the Verification Issue Details section.

Go to the specific information in the Relation Information section.

- Click the View to view the response history

As seen below:

- You will now be able to see a list of the history of responses submitted by the taxpayer.

Click on Download PDF to download the pdf of the submitted response(s).

FAQs

Response history is the history of all the responses that are submitted by the taxpayer on the Compliance Portal.

Once you check for response history, there is an option to download your responses. Click on Download PDF and all your previous responses will be downloaded.

Upon examining the online response submitted by the taxpayer, ITD can raise an additional query request to seek further information/clarification from the taxpayer. The taxpayer needs to respond to the additional query request as well.